On March 23, Bitcoin (BTC) price recovered the $28,000 support after a brief correction below $27,000. The movement closely tracked the traditional financial sector, particularly the tech-heavy Nasdaq Index, which gained 2.1% as Bitcoin surpassed the $28,000 threshold.

On March 22, the Federal Reserve raised its benchmark interest rate by 0.25%, but hinted that it is nearing its maximum level for 2023. In the end, however, Fed Chair Jerome Powell stated that it is too soon to determine the extent of the tighter credit conditions, so monetary policy will remain flexible.

Initially, it appears encouraging that the central bank is less inclined to increase the cost of money. However, the global economies are exhibiting signs of stress. For instance, consumer confidence in the euro-area decreased by 19.2% in March, reversing five consecutive months of gains and defying economists’ predictions of an improvement.

The recession is still putting pressure on companies’ profits and leading to layoffs. For example, on March 23, the professional services company Accenture said it would end the contracts of 19,000 workers over the next 18 months. On March 22, the company Indeed, which helps people find jobs, let go of 2,200 workers, or 15% of its staff.

The stronger the correlation to traditional markets, the less likely a decoupling. As a result, according to futures and margin markets, the Bitcoin price increase has not instilled much confidence in professional traders.

Bulls and bears exhibit a balanced demand on margin markets

Margin trading allows investors to borrow cryptocurrency to leverage their trading position, potentially increasing their returns. For example, one can buy Bitcoin by borrowing Tether (USDT), thus increasing their crypto exposure. On the other hand, borrowing Bitcoin can only be used to bet on a price decline.

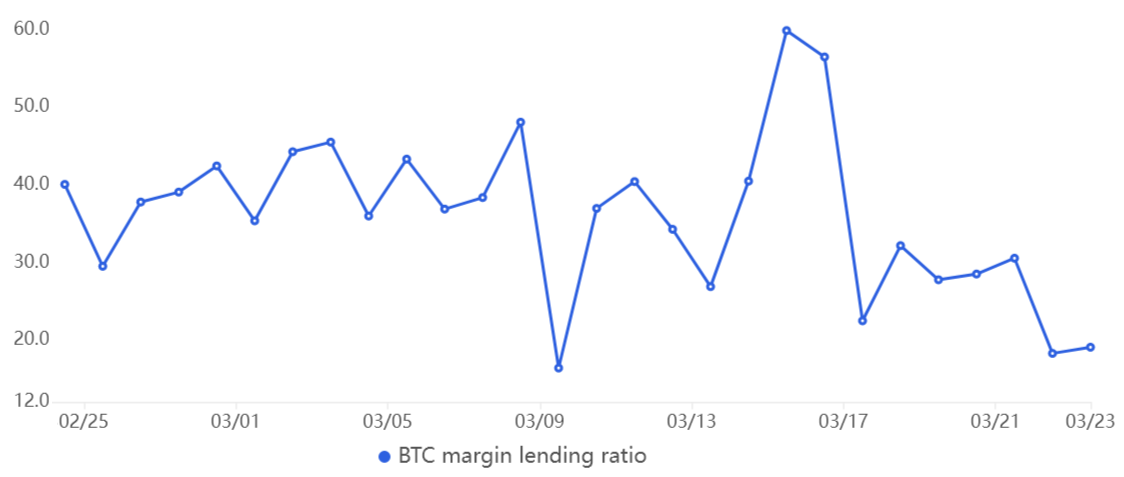

Unlike futures contracts, the balance between margin longs and shorts isn’t necessarily matched. When the margin lending ratio is high, it indicates that the market is bullish — the opposite, a low lending ratio, signals that the market is bearish.

On March 15, the margin markets longs-to-short indicator at the OKX exchange peaked at 60, but by March 17 it had fallen to 22. This indicates that during the rally, reckless leverage was not used. Historically, levels above 40 indicate a highly imbalanced demand favoring longs.

The indicator is currently at 19, indicating a balanced situation given…

Click Here to Read the Full Original Article at Cointelegraph.com News…