Blur (BLUR) could rise by up to 30% by March 2023 owing to a mix of technical and fundamental factors.

Blur airdrop hype

Blur is a nonfungible token (NFT) aggregator that indexes digital art listings across various base marketplaces like LooksRare and OpenSea. In doing so, the aggregator allows users to trade across all NFTs marketplaces via a single interface.

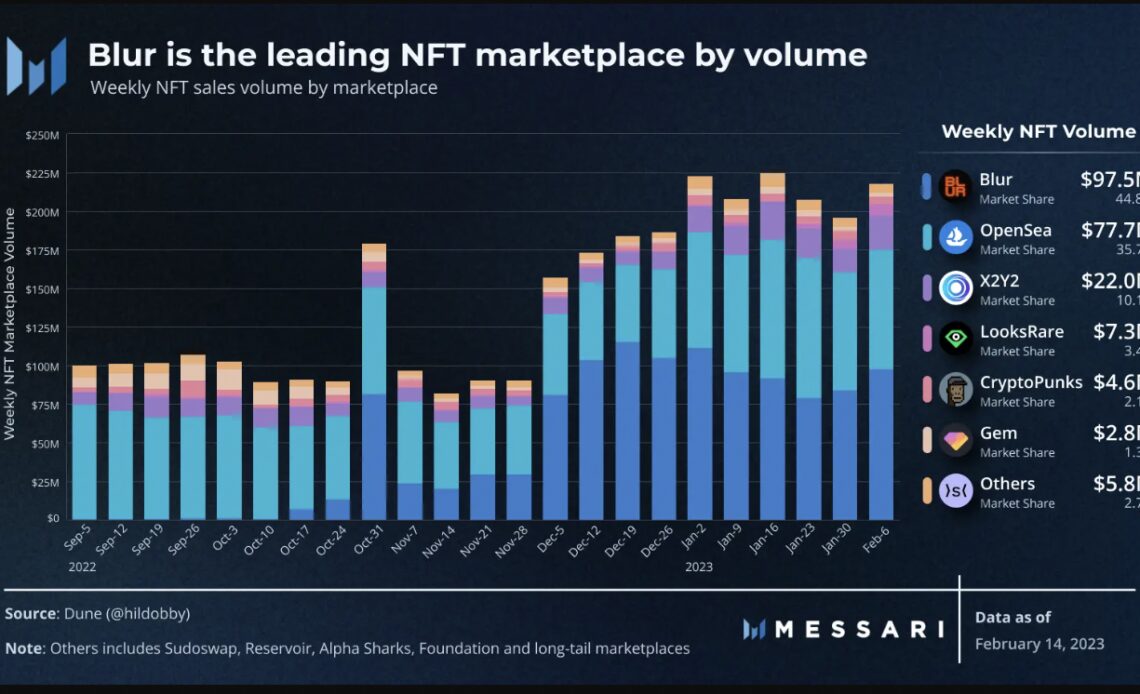

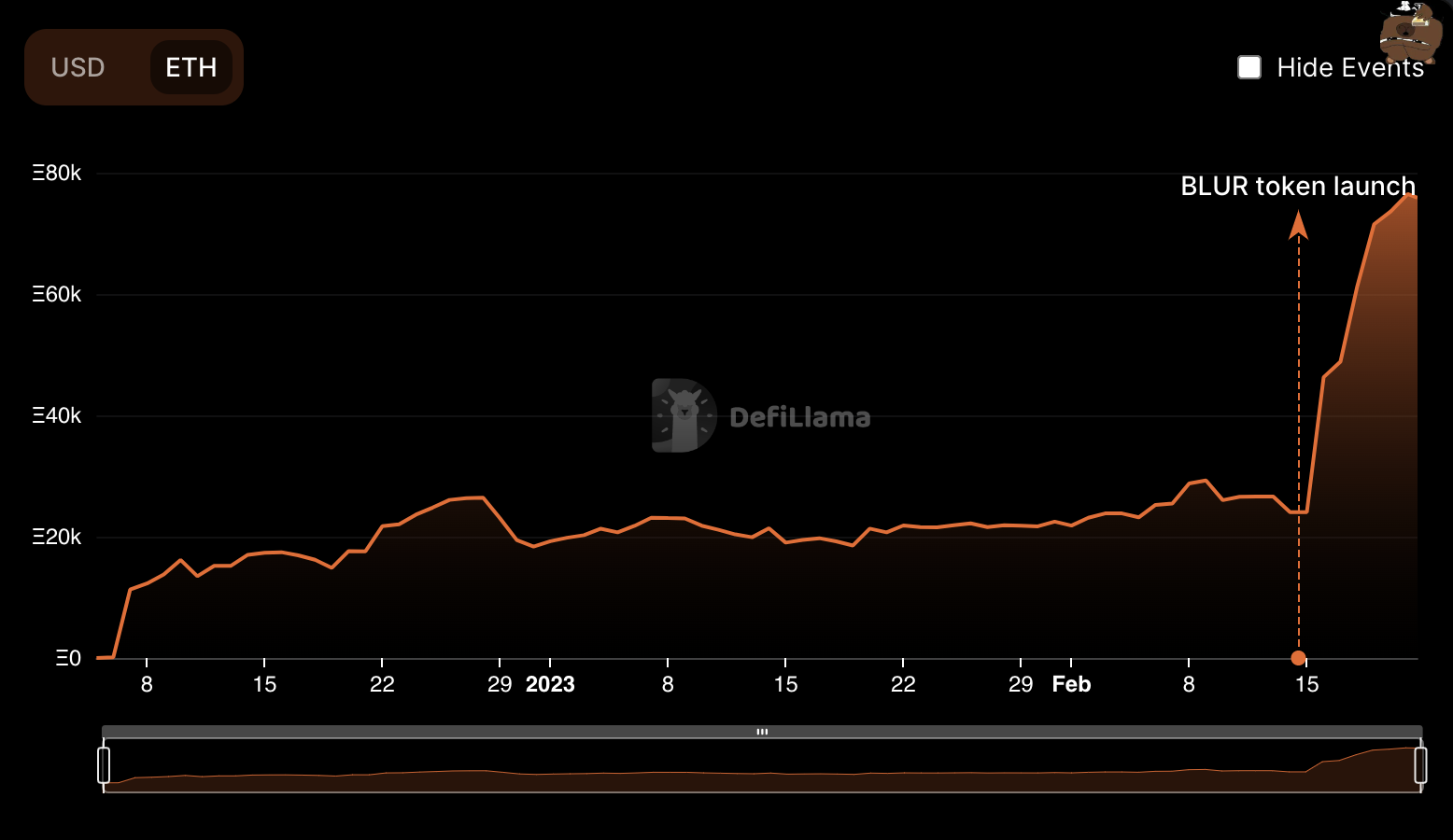

Since its launch in October 2022, Blur has become the leading NFT aggregator, accounting for 40%-60% of the daily NFT trading volume, according to data tracked by Messari.

The period has also witnessed the Blur team “airdropping” free BLUR tokens to users who have traded Ethereum-based NFTs in the past six months. On Feb. 15, Blur officially launched its native token of the same name, allowing airdrop recipients to trade it for fiat money and other crypto assets.

According to Dune Analytics, Blue has airdropped 360 million tokens across its users. Interestingly, users have claimed nearly 339 million BLUR tokens in the first six days of the launch against the 60-day deadline.

Typically, traders dump airdropped tokens early to secure an instant profit. Nonetheless, BLUR’s price remains approximately 25% higher than its market debut price of $0.88, suggesting that most traders have decided to hold it longer.

