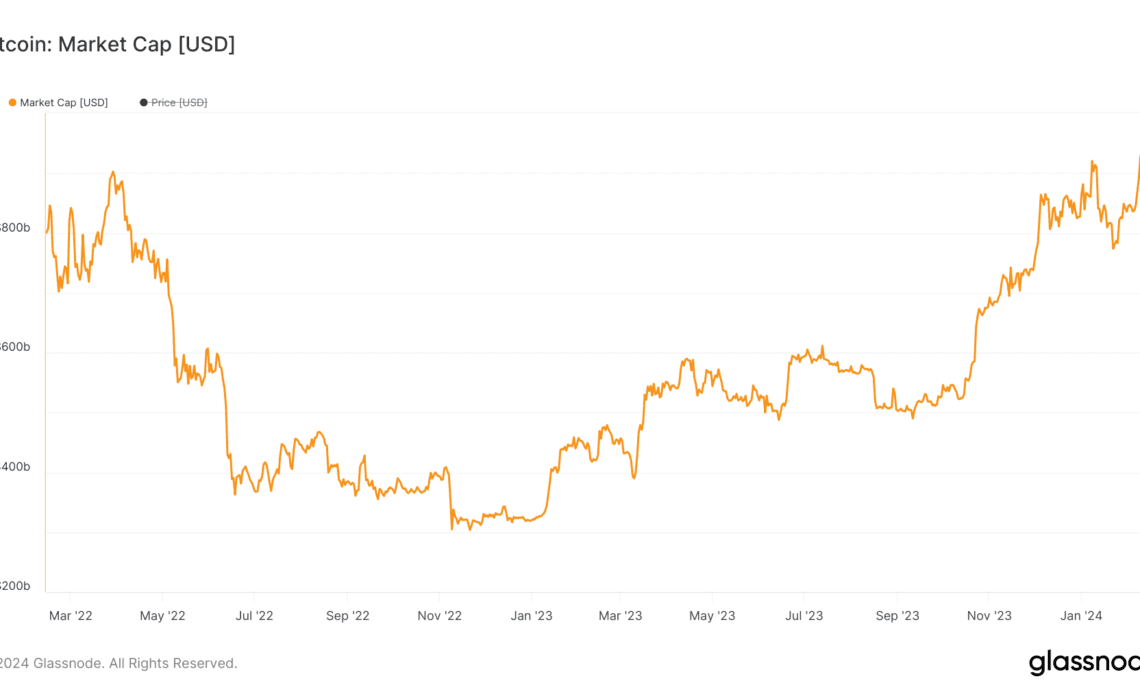

Bitcoin’s price saw a significant increase in February, jumping from $43,049 at the beginning of the month to $49,900 on Feb. 12, as of press time. Crossing $49,000 marks a significant milestone for BTC, as it indicates the potential to breach the $50,000 resistance and move closer to its all-time high. Alongside its price surge, Bitcoin’s market capitalization increased dramatically by over $102.5 billion in February. During the same timeframe, Bitcoin’s realized cap saw a more modest increase, rising just over $4 billion, from $447.48 billion to $451.66 billion.

Understanding the differences and increases in these two metrics is crucial for market analysis. While both might seem too broad to offer insight into subtle market movements, their difference, and long-term trends are often among the best market health indicators. This is especially true for realized cap, an often overlooked metric that provides valuable information about the aggregate cost basis for the entire market.

Market capitalization is calculated by multiplying Bitcoin’s current market price by the total number of coins in circulation. It’s a very crude metric but a widely used one, as it’s the best way to present the size of a particular asset or market. Market cap is highly responsive to price fluctuations and often experiences significant shifts within short periods, mirroring the immediate market sentiment and speculative activities. An uptick in Bitcoin’s market price can quickly and aggressively expand the market cap, showing the current valuation of all Bitcoins at BTC’s latest market price.

Realized cap, on the other hand, provides a more nuanced perspective of Bitcoin’s value. Unlike market cap, which only considers Bitcoin’s latest market price, realized cap considers the history of each coin to understand its contribution to the total value of the Bitcoin network. This method looks at the price at which each Bitcoin was actually moved. By focusing on these transaction prices, realized cap offers a snapshot of the market that considers the actual prices people paid for their BTC rather than the current market price, which can be influenced by short-term trading.

When Bitcoins are traded at prices higher than the price at which they were last moved, the realized cap increases. This is because the newer, higher transaction prices are now considered, raising the overall “cost…

Click Here to Read the Full Original Article at Bitcoin (BTC) News | CryptoSlate…