The biggest Donald Trump-inspired memecoin on the market has exploded off its lows as the former president’s odds of winning the November election increase.

After hitting $1.64 on September 24, TRUMP (MAGA) ran up to $5.67 by October 7th, a 246% rally in just under two weeks.

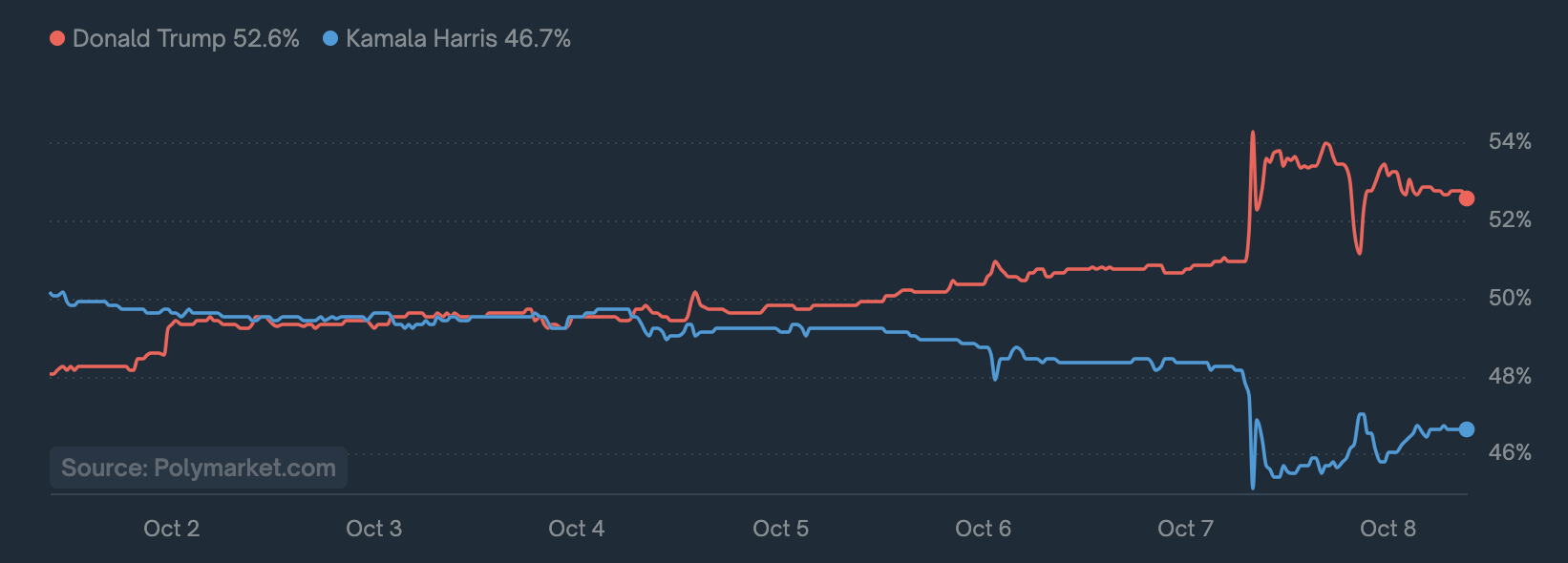

The move coincided with Donald Trump taking the lead on crypto betting platform Polymarket’s “Presidential Election Winner 2024” portal.

MAGA is currently trading at $4.37 with a market cap of $201.1 million.

Trump now has a 52.6% chance of winning the November 5th election compared to Kamala Harris’ 46.7%, according to Polymarket.

The Republican nominee made crypto part of his campaign earlier this year, arguing that the US should revive its digital asset industry to become the “crypto capital of the planet.” He also backed the launch of his own crypto platform World Liberty Financial (WLFI) – though details on the project are still unclear.

However, many have argued that the outcome of the US election is largely irrelevant to the future of crypto and its potential for a new bull market.

BitMEX founder Arthur Hayes recently said that regardless of who moves into the White House, they will inevitably increase spending, debase the dollar and ultimately boost Bitcoin (BTC) and digital assets.

“Once that’s settled, then it’s off to the races. Whoever wins the election is going to print money.

Donald Trump’s going to cut taxes, Kamala Harris is going to increase welfare payments, but both sides are in agreement that the government’s role in terms of how much it spends needs to expand, regardless of where that expansion is. So as crypto holders we don’t really care what they spend the money on…”

And VanEck’s head of digital assets Matthew Sigel said that both Kamala Harris and Donald Trump are bullish for Bitcoin, with only nuanced implications for digital assets.

Sigel said both candidates will likely maintain fiscal spending – or increase it – which could lead to further quantitative easing (QE), which has historically been bullish for the asset class.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or…

Click Here to Read the Full Original Article at The Daily Hodl…