Ethereum’s native token Ether (ETH) resumed its decline against Bitcoin (BTC) two days after a successful rehearsal of its proof-of-stake (PoS) algorithm on its longest-running testnet “Ropsten.”

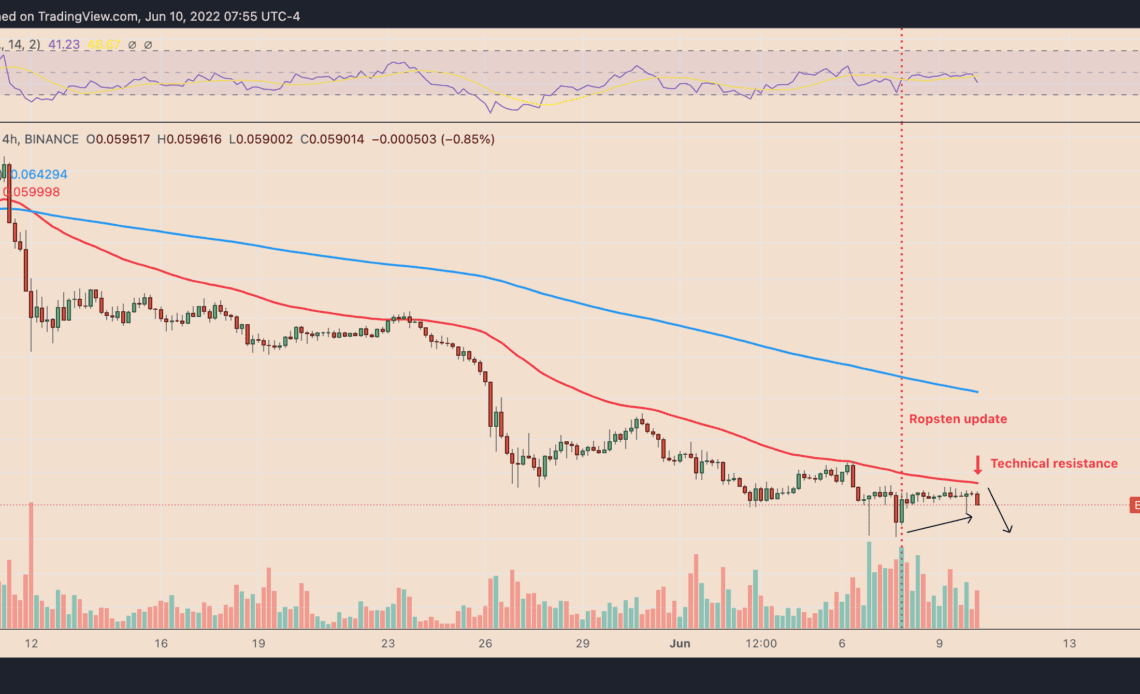

The ETH/BTC fell by 2.5% to 0.0586 on June 10. The pair’s downside move came as a part of a correction that had started a day before when it reached a local peak of 0.0598, hinting at weaker bullish sentiment despite the optimistic “Merge” update.

Interestingly, the selloff occurred near ETH/BTC’s 50-4H exponential moving average (50-4H EMA; the red wave) around 0.06. This technical resistance has been capping the pair’s bullish attempts since May 12, as shown in the chart above.

Staked Ether behind ETH/BTC’s weakness?

Ethereum’s strong bearish technicals appeared to have overpowered its PoS testnet breakthrough. And the ongoing imbalance between Ether and its supposedly-pegged token Staked Ether (stETH) could be the reason behind it, according to Delphi Digital.

“Testnet Merge was a success, yet the ETH market did not react,” the crypto research firm wrote, adding:

“Concerns over the ETH-stETH link are swirling as the health of financial institutions post-Terra is questioned.”

Several DeFi platforms that have staked Ether in Ethereum’s PoS smart contract will not be able to access their funds if the Merge gets delayed. Thus, they risk running into ETH liquidation troubles as they attempt to pay back their stakeholders.

That could prompt these DeFi platforms to sell their existing stETH holdings for ETH. Meanwhile, if they run out of stETH, the selloff pressure risks shifting to their other holdings, including ETH.

If Swissborg tried to exit their entire stETH position, they would bump the peg down another cent.

More importantly, this would consume 25% of the remaining ETH liquidity in the pool. Swissborg also contributes a few thousand Eth to this pool… 6/ pic.twitter.com/sWIdzMWNvU

— Dirty Bubble Media: ⏰ (@MikeBurgersburg)

Click Here to Read the Full Original Article at Cointelegraph.com News…