Another year, another Crypto Holiday special from our team at NewsBTC. In the coming week, we’ll be unpacking 2023, its downs and ups, to reveal what the next months could bring for crypto and DeFi investors.

Like last year, we paid homage to Charles Dicke’s classic “A Christmas Carol” and gathered a group of experts to discuss the crypto market’s past, present, and future. In that way, our readers might discover clues that will allow them to transverse 2024 and its potential trends.

Crypto Holiday With Blofin: A Deep Dive Into 2024

We wrapped up this Holiday Special with crypto educational and investment firm Blofin. In our 2022 interview, Blofin spoke about the fallout created by FTX, Three Arrows Capital (3AC) collapse, and Terra (LUNA). At the same time, the firm predicted a return from the ashes for Bitcoin and the crypto market. The resurrection seems well underway, with Bitcoin surpassing the $40,000 mark. This is what they told us:

Q: In light of the prolonged bearish trends observed in 2022 and 2023, how do these periods compare to previous downturns in severity and impact? With Bitcoin now crossing the $40,000 threshold, does this signify a conclusive end to the bear market, or are there potential market twists investors should brace for?

Blofin:

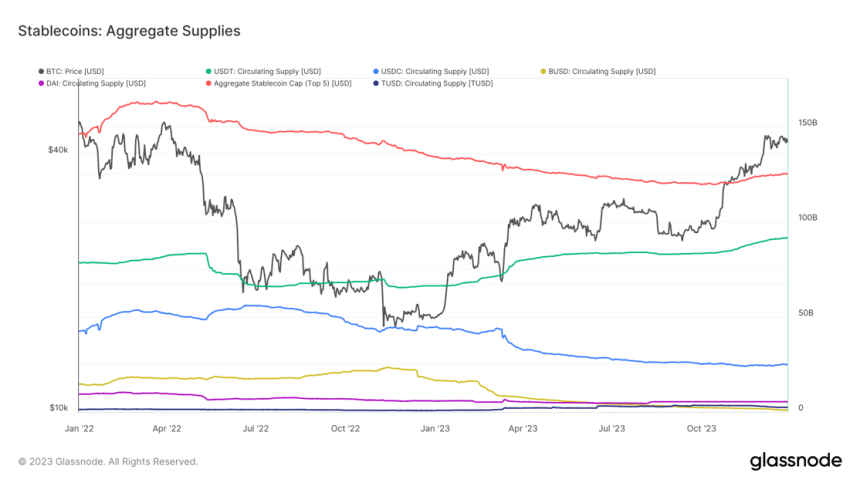

Compared to previous crypto recessions, the 2022-2023 bear market appears milder. Unlike previous cycles, in the last bull market, the widespread use of stablecoins and the entry of massive traditional institutions brought more than $100 billion in cash liquidity to the crypto market, and most of the cash liquidity did not leave the crypto market due to a series of events in 2022.

Even in Mar 2023, when investors’ macro expectations were the most pessimistic, and in 2023Q3, when liquidity bottomed out, the crypto market still had no less than $120 billion in cash liquidity in the form of stablecoins, which provides sufficient support and risk resistance for BTC, ETH and altcoins.

Similarly, due to abundant cash liquidity, in the bear market of 2022-2023, we did not experience a “liquidity dryness” situation similar to March 2020 and May 2021. In 2023, with the gradual recovery of the crypto market, liquidity risks were significantly reduced compared to 2022.

The only troubling thing is that in the summer and autumn of 2023, risk-free returns of more than 5% have caused investors to focus more on the money market and brought about the lowest volatility…

Click Here to Read the Full Original Article at NewsBTC…