Governance tokens are a type of cryptocurrency that allow tokenholders to vote on the direction of a blockchain project. The primary purpose of governance tokens is to decentralize decision-making and to give holders a say in how the project is run.

Governance tokenholders are usually more invested in the project’s success as they stand to gain or lose more, depending on the outcome. Community members can use tokens to influence the direction and features of a blockchain protocol directly. As such, it is possible to implement changes related to the user interface, vote on fees and reward distribution, or even modify the underlying code of a project.

Although most decentralized finance (DeFi) tokens are governance tokens, voting is not their only defining feature. People possessing these governance tokens can use them to take out loans, stake them and earn money through yield farming. Given all this, their primary function is still to distribute power.

Governance tokens are a relatively new invention, and there is still much debate about their efficacy. Some believe they are the key to true decentralization, while others worry that they will lead to the centralization of power among a small group of tokenholders.

How do governance tokens work?

Governance tokens act as the foundation to establish decentralized governance in decentralized autonomous organizations (DAOs), DeFi projects and decentralized applications (DApps).

Users who have made significant contributions to the community or have demonstrated loyalty are frequently awarded governance tokens. Tokenholders then vote on key issues to ensure that the projects progress effectively. Generally, people vote by utilizing smart contracts so that the results are tabulated and enacted automatically.

Each project has its own set of governance token rules. They are dispersed to stakeholders, including the founding team, investors and users, using various calculation methods.

Some governance tokens only vote on a limited number of governance issues, while others vote on everything from development updates to smart contract revisions. Similarly, some governance tokens have the option of generating financial returns; others do not.

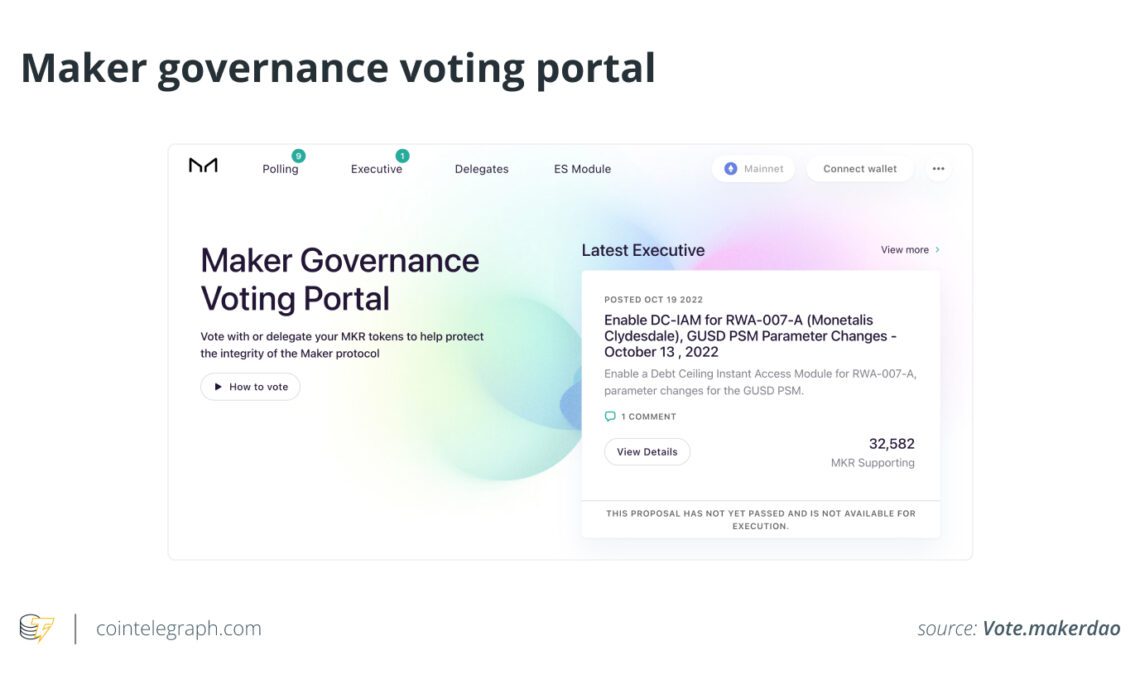

The Ethereum-based DAO, MakerDAO, was among the first issuers of governance tokens. MakerDAO’s stablecoin is called Dai (DAI), while Maker (MKR) tokenholders govern the protocol itself. One token equates to one vote, and decisions with the most votes are adopted.

Among the types of…

Click Here to Read the Full Original Article at Cointelegraph.com News…