Bitcoin (BTC) price broke above $25,000 on Feb. 21, accruing a 53% year-to-date gain at the time, it made sense to expect the rally to continue after U.S. retail sales data from the previous week vastly surpassed the market consensus. This fuelled investors’ hope for a soft landing and the possible aversion of a recession in the U.S. economy.

The apex of the U.S. Federal Reserve’s strategy success would be increasing interest rates and scaling back its $9 trillion balance sheet reduction without significatively damaging the economy. If that miracle happens, the outcome would benefit risk assets, including stocks, commodities and Bitcoin.

Unfortunately, the cryptocurrency markets took a hit after the $25,200 level was rejected and Bitcoin price plunged 10% between Feb. 21 and Feb. 24. Regulatory pressure, mainly from the U.S., partially explains investors’ rationale for the worsening market conditions.

In a Feb. 23 New York Magazine interview, Securities and Exchange Commission (SEC) Chair Gary Gensler claimed “everything other than Bitcoin” is potentially a security instrument and falls under the agency’s jurisdiction. However, multiple lawyers and policy analysts commented that Gensler’s opinion is “not the law.” Hence, the SEC had no authority to regulate cryptocurrencies unless it proved its case in court.

Additionally, at a G20 meeting, U.S. Secretary Janet Yellen stressed the importance of implementing a strong regulatory framework for cryptocurrencies. Yellen’s remarks on Feb. 25 followed the International Monetary Fund (IMF) managing director Kristalina Georgieva pointing out that “if regulation fails,” then outright banning “should not be “taken off the table.”

Let’s look at Bitcoin derivatives metrics to better understand how professional traders are positioned in the current market conditions.

Asia-based stablecoin demand is stagnant

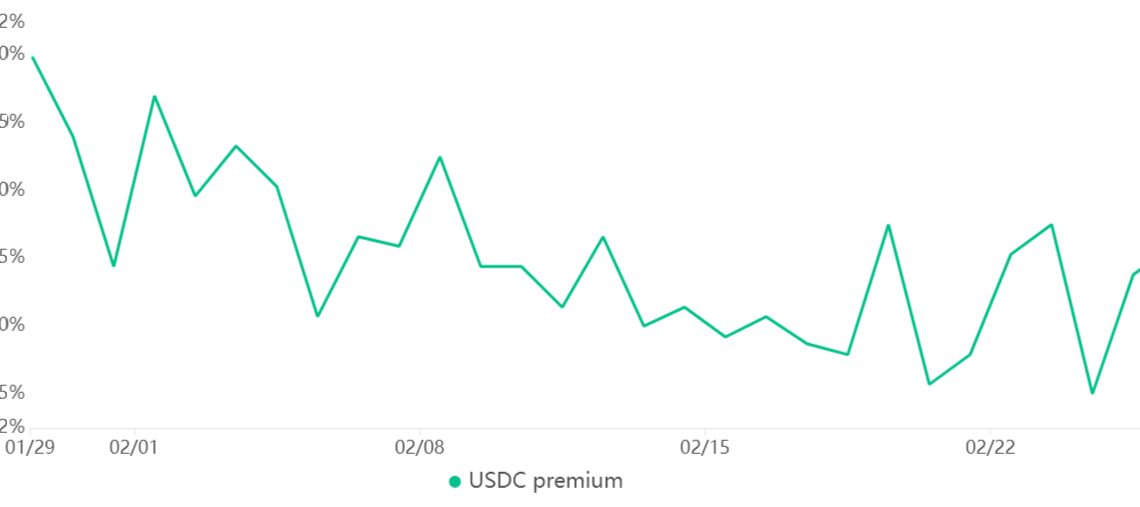

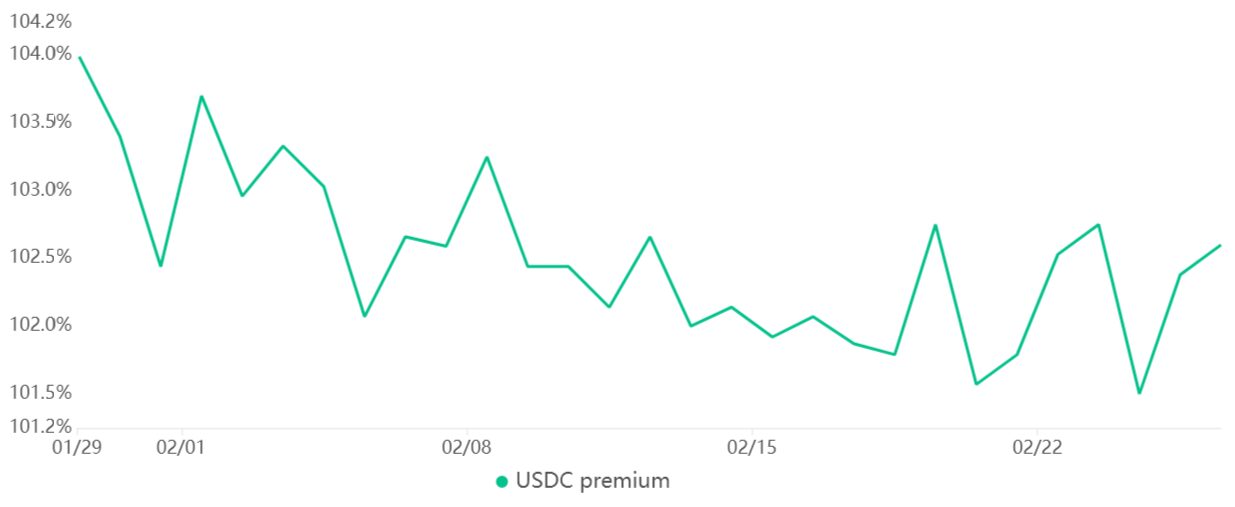

Traders should refer to the USD Coin (USDC) premium to measure the demand for cryptocurrency in Asia. The index measures the difference between China-based peer-to-peer stablecoin trades and the United States dollar.

Excessive cryptocurrency buying demand can pressure the indicator above fair value at 104%. On the other hand, the stablecoin’s market offer is flooded during bearish markets, causing a 4% or higher discount.

After peaking at 4% in late January, the USDC premium indicator in Asian markets has declined to a neutral 2%. The metric has since stabilized at a modest…

Click Here to Read the Full Original Article at Cointelegraph.com News…