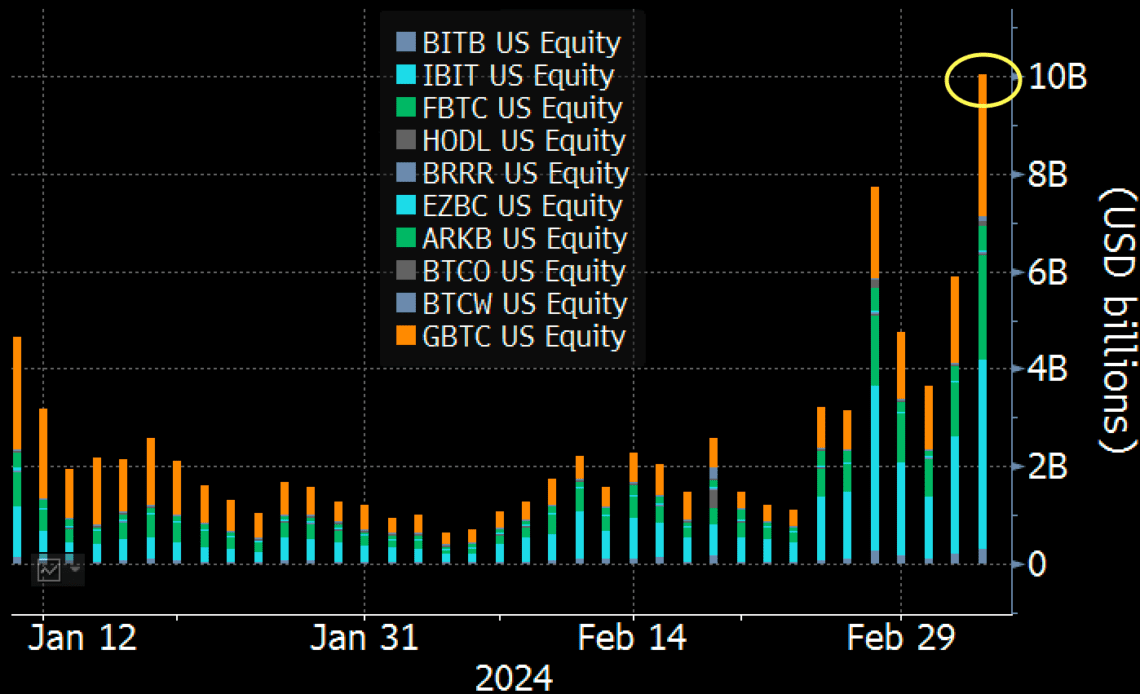

Spot Bitcoin ETFs have continued their record-breaking performance this week, recording over $10 billion in volume on March 5 — the highest since their launch in January.

The previous record was set on Feb. 28, when the ETFs recorded a collective trading volume of approximately $7.7 billion.

IBIT, FBTC retain the lead

Three spot Bitcoin ETFs made up most of the total volume. Trading closed with net inflows of $109.86 million across all ETFs.

BlackRock’s iShares Bitcoin Trust (IBIT) was responsible for about $4 billion in volume on March 5, while the Fidelity Wise Origin Bitcoin Trust (FBTC) made up roughly $2 billion. Grayscale’s Bitcoin Trust (GBTC) recorded $3 billion in daily volume.

Bloomberg ETF analyst Eric Balchunas wrote on X:

“These are bananas numbers for ETFs under 2 [months] old.”

Earlier in the day, Balchunas predicted that spot Bitcoin ETFs would likely surpass their previous record as the total volume reached $6 billion around 7:53 pm UTC.

Individual ETFs break records

Balchunas noted that IBIT, FBTC, BITB, and ARKB all experienced record daily volumes.

He also observed exceptional performance among several non-spot ETFs that allow for strategic investment. BetaPro Inverse Bitcoin ETF (BITI), the ProShares Bitcoin Strategy ETF (BITO), and 2x Bitcoin Strategy ETF (BITX) all saw record volumes.

Several Bitcoin ETFs were among the most active ETFs in general. Data from Barchart indicates that IBIT and the BITO topped the list, surpassing the S&P 500 ETF Trust (SPY) and the Nasdaq QQQ Invesco ETF (QQQ). GBTC and FBTC also ranked among the top ten ETFs by volume.

The Newborn Nine’s remarkable performance has been a critical driver of Bitcoin’s recent price surge as demand outpaces supply. The flagship crypto hit a new all-time high before the halving for the first time in its history.

All volumes coincide with Bitcoin (BTC) prices reaching new highs. BTC briefly touched $69,324 on March 5, surpassing its November 2021 all-time high of $69,044, before a brutal price correction.

Click Here to Read the Full Original Article at Bitcoin (BTC) News | CryptoSlate…