We are standing on the cusp of a new era when digital and

traditional finance converge to create social and economic transformation.

Where barriers to entry once stood, technological advancements are making it

possible for anyone to access wealth-creation opportunities that were once the

domain of the elite few. At the forefront of this transformation is the

emergence of tokens, specifically those that represent real-world assets, such

as stocks, bonds, real estate and others.

By reimagining ownership and trading of assets, tokenization

is unlocking doors to financial opportunities previously out of reach to many.

This shift is not just altering market dynamics, it’s laying the foundation for

a more equitable and accessible financial future

when empowerment and freedom aren’t just ideals but tangible realities.

The ability to invest capital into assets, instead of

holding cash, is not a luxury but a necessity for every household

looking to survive and thrive. Holding cash, often perceived as a safe bet, is

a silent thief eroded by the relentless march of inflation. Consider this, $100

in 2004, sitting idly, would have the purchasing power of merely $60 today.

Contrast this, with the dynamism of the stock market the same amount invested

in the S&P 500 over the same period would have quintupled to an impressive

$470.

Yet, the landscape of stock ownership reveals a stark

imbalance. The wealthiest 10% in the US control an overwhelming 93% of stocks,

illustrating a deep-seated inequality in financial opportunity and access. This

inequality is magnified when looking at sectors like private equity and private

credit, where doors often remain closed to everyday investors.

Enter Tokenization, the Great Equalizer

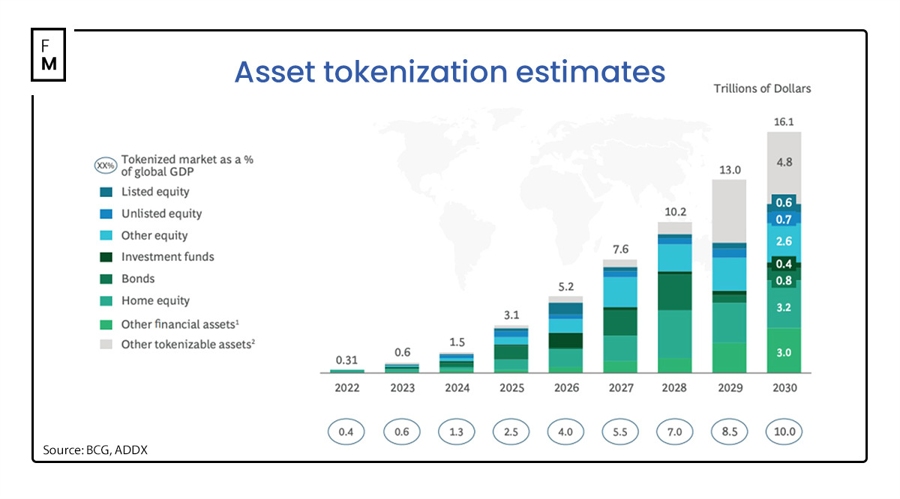

While a distinctly counter-culture ethos characterized the

early days of blockchain, it wasn’t long before traditional financial

institutions sought to leverage this technology to improve existing

financial pipelines. Thus began the race to tokenize the world and empower

traditional assets like stock, bonds, and real estate with the benefits of blockchain, such as

24/7/365 trading, fractional ownership, transparency, and programmability.

“The most important first step is to get in there and start to engage in the ecosystem”—Sandy Kaul of @FTI_Global.

How banks and asset managers can get started with tokenization ⬇️ pic.twitter.com/kG2MdNrUdv

— Chainlink (@chainlink) April 17, 2024

Yet, perhaps the greatest advantage of the tokenization…