Bitcoin (BTC) starts the week on a firm footing as bulls send BTC price to a new ten-month high weekly close.

After a relatively calm week, last-minute volatility is getting traders excited at the prospects of a repeat attack on $30,000 resistance — but a lot stands in the way.

In what is set to be a significant week of macroeconomic data releases, the Consumer Price Index (CPI) print for March is due April 12, along with fresh insights into Federal Reserve policy.

Add to that the Ethereum Shanghai upgrade and a recipe for volatility is there. How will Bitcoin react?

Volatility correlations between the largest cryptocurrency and traditional risk assets are inverting, data shows, while sentiment data also suggests that there is little appetite for sudden selling among the hodler base.

Cointelegraph takes a look at the status quo in the run-up to what promises to be a week that keeps market participants on their toes.

CPI headlines key macro data week

A familiar event leads the week’s macro calendar, with United States Consumer Price Index (CPI) data due for March.

The release, this time on April 12, traditionally accompanies heightened volatility in risk assets, making that date a key area to watch for “fakeouts” in crypto markets.

The Federal Reserve will further produce the minutes of its latest Federal Open Market Committee (FOMC) meeting, during which it opted to continue raising interest rates.

Key Events This Week:

1. March CPI inflation data on Wednesday

2. Fed minutes on Wednesday

3. March PPI inflation data on Thursday

4. Consumer sentiment data on Friday

5. Retail sales data on Friday

6. 4 Fed speakers this week

This week determines what the Fed does next.

— The Kobeissi Letter (@KobeissiLetter) April 9, 2023

The environment is thus somewhat complicated when it comes to CPI impact on asset performance. While traders want to see inflation receding faster than expected, the Fed itself remains hawkish, last month confirming that further interest rate hikes may be appropriate.

However, divergence between the Fed and markets is equally in evidence — sentiment has begun to show that the latter simply do not believe that rate hikes will continue much longer.

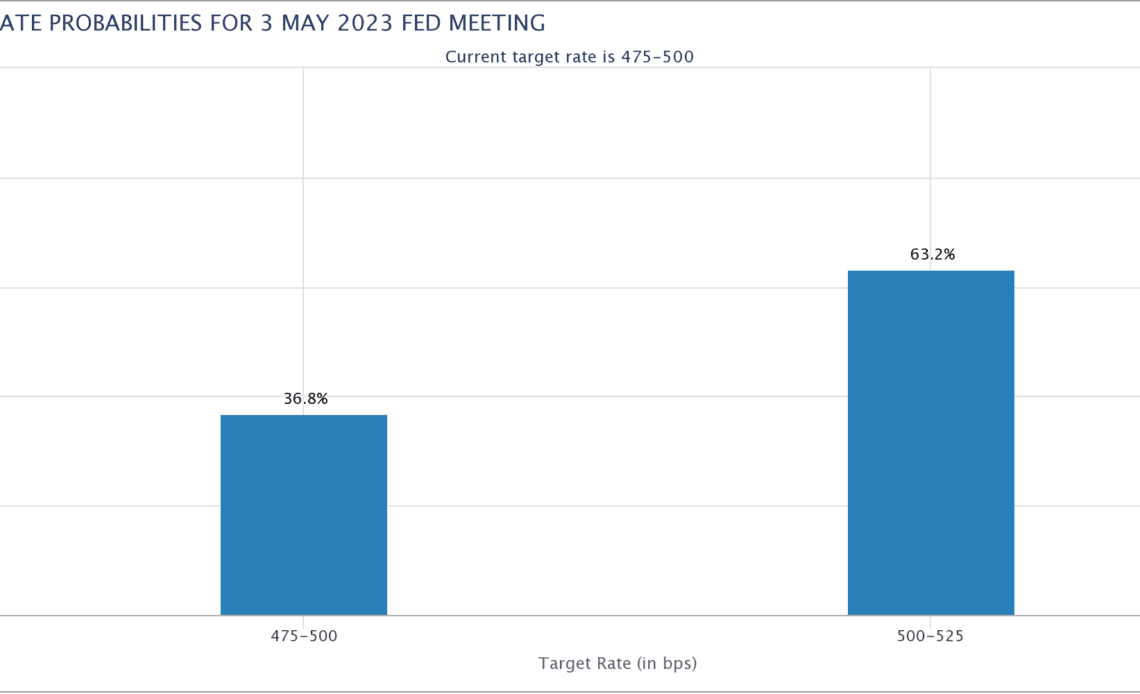

According to CME Group’s FedWatch Tool, next month’s FOMC meeting will likely end in a repeat 0.25% hike. Those odds are highly flexible, and react immediately to any new macro data releases, CPI included.

For macroeconomic and stock market…

Click Here to Read the Full Original Article at Cointelegraph.com News…