On the last day of June, the European Union reached an agreement on how to regulate the crypto-asset industry, giving the green light to Markets in Crypto-Assets (MiCA), the EU’s main legislative proposal to oversee the industry in its 27 member countries. A day earlier, on June 29, lawmakers in the member states of the European Parliament had already passed the Transfer of Funds Regulation (ToFR), which imposes compliance standards on crypto assets to crack down on money laundering risks in the sector.

Given this scenario, today we will further explore these two legislations that, due to their broad scope, can serve as a parameter for the other Financial Action Task Force (FATF) members outside of the 27 countries of the EU. As it’s always good to understand not only the results but also the events that led us to the current moment, let’s go back a few years.

The relation between the FATF and the newly enacted EU legislation

The Financial Action Task Force is a global intergovernmental organization. Its members include most major nation-states and the EU. The FATF is not a democratically elected body; it is made up of country-appointed representatives. These representatives work to develop recommendations (guidelines) on how countries should formulate Anti-Money Laundering and other financial watchdog policies. Although these so-called recommendations are non-binding, if a member country refuses to implement them, there can be serious diplomatic and financial consequences.

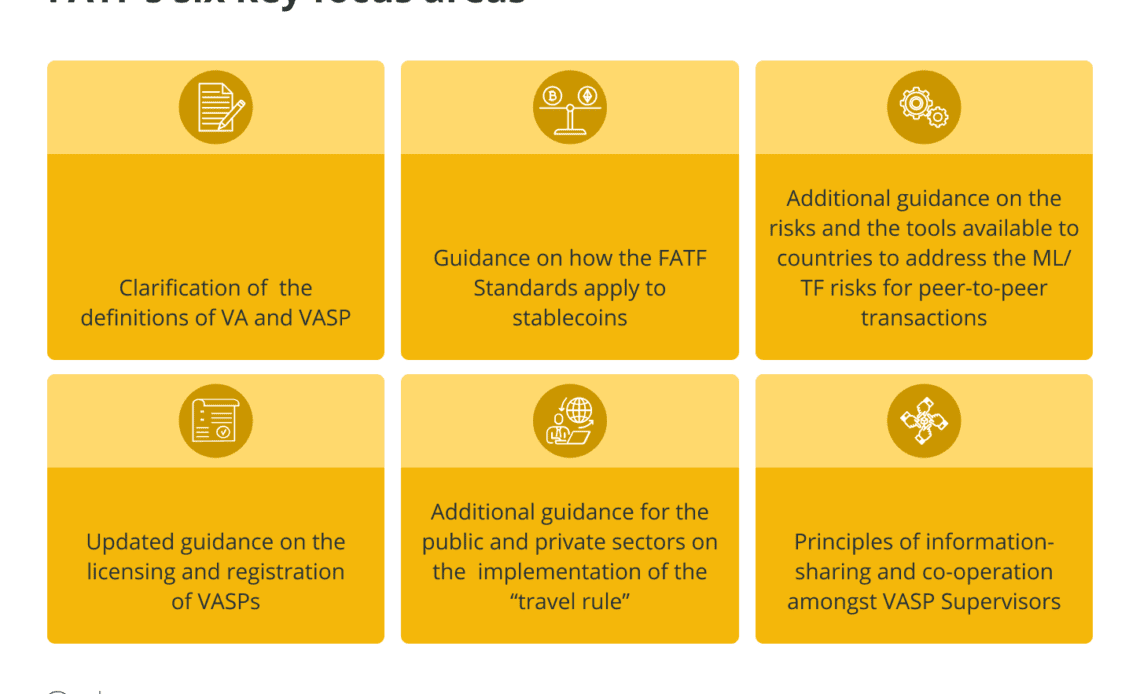

Along these lines, the FATF released its first guidelines on crypto assets in a document published in 2015, the same year when countries like Brazil started debating the first bills on cryptocurrencies. This first document from 2015, which mirrored the existing policies of the United States regulator the Financial Crimes Enforcement Network, was reassessed in 2019, and on October 28, 2021, a new document titled “Updated Guidance for a risk-based approach to virtual assets and VASPs” came out containing the current FATF guidelines on virtual assets.

Related: FATF includes DeFi in guidance for crypto service providers

This is one of the reasons why the EU, the U.S. and other FATF members are working hard to regulate the crypto market, in addition to the already known reasons such as consumer protection, etc.

If we look, for example, at the 29 of 98 jurisdictions whose parliaments have already legislated on the “travel rule,” all have followed the FATF’s recommendations to ensure…

Click Here to Read the Full Original Article at Cointelegraph.com News…