Bitcoin (BTC) is on track to close the week with gains of more than 23%. The banking crisis in the United States and Europe seems to have boosted buying in Bitcoin, indicating that the leading cryptocurrency is behaving as a safe haven asset in the near term.

All eyes are on the Federal Reserve’s meeting on March 21 and 22. The failure of the banks in the U.S. has increased hopes that the Fed will not hike rates in the meeting. The CME FedWatch Tool shows a 38% probability of a pause and a 62% probability of a 25 basis points rate hike on March 22.

Analysts are divided on the consequences of the current crisis on the economy. Former Coinbase chief technology officer Balaji Srinivasan believes that the U.S. will enter a period of hyperinflation while pseudonymous Twitter user James Medlock believes otherwise. Srinivasan plans to wage a millionaire bet with Medlock and another person that Bitcoin’s price will reach $1 million by June 17.

Although anything is possible in crypto markets, traders should be prudent in their trading and not get carried away with lofty targets.

Let’s study the charts of Bitcoin and altcoins that are showing signs of the resumption of the up-move after a minor correction.

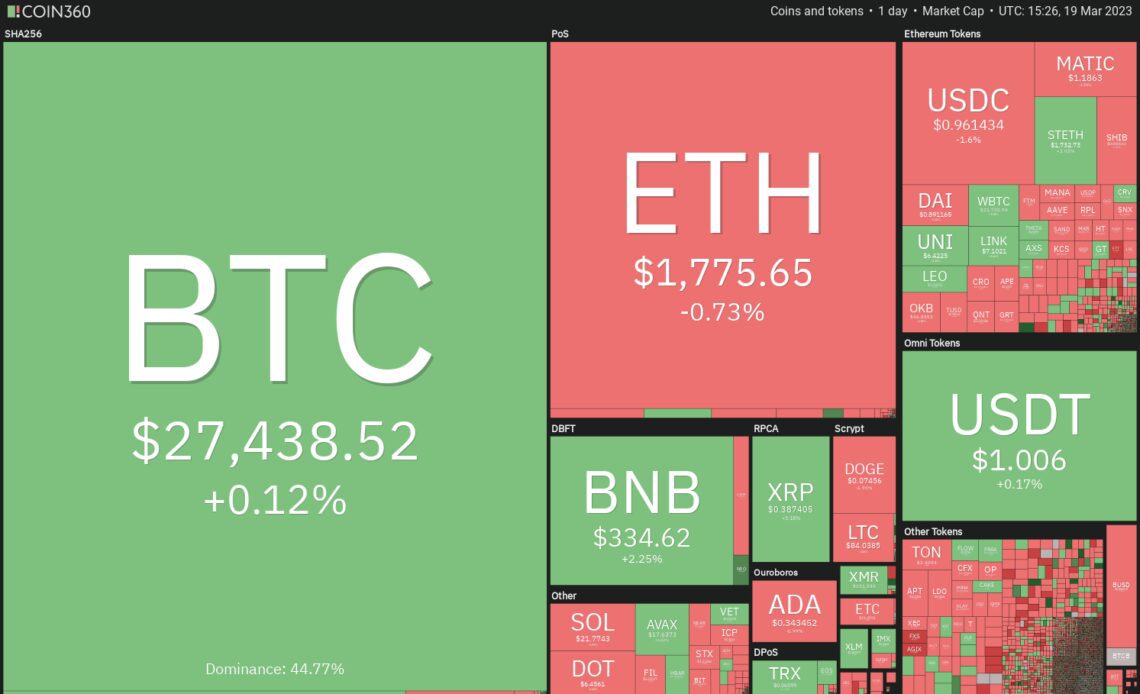

Bitcoin price analysis

Bitcoin soared above the $25,250 resistance on March 17, completing a bullish inverse head and shoulders (H&S) pattern.

Usually, a breakout from a major setup returns to retest the breakout level but in some cases, the rally continues unabated.

The rising 20-day exponential moving average ($24,088) and the relative strength index (RSI) in the overbought territory indicate advantage to buyers. If the price breaks above $28,000, the rally could pick up momentum and surge to $30,000 and thereafter to $32,000. This level is likely to witness strong selling by the bears.

Another possibility is that the price turns down from the current level but rebounds off $25,250….

Click Here to Read the Full Original Article at Cointelegraph.com News…