New Hampshire is on the verge of becoming a national leader in cryptocurrency if its legislature follows through on recommendations made by a commission appointed by Governor Chris Sununu. The recommendations would establish a legal framework for blockchain and crypto businesses in the state, providing clarity and certainty to entrepreneurs and regulators while avoiding the onerous and largely pointless special rules federal regulators and members of Congress want to impose on the industry. The proposed rules would also protect consumers, depositors and investors.

Blockchain businesses presently exist in something of a legal gray area in the United States. Congress has provided little guidance to the regulatory agencies, resulting in confusion and difficulties in maintaining compliance. This adds unnecessary costs and sometimes causes companies to do contradictory things. Responsibility for regulating the companies is split between the Securities and Exchange Commission and the Commodity Futures Trading Commission.

While these agencies regulate different things, they have different approaches and it’s not even clear if one agency or the other has priority. Due to the lack of clarity, many cryptocurrency exchanges and businesses have moved their operations and corporate domiciles out of the United States to countries with fewer regulations. Bermuda, the Bahamas, Antigua and Barbuda and Malta are popular offshoring sites.

Related: What creditors can expect from Genesis’ bankruptcy — and what others can learn

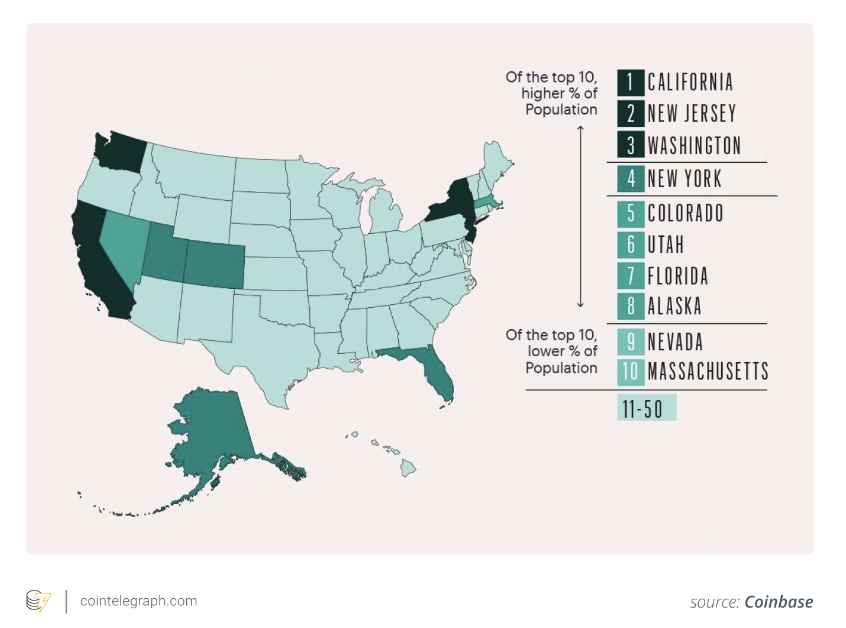

Coinbase CEO Brian Armstrong said last year that regulatory uncertainty drove 95 percent of trading offshore. “Punishing U.S. companies … makes no sense,” he tweeted. Circle moved its exchange to Bermuda in 2019, while Fidelity Investments had to offer an exchange-traded Bitcoin fund in Canada in 2021. Digital Chamber of Congress president Perianne Boring also attributed offshoring to uncertainty, saying, “they’re not willing to operate in a gray area with potential enforcement hanging over their head.”

New Hampshire’s framework would remove that gray area, setting the rules on how digital assets should be treated by regulators — as securities, commodities or currencies — and help ensure they follow Anti-Money Laundering (AML) and fraud rules. While officials will have their work cut out to lure crypto businesses away from the Caribbean, new startups will benefit, as the new rules could attract more risk-averse investors.

Click Here to Read the Full Original Article at Cointelegraph.com News…