Up until the start of this week, Bitcoin (BTC) had been demonstrating record-low volatility, and this gave altcoins enough latitude to paint some nice technical setups.

At the same time, on-chain data and technical analysis were beginning to suggest that BTC was midway through carving out a bottom, and many analysts believed that brighter days lay ahead.

Fast forward to the present, and the volatility spike the market received actually turned out to be a black swan event.

As you already know, FTX is kaput.

Alameda Research is kaput.

BlockFi has put a stop to withdrawals, citing an inability to “operate as usual,” so it’s “pausing client withdrawals as allowed under our Terms,” suggesting that the company is also kaput.

The contagion is spreading, and the shrapnel from this Krakatoa-level event is bound to ripple throughout the entire crypto ecosystem.

At this time, it’s difficult to make a confident short-term investment thesis for assets by simply looking at the chart, and the best thing unsure investors can do is either stick to a time-tested plan or do nothing.

The most likely short-term outcome is volatility will remain high, and crypto prices will continue to whipsaw for a while.

Nobody is comfortable focusing on the potential negative outcomes that lie ahead for the crypto sector and cryptocurrency prices, but it’s every investor’s responsibility to consider the absolute worst outcomes and have a contingency plan in place.

That way you don’t freak out when shit really hits the fan.

Here are a few things to keep an eye on over the coming days.

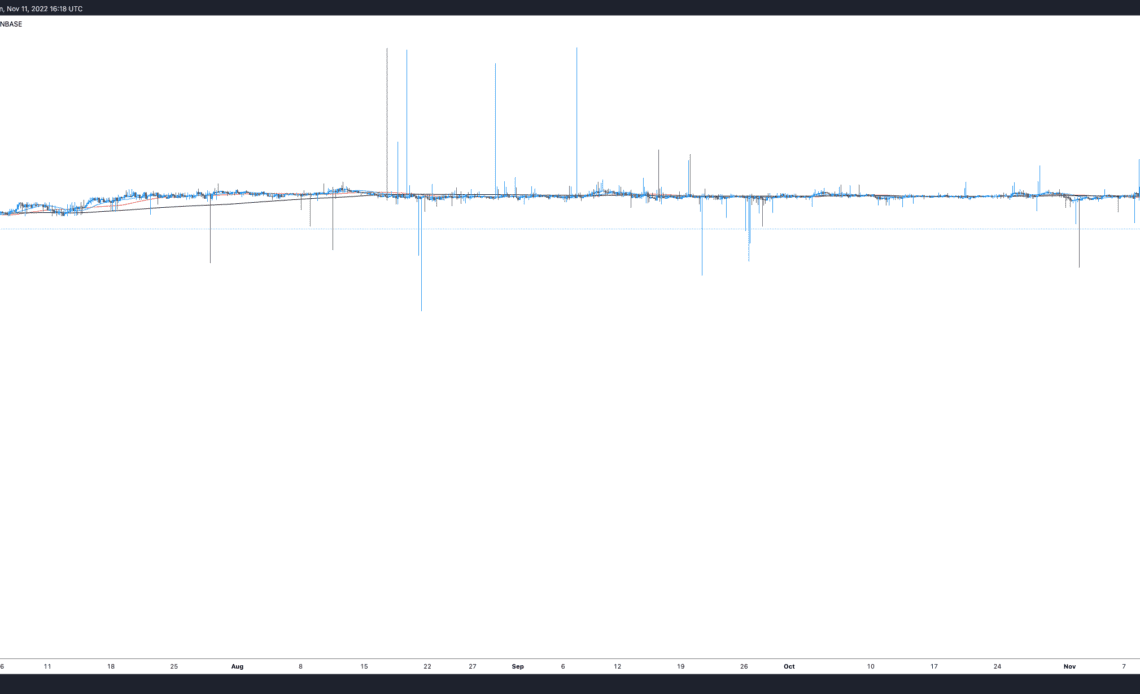

USDT/USD vs. USDC/USD

During high volatility events, stablecoins sometimes break their peg with the dollar. If there’s some wild FUD about Bitcoin being banned, hacked or dying, stablecoins prices sometimes rise above $1.00 as traders seek shelter in assets fixed to the dollar.

During crypto black swan events, sometimes Tether (USDT) loses its dollar peg. It’s happened a number of times in the past, and usually, once the smoke clears it regains the 1:1 peg.

On Nov. 9, USDT/USD broke below its dollar peg, dipping as low as $0.97 at one point, according to data from TradingView and Coinbase. While USDT dipped below its peg, USD Coin’s (USDC) value spiked to $1.01.

While we won’t explore the unconfirmed reasons why there was dislocation between the two, the unsubstantiated rumors related to Tether and Alameda Research can easily be found on Twitter….

Click Here to Read the Full Original Article at Cointelegraph.com News…