In the last four days, the Bitcoin price has plummeted over 15%, with a significant 7.8% drop occurring in just the past 24 hours. From a high of nearly $72,000 in early June, the price of BTC has now declined by almost 25%. Here are the key factors behind yesterday’s dramatic fall in price.

#1 Mt. Gox’s Bitcoin Repayments

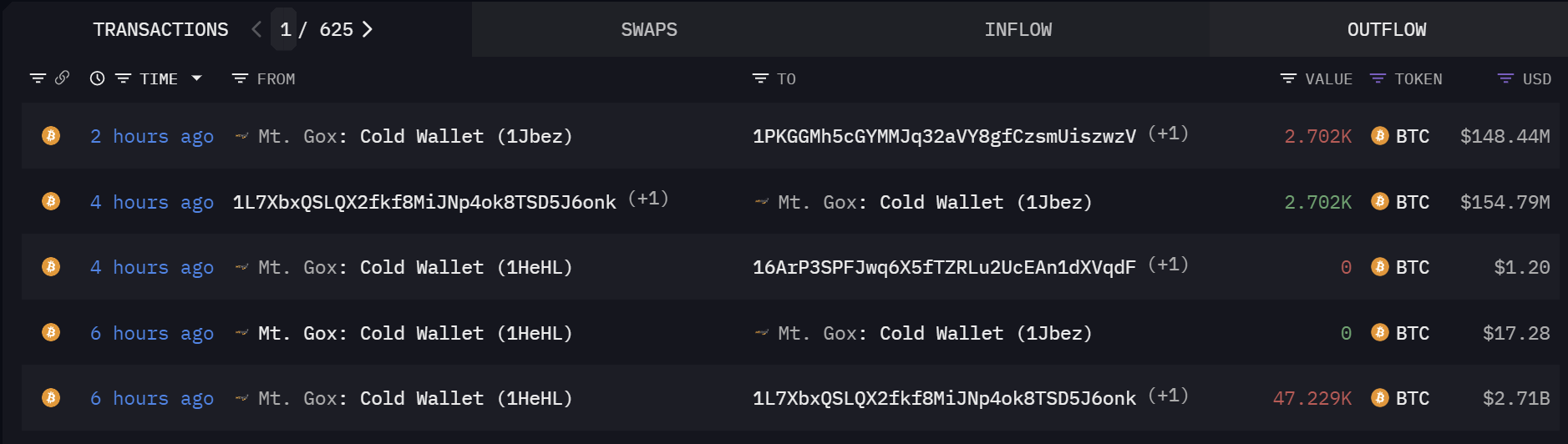

The impending distribution of 142,000 BTC by the defunct crypto exchange Mt. Gox has significantly stirred market anxiety. This amount, representing 0.68% of the total Bitcoin supply, is slated for distribution among the creditors of the exchange, which ceased operations in 2014 due to a major hacking event.

The distribution process has already seen large transfers, with 52,633 BTC moved in recent hours, suggesting that preparations are underway for a large-scale disbursement. Market observers and analysts are closely monitoring these movements, as the potential for massive selling by these creditors could inject considerable volatility into the market.

The psychological impact of this distribution has presumably led to preemptive selling among Bitcoin holders, further amplifying market jitters.

#2 German Government

The German government’s decision to begin liquidating its Bitcoin holdings has sent ripples through the market as well, with transactions recorded on major exchanges such as Bitstamp, Coinbase, and Kraken.

Related Reading

Over a fortnight, the government reduced its holdings from 50,000 BTC to 42,274 BTC. Market participants are understandably nervous that a continuous sell-off by a major holder like a government could lead to downward price pressure.

#3 Massive Long Liquidations

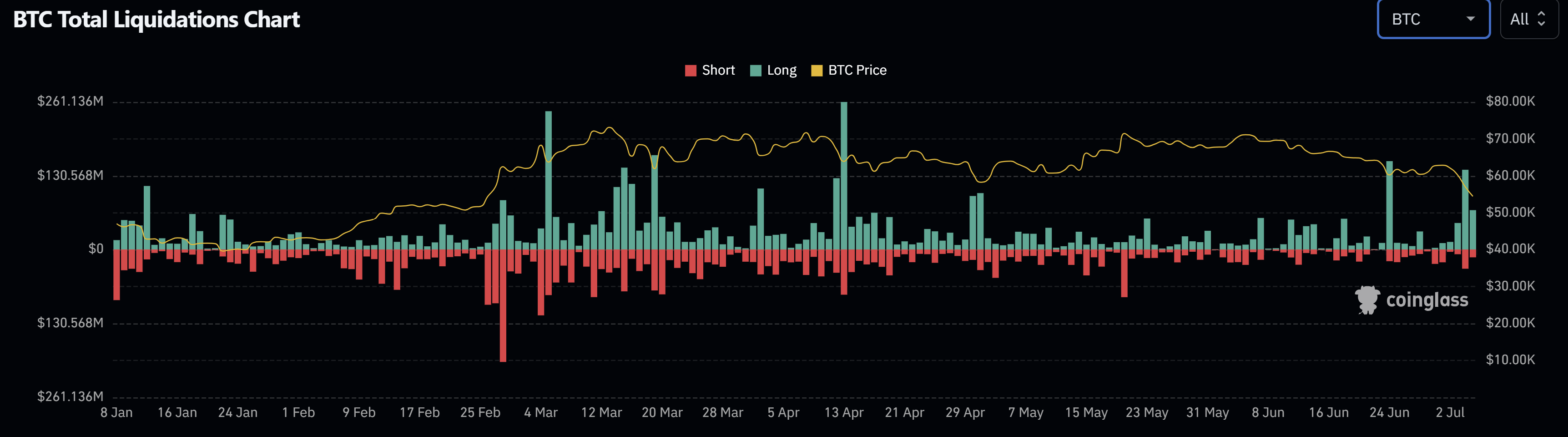

The Bitcoin market has experienced a sharp increase in the liquidation of long positions, with a record $212 million worth of BTC liquidated just in the past 48 hours. This liquidation is the most significant since April 13, when $261 million worth of BTC longs were liquidated, leading to a steep decline in Bitcoin’s price from $68,500 to $61,600.

Such liquidations often trigger a chain reaction, leading to forced sell-offs and further price declines. These liquidations are indicative of a highly leveraged market where investors might be overextended, contributing to heightened market volatility.

#4 BTC Miner Capitulation

Post the Bitcoin halving event on April 20, 2024, the mining reward was halved from 6.25 to 3.125 BTC, escalating…

Click Here to Read the Full Original Article at NewsBTC…