Bear markets are typically marked by a capitulation event where discouraged investors finally abandon their positions and asset prices either consolidate as inflows to the sector taper off or a bottoming process begins.

According to a recent report from Glassnode, Bitcoin hodlers are now “the only ones left” and they appear to be “doubling down as prices correct below $30K.”

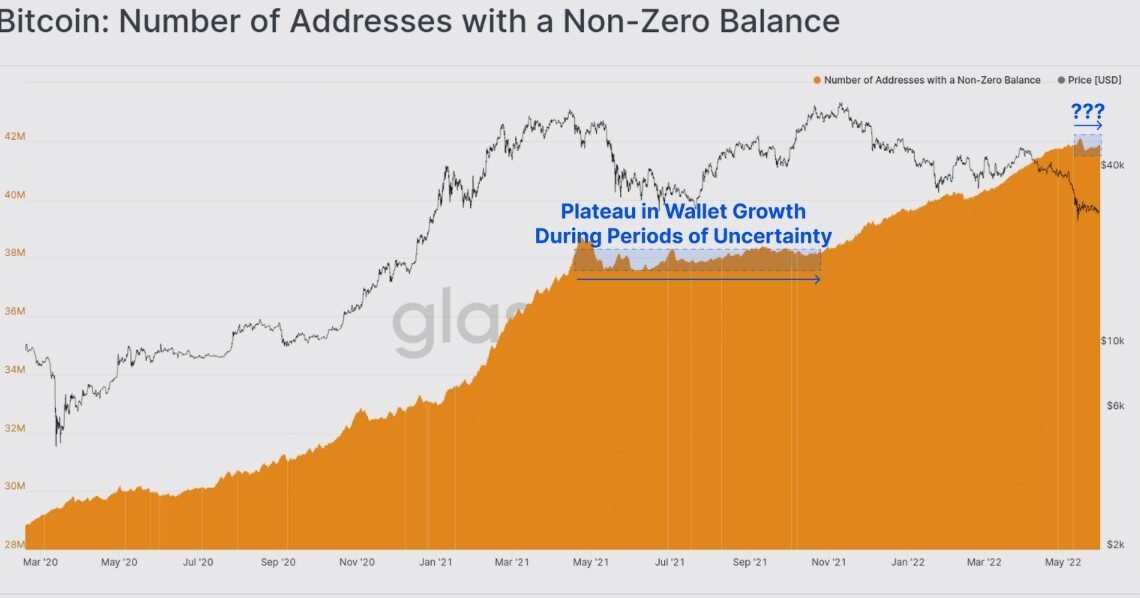

Evidence of the lack of new buyers can be found looking at the number of wallets with non-zero balances, which has plateaued over the past month, a process that was seen after the crypto market sell-off in May of 2021.

Unlike the sell-offs that occurred in March 2020 and November 2018, which were followed by an upswing in on-chain activity that “initiated the subsequent bull runs,” the most recent sell-off has yet to “inspire an influx of new users into the space.” Glassnode analysts say this suggests that the current activity is predominantly being driven by hodlers.

Signs of heavy accumulation

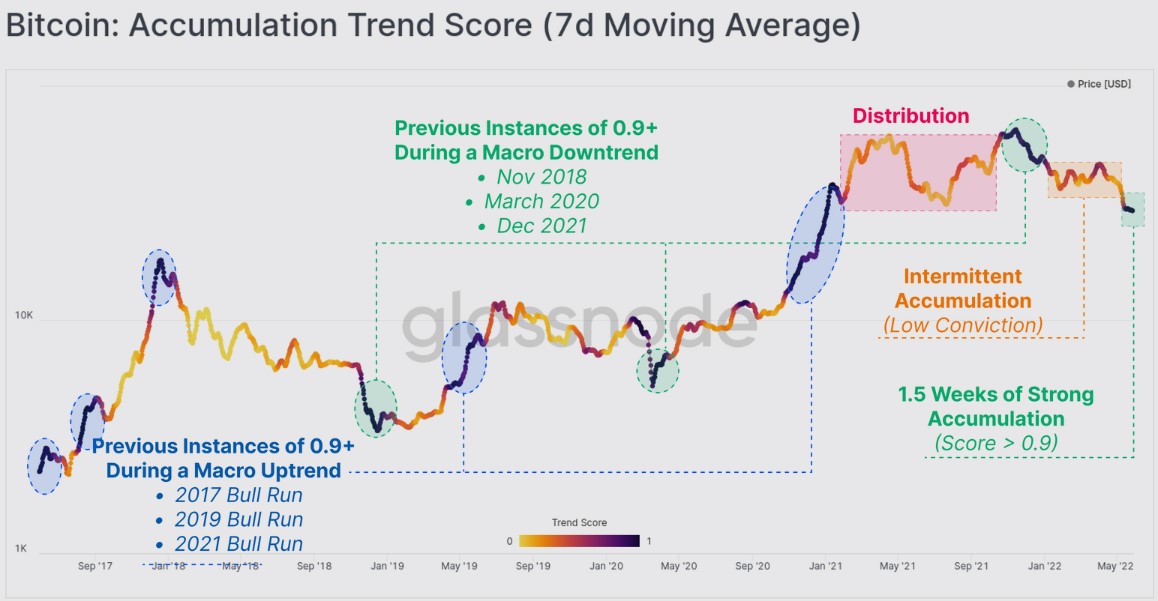

While many investors are disinterested in BTC’s sideways price action, contrarian investors view it as an opportunity to accumulate, a point evidenced by the Bitcoin accumulation trend score which “has returned a near perfect score above 0.9” for the past two weeks.

According to Glassnode, high scores on this metric during bearish trends “generally trigger after a very significant correction in price as investor psychology shifts from uncertainty to value accumulation.”

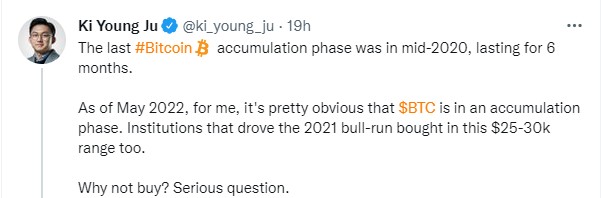

The idea that Bitcoin is currently in an accumulation phase was also noted by CryptoQuant CEO Ki Young Ju, who posted the following tweet asking his Twitter followers “Why not buy?”

A closer look at the data shows that the recent accumulation has been largely driven by entities with less than 100 BTC and entities with more than 10,000 BTC.

In the recent volatility, the aggregate balance of…

Click Here to Read the Full Original Article at Cointelegraph.com News…