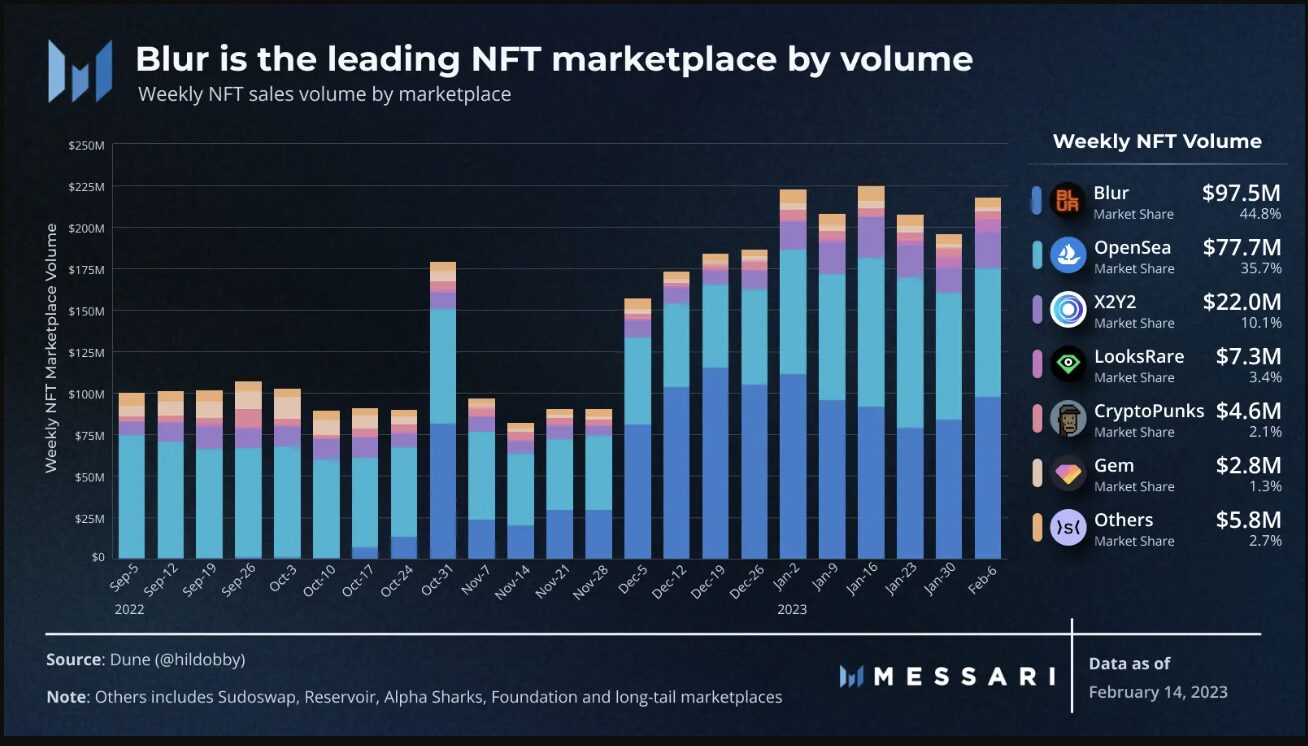

One reason could be the Blue team’s intention to conduct another airdrop in the coming months. The news coincides with Blur’s total-value-locked (TVL) metric reaching a record high of 76,490 ETH, according to Defi Llama.

“Blur airdrop reminds me of the Uniswap airdrop,” noted independent market analyst Nekoz, adding:

“Early sellers sold for a ps5. Diamond hand sellers sold it for 5 figures. Imo if you don’t need the funds, just chill with it. It will be the number 1 NFT platform.”

BLUR price Doji reversal

BLUR price technicals are also hinting at a bullish scenario being more likely.

On the four-hour chart, BLUR has painted a Doji pattern at the end of its short-term correction phase. That is confirmed by the four-hour candlestick with almost the same open and close levels, and extreme bearish and bullish wicks.

The Doji shows indecisiveness among traders about the next market bias. But coupled with Blur’s other technical indicators, namely its short-term support level of around $1 and a neutral relative strength index (RSI), it appears the Doji may result in a bullish reversal in the coming weeks.