Chainlink (LINK) co-creator Sergey Nazarov says this could be the year that sees a great merger between blockchain and the traditional global financial system.

In a speech at the Consensus 2024 conference, Nazarov says the market for on-chain assets is more than $100 trillion.

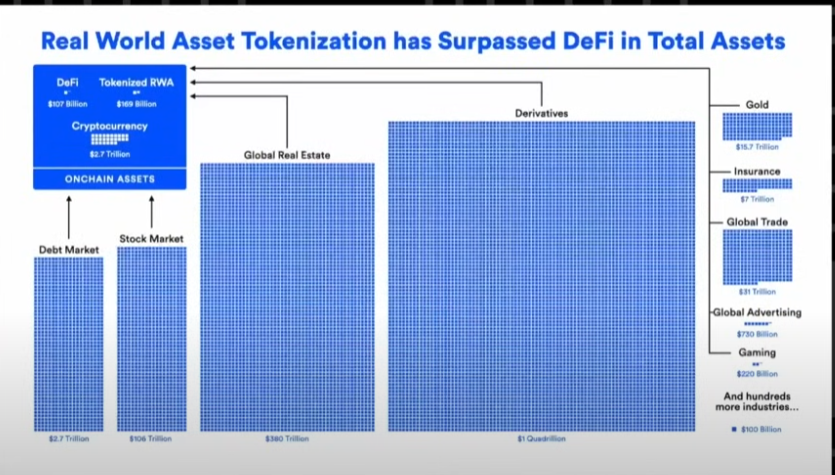

The Chainlink co-creator shares a chart showing that the $2.7 trillion debt market and the $106 trillion stock market can move into the blockchain. The chart also shows that other assets such as global real estate and derivatives can be tokenized.

Nazarov says that eventually, all financial transactions will take place on-chain, and that 2024 is the year that the global financial system will start moving its settlement systems onto the public blockchains.

“So we’re kind of at another tipping point where the amount of value that you’re seeing in this real-world asset digital asset tokenization trend, even on public chains, has now surpassed DeFi (decentralized finance). And this isn’t even counting all the value in private chains, banks’ chains, and all those more private systems, so it’s even more value than that.

The world we’re going to is still the world where all the world’s value, all the credits, all derivatives, all commodities, everything is basically on-chain, and represented on-chain and composable on-chain into more and more advanced financial products, in an efficient quick way so we’re not taking months, we’re talking minutes to seconds.

Right now what takes months, will take minutes to seconds, and as more and more assets get on-chain, they’ll become composable, and they’ll begin to create their own benefits from being composed into more and more advanced baskets of things.

So right now, we’re basically in the position where we’re at a tipping point, where the numbers have surpassed what they were in the past, and we’re on a trajectory where all the world’s biggest institutions are starting to look at how to put their value on-chain.

So I would say, basically that this year is when our industry shifts into this new direction about public chains and about the global financial system merging into a single industry, into a single internet of contracts.”

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Click Here to Read the Full Original Article at The Daily Hodl…