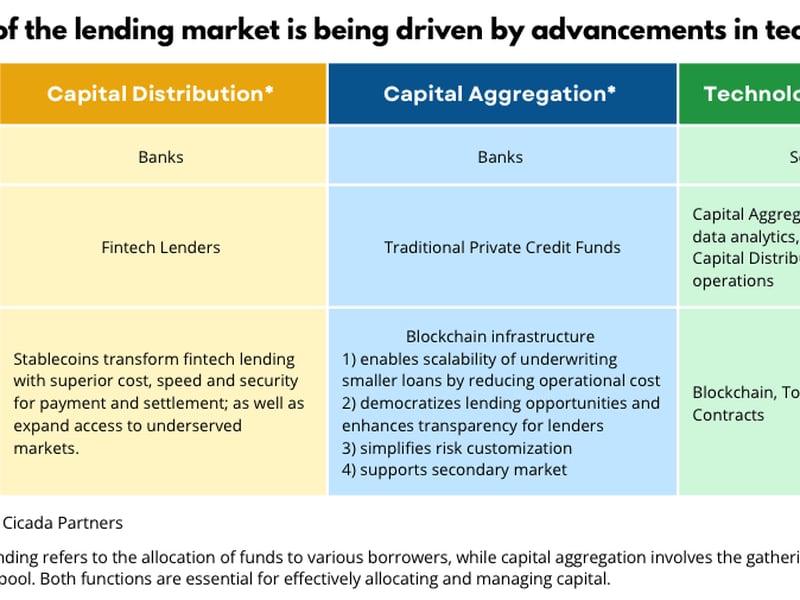

Lending markets are evolving, transitioning from a traditional, bank-centric framework to a more diverse and technologically advanced ecosystem. This evolution is particularly evident since the Global Financial Crisis (GFC) and is fundamentally reshaping the landscape of capital aggregation and distribution.

However, the current market structure still faces considerable friction. We believe, integrating blockchain into the existing financial tech stack will improve the efficiency of capital flows and expand access.

You’re reading Crypto Long & Short, our weekly newsletter featuring insights, news and analysis for the professional investor. Sign up here to get it in your inbox every Wednesday.

Blockchain-enhanced capital distribution

The diminishing role of traditional banks in capital distribution post-GFC has paved the way for fintech lending companies like SoFi and Ramp. These firms are filling the void with innovative solutions such as buy now pay later (BNPL) options by leveraging online platforms, data analytics and machine learning.

Despite advancements, issues like archaic payment systems and SME funding gaps persist. Stablecoins can help overcome these challenges by revolutionizing fund disbursement with superior cost and speed. By leveraging stablecoins, fintechs can tap into new markets with limited access to conventional banking services, offering more accessible and efficient financial solutions at a global scale.

The $150 trillion opportunity

Private credit has flourished post-GFC, growing to $1.6 trillion and becoming a competitive source of large scale financing. However, compared with the state of innovation in capital distribution, capital aggregation’s growth historically was hindered by its manual processes and too many intermediaries, which made onboarding large numbers of smaller ticket LPs uneconomical.

Tokenization can streamline and automate these intensive operational processes. Such efficiency brings two major advantages. Firstly, it is now more economically viable to underwrite smaller loans. Secondly, it democratizes investment opportunities, lowering barriers to entry for a broader spectrum of lenders, including those with smaller capital contributions often overlooked today. Other benefits include improved transparency, secondary liquidity, and simplified risk…

Click Here to Read the Full Original Article at Cryptocurrencies Feed…