Ethereum’s native asset Ether (ETH) has more than doubled in value since bottoming out at around $885 in June 2022. Now, it eyes a decisive move toward $2,500 in August per a slew of technical and fundamental indicators.

Ethereum chain split means more tokens

A big part of Ether’s ongoing rally has appeared due to “the Merge,” a network upgrade that will switch Ethereum’s underlying blockchain protocol from proof-of-work (PoW) to proof-of-stake (PoS) in September.

Simultaneously, switching to PoS will also eliminate the role of miners in the chain by replacing them with validators. This fear has prompted Chandler Guo, a Chinese crypto miner, to resist the Merge by keeping Ethereum’s PoW version alive.

A chain split is possible as a result. Guo has already branded his version of the Ethereum PoW chain as “ETHPoW,” alongside its native token “ETHW.” Furthermore, some crypto exchanges have already listed the token for trading with even Binance considering doing the same, if necessary.

The Ethereum Merge is approaching.

Here’s what you need to know if you hold $ETH on #Binance:

Binance will support “The Merge”.

In case of newly forked tokens, we will evaluate and consider support for distribution and withdrawal.View details ⤵️https://t.co/iuQSsXZ7fk

— Binance (@binance) August 10, 2022

A key takeaway from a potential chain split is existing Ether holders will receive an equal amount of tokens from the new chains.

In turn, that could boost ETH’s demand in the market, leading its price toward the $2,500 mark in the run-up to the Merge.

Bullish flipping underway

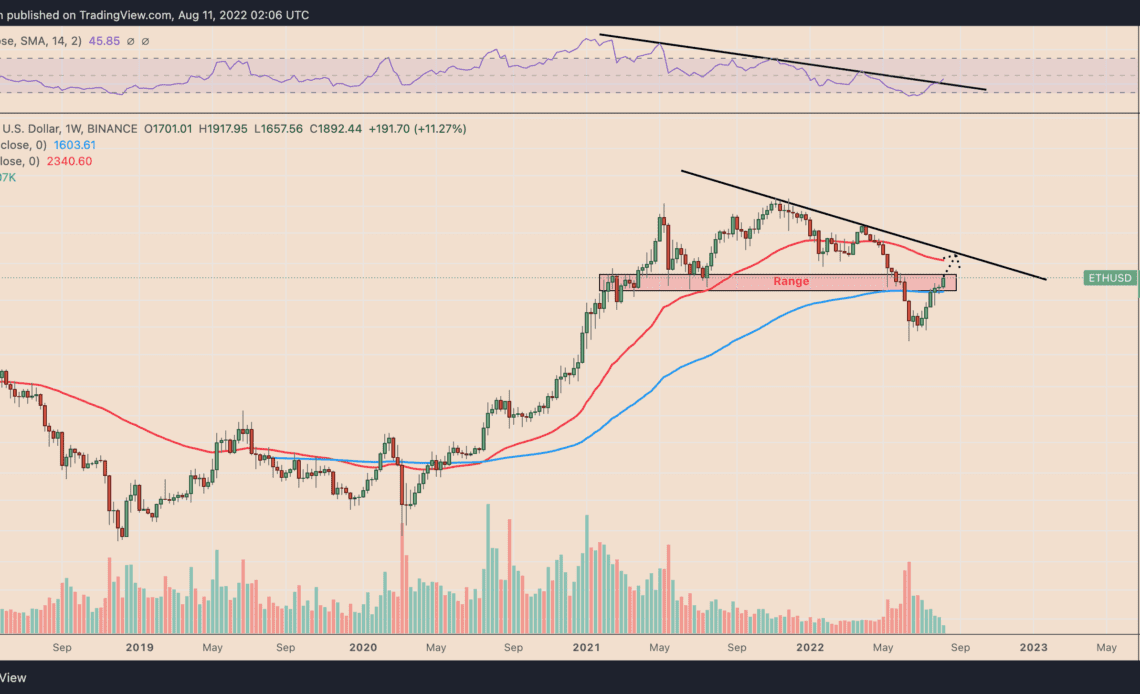

During its recent price recovery, Ether has confidently rallied toward a critical support-turned-resistance range of $1,625-$1,975.

ETH/USD now aims to retake the range as support, thus giving itself a strong price floor to pursue a rally toward and above $2,000. Its nearest upside target is the 50-week exponential moving average (50-week EMA; the red wave in the chart below) at $2,340.

Click Here to Read the Full Original Article at Cointelegraph.com News…