Ether (ETH) bulls like a positive spread between its spot and ETH futures prices because the so-called contango reflects optimism about a higher rate in the future. But as of Aug. 1, the Ethereum futures curve slid in the opposite direction.

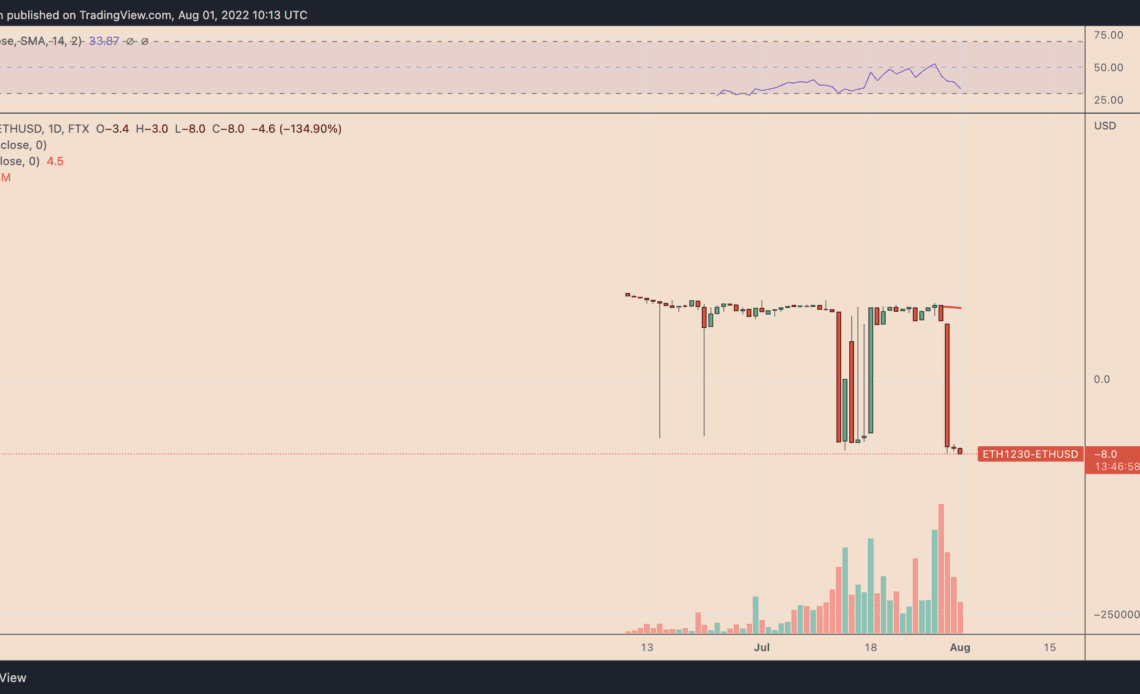

Ethereum quarterly futures in backwardation

On the daily chart, Ethereum futures quarterly contracts, scheduled to expire in December 2022, have slipped into backwardation, a condition opposite to contango, wherein the futures price becomes lower than the spot price.

The spread between Ethereum’s spot and futures price grew to minus $8 on Aug. 1.

One one hand, the current ETH spot price being higher than its year-end outlook appears like a bearish sign. However, the conditions surrounding the current negative spread between the Ether spot and futures price suggests traders may actually be bullish on ETH.

For instance, Bitcoin (BTC) has gained 15% since its futures entered backwardation in late June for the first time in a year.

ETH could rally on “airdrop” hopes

Moreover, a potential chain split will likely be a bullish in the run-up to the Merge in September, according to some analysts.

Roshun Patel, former vice president of institutional lending at Genesis Trading, noted that the December Ether futures have flipped into backwardation due to Ethereum “fork odds,” which could prompt traders to buy spot ETH ahead of the Merge.

Meanwhile, Patel hinted that traders could be offsetting their upside spot risks by taking bearish positions on December futures contracts.

dec flipping into backwardation on eth starting to price in fork odds. Back in 2020 the play with the bchabc fork was buy spot and short the quarts pic.twitter.com/Oyde1htnz8

— Roshun Patel (@roshunpatel) July 31, 2022

The statement came after Galois Capital’s survey on the Merge. In the July 28 Twitter poll, the crypto hedge fund asked its followers whether or not the Merge would end up splitting the Ethereum…

Click Here to Read the Full Original Article at Cointelegraph.com News…