In the midst of the recent turbulence within the cryptocurrency market, Chainlink (LINK) has emerged as a notable outlier, demonstrating resilience against the sweeping downturn that has left major altcoins crumbling.

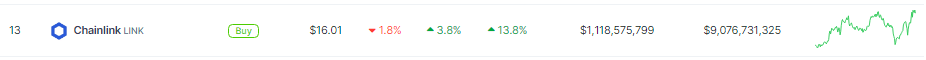

Surprisingly, LINK has steadfastly clung to the $16 mark, showcasing a 14% rally in the last seven days and defying the prevailing market trends. However, investors are left to ponder whether this is a promising sign for Chainlink’s future or merely a momentary blip in the radar.

Source: Coingecko

Massive Chainlink Whale Purchase

This positive signal coincides with a notable $8.9 million whale purchase, injecting a substantial dose of confidence into the market. Yet, beneath the surface, murmurs of a whale exodus are causing concern.

After the price of $LINK dropped today, a whale spent 8.9M$ to buy 601,949 $LINK at $14.81 with 3 new wallets.https://t.co/W7BjWM2XsP pic.twitter.com/xlFPqWv4ko

— Lookonchain (@lookonchain) January 19, 2024

This purchase also dampens some worries especially following a recent selling spree by Chainlink investors, who offloaded a significant 2.3 million tokens since January 12th.

The positive signal also comes after recent concerns in the absence of a noteworthy uptick in fundamental growth metrics such as network usage. Without substantial real-world adoption, the coveted $20 price point for Chainlink might remain an elusive mirage.

LINK market cap currently at $9.044 billion. Chart: TradingView.com

Chainlink’s Strengths Persist Amid Market Uncertainty

Meanwhile, IntoTheBlock’s global in/out of the money (GIOM) chart uses the historical entry prices of the current LINK holders to highlight critical levels of support and resistance.

Source: IntoTheBlock

In the near term, investors may opt for short-covering maneuvers to prevent falling into a net-loss position, a strategy that could lead to the consolidation of Chainlink’s (LINK) price just below the $15 threshold in the upcoming days.

Conversely, bullish market participants could potentially counter this bearish scenario by successfully pushing the price beyond the $20 territory. However, a potential hurdle arises from the fact that over 94,000 holders have accumulated 51 million LINK at a minimum price of $18.8.

This sizable accumulation suggests the possibility of bears establishing a formidable sell-wall in that price range, potentially triggering a retreat in LINK’s value.

The interplay of these dynamics…

Click Here to Read the Full Original Article at NewsBTC…