While markets are going up, people get more comfortable putting their cryptoassets into trusted third parties such as centralized exchanges and centralized lending platforms that promise increasingly enticing returns. The good times never last, though. As markets peak and monetary policy tightens, companies that overleveraged on the way up expose themselves to liquidity risks. If you deposited your cryptoassets into these products, perhaps unaware of their risk taking, your assets are exposed to their risks.

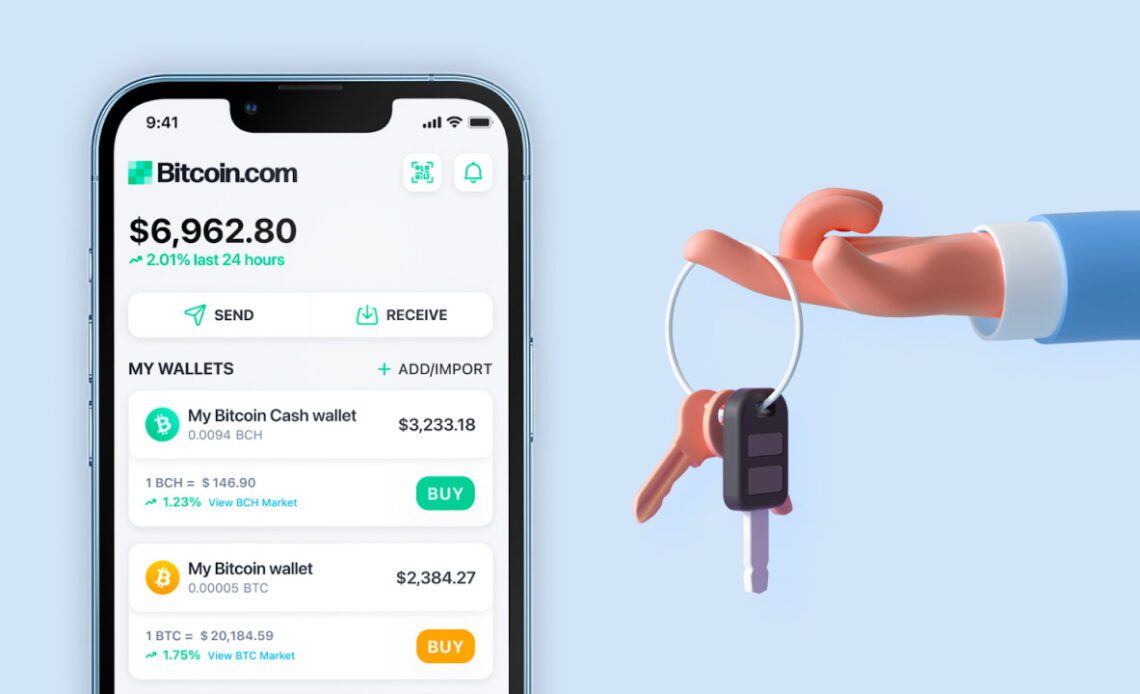

Not Your Keys, Not Your Coins

Pretty much everyone in crypto has heard this phrase at this point. This phrase is most applicable in the current market environment. Crypto and traditional markets are currently undergoing a contraction. During every contraction, whether it is in crypto or traditional markets, highly leveraged businesses have a greater chance of failing. Even worse, there have been countless stories of unscrupulous companies reaching for their customers’ funds to paper over the cracks.

We highly recommend for people to move your funds off of centralized services into self-custodial wallets (sometimes called non-custodial). Make sure it’s truly self-custodial, or you still don’t have complete control over your assets. Read more about the difference between custodial and self-custodial wallets here.

Risk Exposure to Failing Crypto Products

Self-custody doesn’t completely protect from risks associated with failing projects. We saw this spectacularly with LUNA/UST a month ago. However, there is a difference between custodial and self-custodial projects. The risks of LUNA/UST were apparent for many to see because the finances were mostly on-chain, transparent and free for anyone to observe. Despite that, plenty of participants, both retail and “sophisticated” institutional users were wiped out.

A far worse problem is the centralized crypto products because their finances are shrouded in mystery. It prevents any foreknowledge of their impending problems until it suddenly blows up. This is already unfolding now.

Celsius Network, a centralized borrow/lend crypto platform suddenly announced on June 13 that they were freezing customer assets. This was especially shocking given their CEO’s tweet responding to rumors of freezing customer withdrawals the day before.

Mike do you know even one person who has a problem withdrawing from Celsius?,

why spread FUD and misinformation.

If you are paid for this then let everyone know…

Click Here to Read the Full Original Article at Bitcoin News…