Key Takeaways

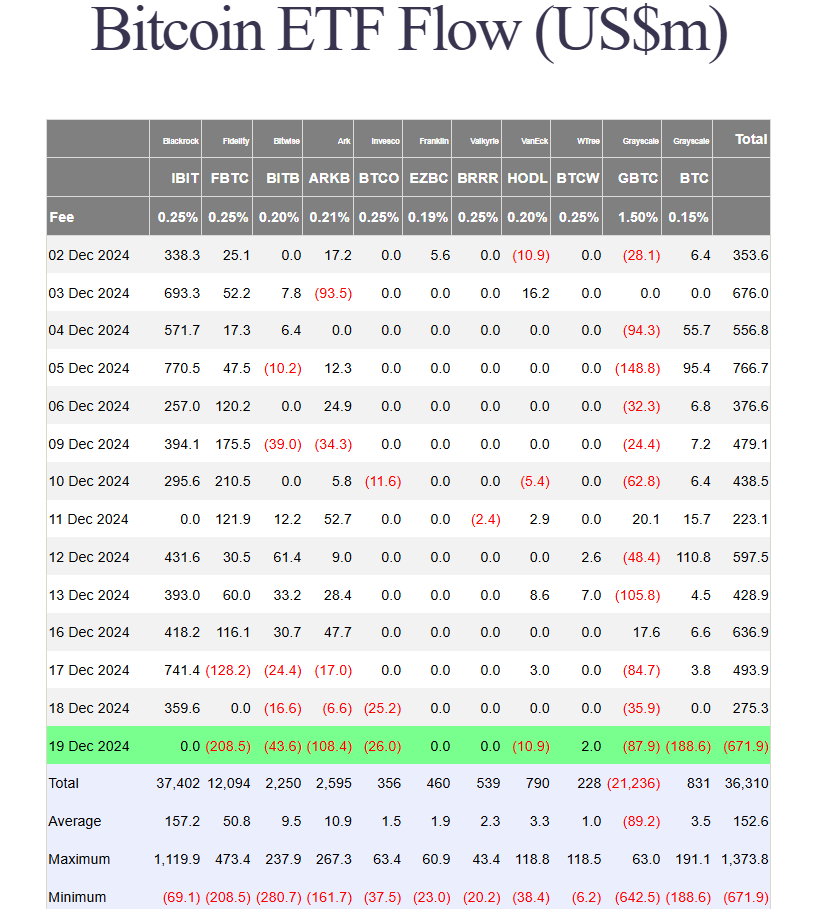

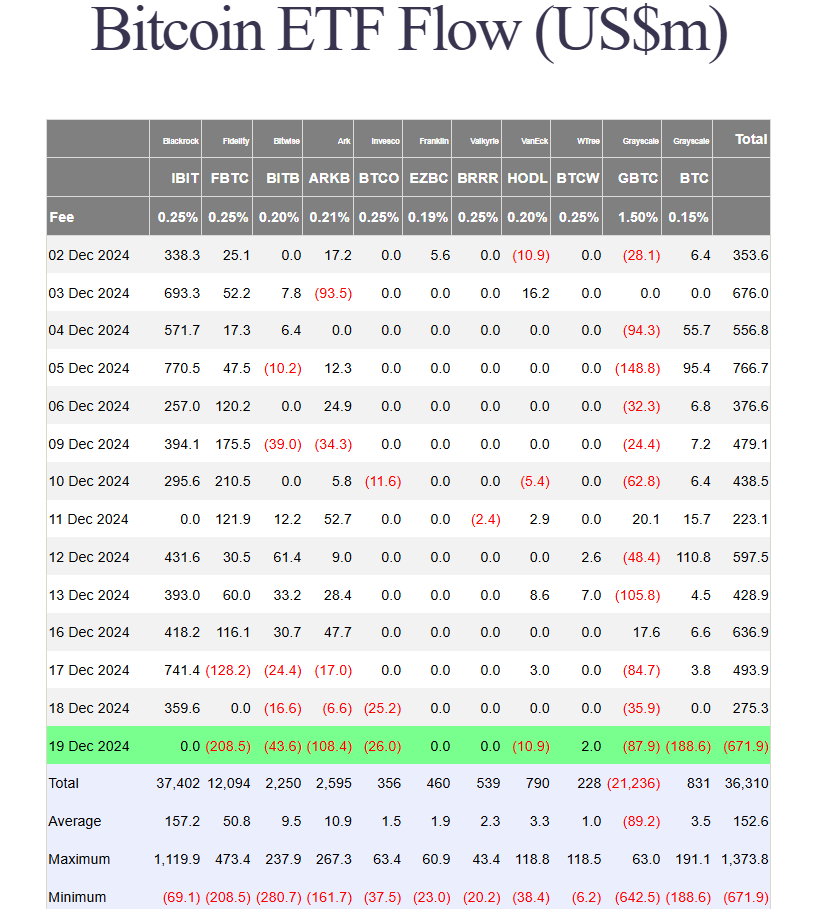

- US Bitcoin ETFs experienced historic outflows with investors withdrawing $672 million in a day.

- Fidelity’s Bitcoin Fund led the outflows, followed by Grayscale and ARK Invest ETFs.

Share this article

US spot Bitcoin ETFs experienced their largest single-day outflows on record, with investors withdrawing approximately $672 million on Thursday amid a broad crypto market decline post-Fed policy meeting, Farside Investors data shows.

The massive withdrawal marked the end of a two-week positive streak for the 11 funds that directly hold Bitcoin. The previous outflow record was set on May 1, when the funds saw nearly $564 million in withdrawals after Bitcoin dropped 10% to $60,000 over a week.

Fidelity’s Bitcoin Fund (FBTC) led the exodus with $208.5 million in outflows, while Grayscale’s Bitcoin Mini Trust (BTC) recorded its lowest point since launch with over $188 million in net outflows.

ARK Invest’s Bitcoin ETF (ARKB) and Grayscale’s Bitcoin Trust (GBTC) also saw huge withdrawals, with ARKB losing $108 million and GBTC shedding nearly $88 million.

Three competing ETFs managed by Bitwise, Invesco, and Valkyrie collectively lost $80 million.

BlackRock’s iShares Bitcoin Trust (IBIT), which has accumulated $1.9 billion in net inflows so far this week and was a major contributor to the group’s recent strong performance, recorded zero flows for the day.

WisdomTree’s Bitcoin Fund (BTCW) was the sole gainer, attracting $2 million in new investments.

Bitcoin’s price fell below…

Click Here to Read the Full Original Article at Markets Archives – Crypto Briefing…