Dogecoin has finally reached a very precarious moment. The former darling of the meme token world turned into a bearish trend, with recent charts unveiling a concerning decline.

Related Reading

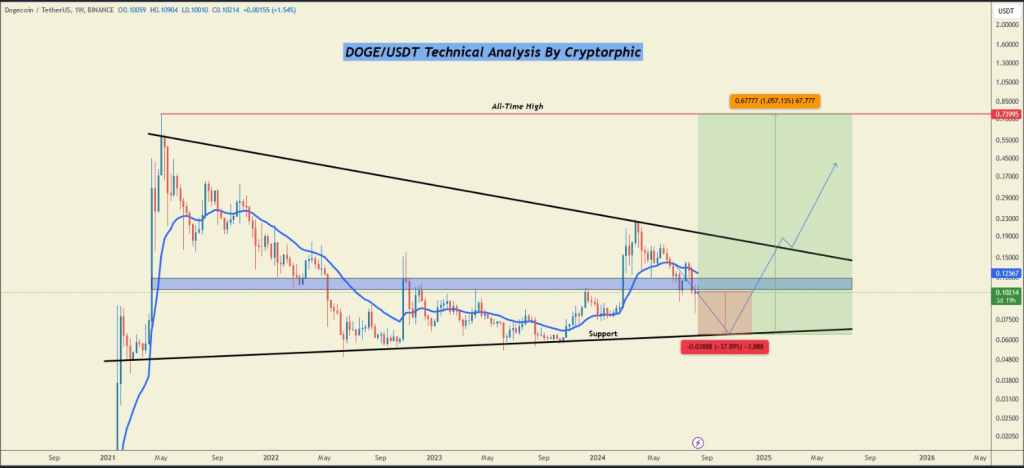

Analysts made the observation that DOGE has dropped below a key resistance area that formerly acted as a crucial support level, a sign of more losses in store. Investors are now worried that in case it continues failing to find stability, it could drop another 38% to 40%. Other major support levels are at $0.055-0.0628; and breaking these could set the stage to steeper declines.

DOGE Technical Analysis in Weekly Timeframe

DOGE is in a downtrend on the weekly timeframe. The price has broken below the blue box, which was a key support, and it’s now acting as resistance.

If the market doesn’t shift from bearish to bullish, DOGE will likely drop toward the… pic.twitter.com/ukbVPEArsG

— Cryptorphic (@Cryptorphic1) August 15, 2024

Dogecoin: Market Sentiment

Market sentiment now holds the key to the immediate fate of Dogecoin. Generally, it is not very optimistic at the moment. The change of status quo, that is, DOGE going back to a strong bearish reaction, would require the market to change significantly.

In the event that level of the market reaction is absent, then there may be a downward extension in DOGE price. However, if the coin tries to move upward, resistance would be spotted at $0.104 and $0.118. At the same time, the support accumulation zone is marked at $0.6243. Should DOGE succeed in having a bounce above these key levels, its short-term prospects remain uncertain.

On-Chain Data And Holder Behavior

However, on-chain data from IntoTheBlock was able to provide some insight into holder sentiment. The data showed that around 73% of the current holders of Dogecoin at current prices are in profit. In particular, 67% of these holders have kept their DOGE for more than a year, in other words, strong hands in the market. That, while the short-term perspective remains cautious, there is serious long-term holder confidence.

Long-Term Potential And Forecast

While the resistance continues at the moment, there seems to be a silver lining for DOGE’s long-term growth. For the next three months, CoinCheckup reports that DOGE is expected to increase by 114%. And all these potential highs can be supported by technical indicators: at the time of writing, both the Relative Strength Indicator (RSI) and the Moving Average Convergence Divergence…

Click Here to Read the Full Original Article at NewsBTC…