The cryptocurrency industry is abuzz with speculation after recent reports suggested China may soften its stance on a yuan-backed stablecoin, but law experts caution against overinterpreting the news.

Reuters reported Wednesday that Beijing is considering approving a stablecoin pegged to the renminbi as part of a roadmap to boost the currency’s internationalization. It was the second report this month, following a similar Financial Times story on Aug. 5. Despite the news, Chinese officials have yet to confirm whether it’s considering a stablecoin push.

Even if Chinese authorities move ahead, analysts stress that such a stablecoin would almost certainly circulate offshore, not in the mainland.

“The news about stablecoins linked to China’s currency is likely genuine, but it’s not what most people assume. China is unlikely to issue stablecoins onshore, but we can expect them offshore,” Joshua Chu, co-chair of the Hong Kong Web3 Association, told Cointelegraph.

China’s currency operates in two distinct markets — the onshore yuan (CNY) and the offshore yuan (CNH) — and any stablecoin initiative would likely be tied to the latter.

Don’t expect China to peg a stablecoin to the CNY

China’s currency has been deliberately split into CNY and CNH. The CNY is strictly confined to the mainland, and it’s not a currency that moves freely in and out of China. A stablecoin pegged to the CNY would clash with Beijing’s strict capital control rules.

The CNH and CNY are the same currency, but their prices can diverge because they trade in different markets. Simply put, if overseas markets are bearish on China, the CNH can weaken more than the CNY. If there’s strong foreign demand for China’s assets, CNH can trade more strongly than CNY.

Related: Banking lobby fights to change GENIUS Act: Is it too late?

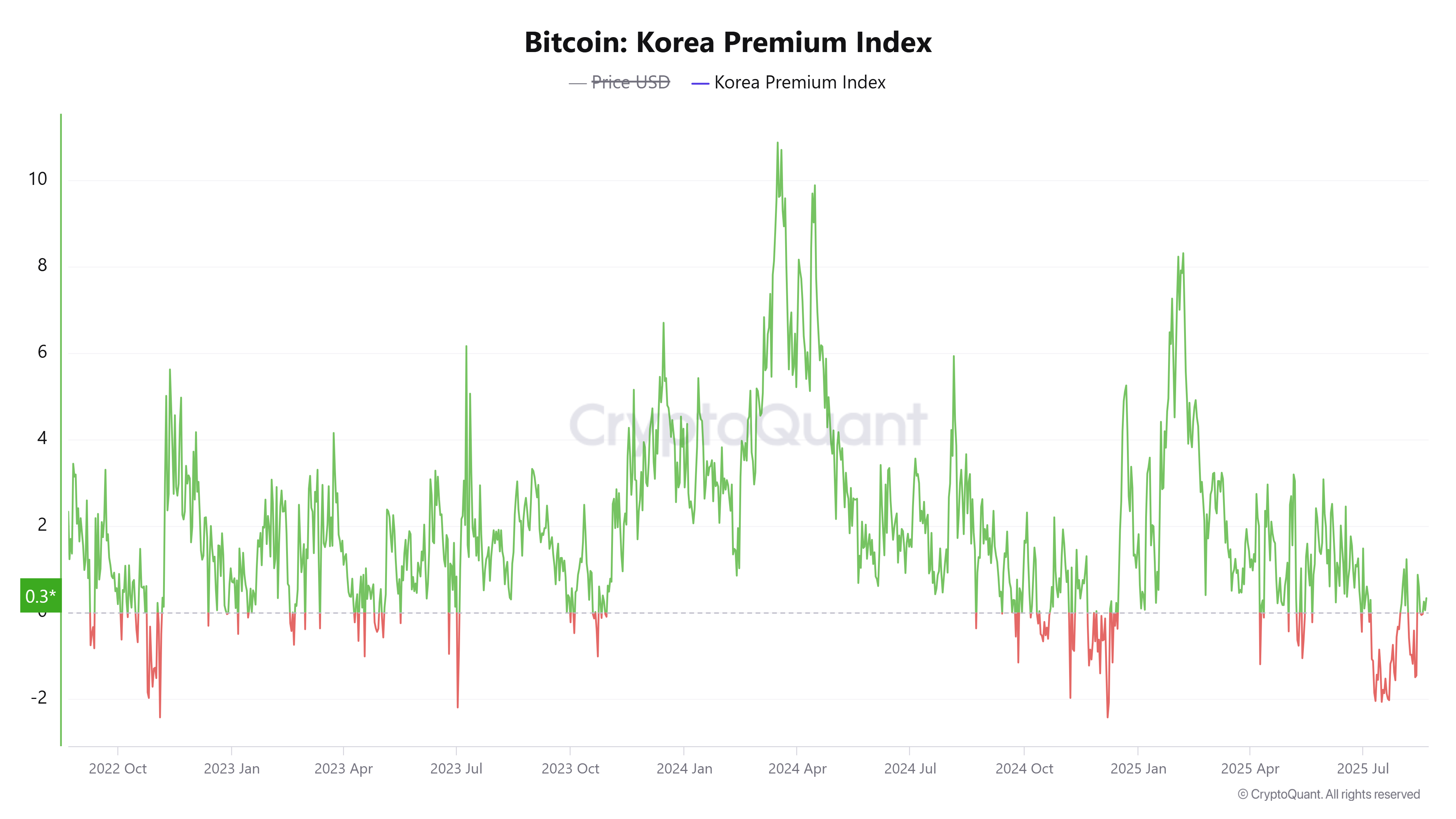

A similar effect known as “kimchi premium” is seen in South Korea’s Bitcoin (BTC) market, where BTC often trades at a premium due to the country’s confined crypto market.

Previous reports suggest China’s internet giants have lobbied to greenlight the offshore yuan stablecoin. Within the domestic market, Beijing has been committed to the digitization of its CNY through the development of its central bank digital currency (CBDC), the digital yuan, also known…

Click Here to Read the Full Original Article at Cointelegraph.com News…