On May 1, U.S. regulators seized and sold First Republic Bank (FRB) and its assets to JPMorgan in what has now become the largest bank failure since 2008. FRB is the fifth bank to fail in less than two months, following on from Silvergate, Silicon Valley Bank, Signature Bank, and Credit Suisse.

Despite the rising number of struggling banks, regulators continue to assure the public that these failures aren’t part of a global banking crisis — blaming short-term turmoil among local lenders for the fallout.

A source close to Treasury Secretary Janet Yellen told CNN that First Republic was an outlier in the regional banking sector. First-quarter results showed that almost all midsize and regional banks were “well-capitalized” and that deposit flows have stabilized, the source argued.

Jamie Dimon — the CEO of JPMorgan — echoed the statement, assuring participants of a recent investor call that the banking sector was “stable.”

“No crystal ball is perfect, but yes, I think the banking system is very stable. This part of the crisis is over.”

Bending the banking system

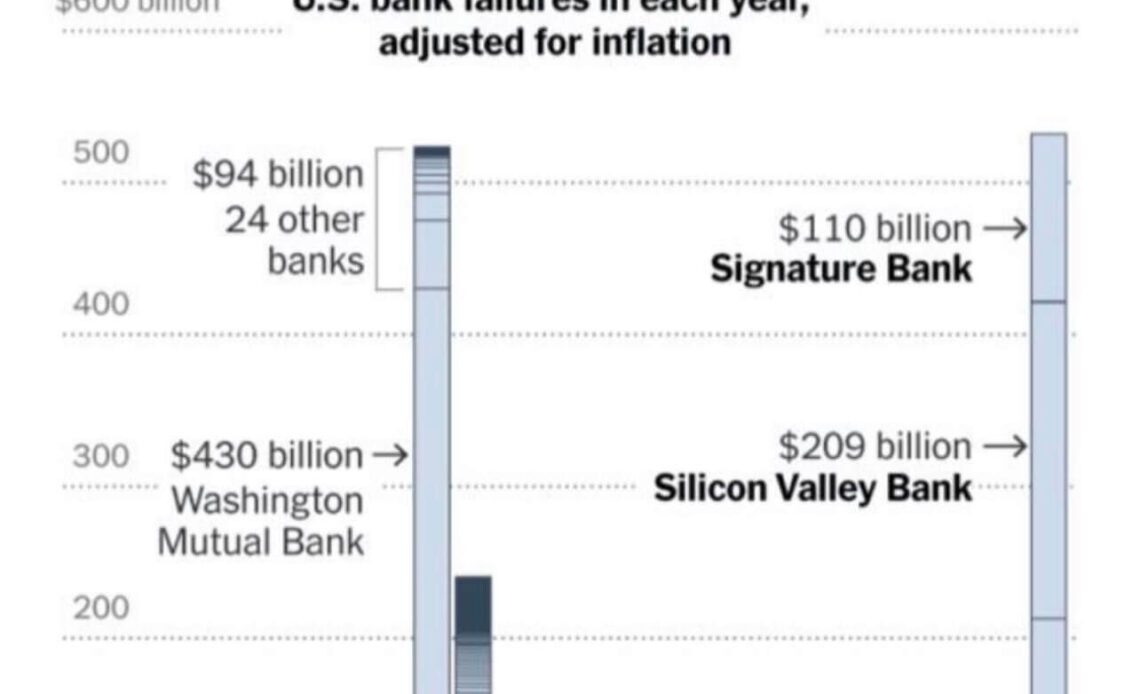

However, the failure of First Republic, Signature, and Silicon Valley Bank is already bigger than the 25 banks that failed in 2008.

Data from The New York Times showed that the three had over $530 billion in assets — while Washington Mutual and the 24 other banks that crumbled in 2008 managed around $524 billion, adjusting the data for inflation.

JPMorgan’s acquisition of First Republic was lauded by U.S. regulators as a heroic move that saved the taxpayers from fronting the bill for its failure. However, it sets a dangerous precedent that could see the U.S. market become dangerously centralized and government-dependent.

While there’s no explicit law prohibiting banks from controlling any percentage of the country’s total deposits, there are safeguards in place that prevent systemic banking issues. The Dodd-Frank Act — passed in 2010 in response to the 2008 financial crisis — enables regulators to block mergers and acquisitions that would result in a bank becoming “too big to fail.”

Numerous economists and analysts warned that JPMorgan’s acquisition of First Republic should never have been allowed. The controversial $10 billion deal saw JPMorgan acquire the substantial majority of FRB’s assets and assume its deposits — both insured and uninsured — from the FDIC.

This pushed…

Click Here to Read the Full Original Article at Bitcoin (BTC) News | CryptoSlate…