This week saw a positive recovery in some crypto assets, Ethereum included. It is gaining momentum and preparing for a bullish rally in the days to come. Although Ethereum is still below $1,300, some factors suggest a possible increase to $1,350 and $1,550.

The crypto market has been filled with FUD (fear, uncertainty, and doubt) in the past weeks following the FTX crisis. Crypto investors are left speculating whether to buy or sell holdings as assets plunged deeper. For example, reports show that Ethereum lost nearly 39% in a couple of weeks.

The crypto market has been anticipating news of the U.S. Federal Reserve dropping its bullish stance on interest rate hikes from December. As signals point towards this expectation becoming a reality, some assets started showing signs of recovery. However, despite the bullish trend, Bitcoin remains down due to miners’ capitulation, while Ethereum is rising.

Factors Indicating Massive Ethereum Price Surge

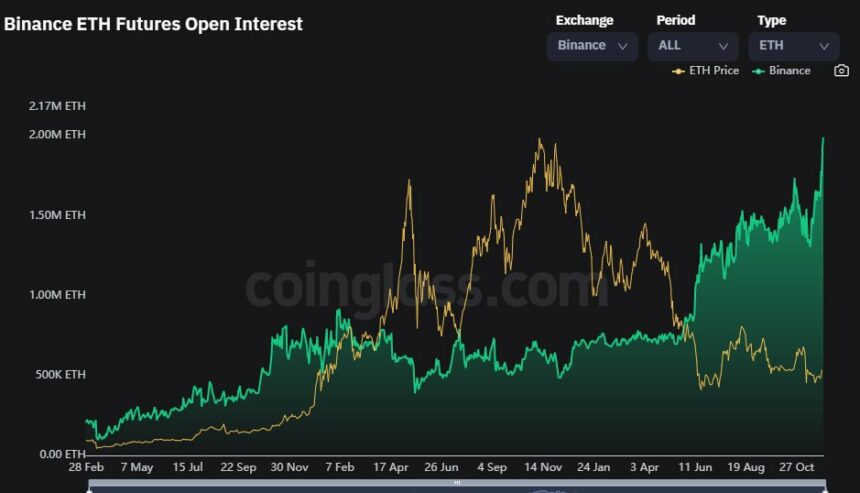

Coinglass’ crypto derivatives data shows that Ether futures open interest on Binance has reached an all-time high of 2.01 million. It amounts to a 9% increase in Open Interest in the last 24 hours, indicating a high probability that Ethereum will increase in the coming weeks.

On-chain data from Glassnode also revealed that the total value of the Ethereum 2.0 deposit contract hit an all-time high of 15,492,407 ETH. Ethereum validators’ revenue has also reached a 1-month high of 11.310%.

These records have got players and analysts reacting. For example, Michael van de Poppe believes ETH is exhibiting strength as it rose from the $1,150 level to the current price. The analyst predicts that a break above the $1,225 level would trigger a rally toward $1,350 and maybe $1,550.

Traders look forward to holding their Ether if it remains above the support level of $1,200. Analysts also believe the ETH price increase will rub off on other altcoins.

ETH Price Journey

Many traders were bullish about Ethereum’s price increase after the completion of the merger. However, Ethereum neither surpassed nor bounced back to the $1,700 level after the merge. With the macroeconomic situation, the asset continued falling and went below the $1,500 physiological.

Whale accumulations saw ETH price drop from $1,661 to $1081 in one month. Whales saw the price declines as an opportunity to accumulate ETH holdings. Whale accumulations are often indicators of an asset’s bullish recovery. However, it didn’t…

Click Here to Read the Full Original Article at NewsBTC…