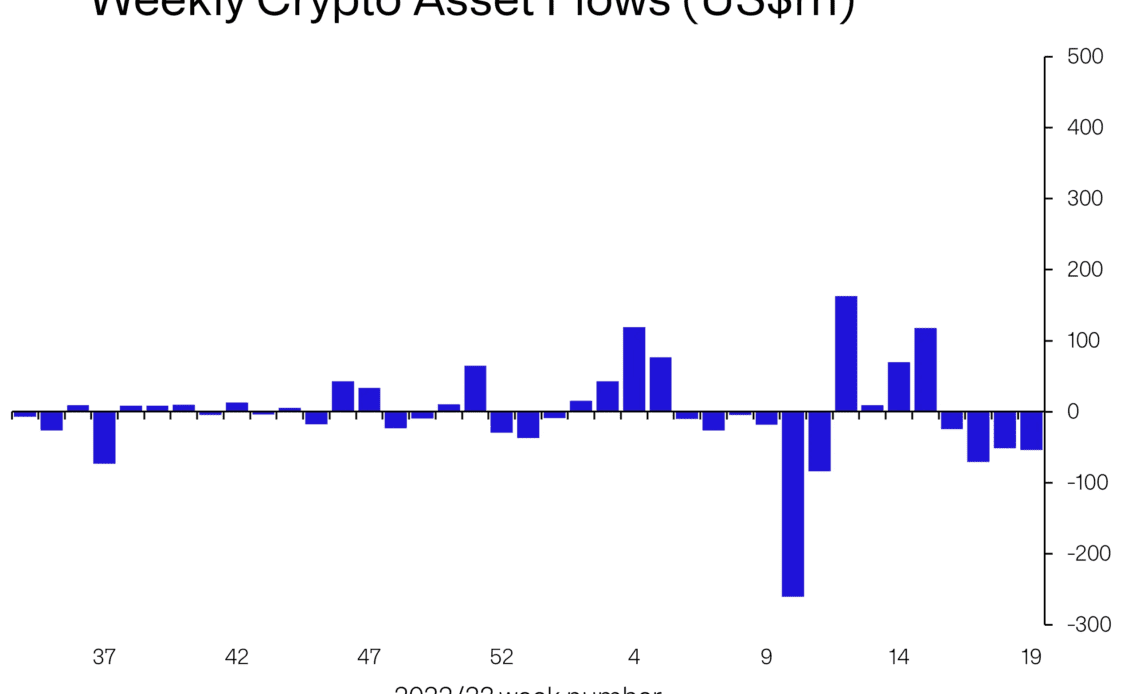

Digital assets manager CoinShares says institutional investors continue to have a bearish sentiment about the market as crypto suffers major outflows for the fourth week in a row.

In its latest Digital Asset Fund Flows Weekly Report, CoinShares finds that institutional investors sold off $54 million in crypto holdings last week for a fourth consecutive week of outflows.

“Digital asset investment products saw a 4th consecutive week of outflows totaling US $54 million, bringing the total outflow to US $200 million, representing 0.6% of total assets under management (AuM). The recent price declines have seen total AuM fall by 13% since their mid-April peak.”

King crypto Bitcoin (BTC) suffered the brunt of the outflows, totaling $38 million, according to CoinShares.

“Bitcoin saw outflows totaling US$38 million, with the last four weeks of outflows now totaling US $160 million. This represents 80% of all outflows over the period, when combined with short-bitcoin outflows they represent US $201 million highlighting that the recent investor activity has almost solely been focussed on the asset.”

While multi-asset investment products, those investing in more than one digital asset, suffered outflows of $7 million last week, Cardano (ADA), Tron (TRX) and The Sandbox (SAND) products raked in inflows of $0.5 million, $0.23 million and $0.2 million respectively.

“Unusually, inflows were seen across 8 different altcoin assets, suggesting investors are becoming more adventurous, and selective.”

Ethereum (ETH) products also took in $0.1 million in inflows.

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Marciano Graphic/Fotomay

Click Here to Read the Full Original Article at Bitcoin News – The Daily Hodl…