The crypto industry surged significantly in 2024, delivering a high performance that could shape its future. Investors are now looking ahead to 2025 with

predictions of Bitcoin hitting $210,000, Solana reaching $1,000, and

institutional adoption transforming the industry. The market also witnessed

the surprising dominance of meme coins this year.

The influence of U.S. policy remains significant, with

a shift toward more favorable crypto regulation following the Republican

electoral sweep.

The introduction of the Bitcoin Strategic Reserve Bill

further set the stage for Bitcoin’s geopolitical role. Analysts now consider scenarios in which nation-states hold BTC as a strategic asset.

Memecoins became a defining theme of 2024, spurred by

growing disillusionment with VC-backed projects. Retail investors turned to meme coins like PEPE and DOGE, viewing them as a fairer playing field due to

their lower inflation and transparent supply.

While meme coins are often criticized for their lack of

utility, their performance signaled a key shift in market sentiment. Investors

rejected hype-driven VC launches in favor of assets that resonated with

community-led movements.

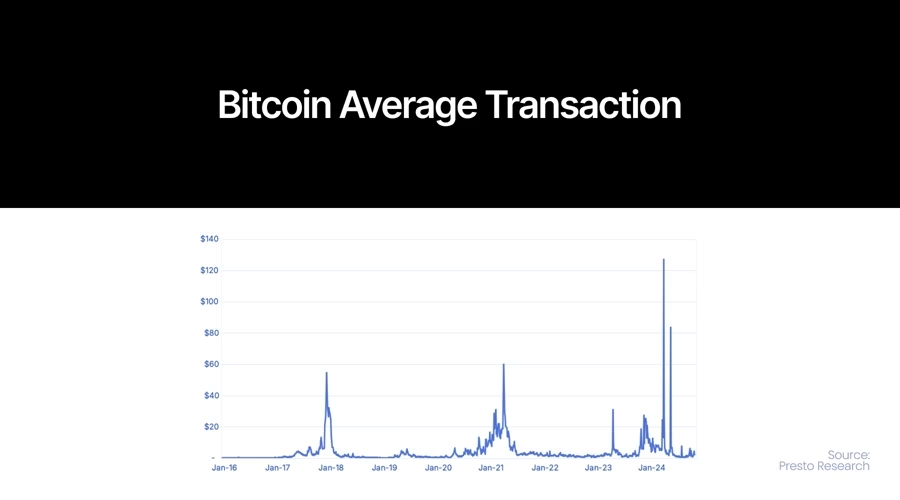

Source: Presto Research

Stablecoins rebounded strongly in 2024, with their

aggregate market cap surging to $200 billion. Analysts predict this figure will

climb to $300 billion in 2025, cementing stablecoins as the blockchain’s most

successful application.

The momentum seen in 2024 has sparked bold predictions

for 2025. Analysts foresee Bitcoin climbing to $210,000, driven by the MVRV

ratio, a valuation metric that measures market value against realized value. Broader corporate adoption, led by MicroStrategy’s

success and improved accounting rules, could also drive BTC’s ascent.

Meanwhile, Solana’s institutional adoption and network

growth have positioned it for explosive gains. Analysts predict SOL could hit

$1,000 in 2025, citing the platform’s technological advancements and rising

on-chain activity.

The U.S. is poised to maintain its dominance in the

crypto market, fueled by a crypto-friendly political environment under the

Trump administration.

The Rise of Crypto Indices

The rise of crypto indices could further cement

mainstream adoption in 2025. Similar to the S&P 500 in equities, crypto

indexes are expected to provide diversified exposure to investors. These

products will simplify entry for new investors, offering sector-based baskets

that capture specific market themes.

Source: Presto…