This past year has been a testament to the blockchain space’s ability to recover from even the harshest external conditions. From the depths of the “crypto winter” at the beginning of the year, the overall market cap of the crypto space has grown by 90% to $1.69 trillion, with bitcoin more than doubling from its yearly low of $16k in Jan 2023 to over $40k in December.

This post is part of CoinDesk’s “Crypto 2024” predictions package.

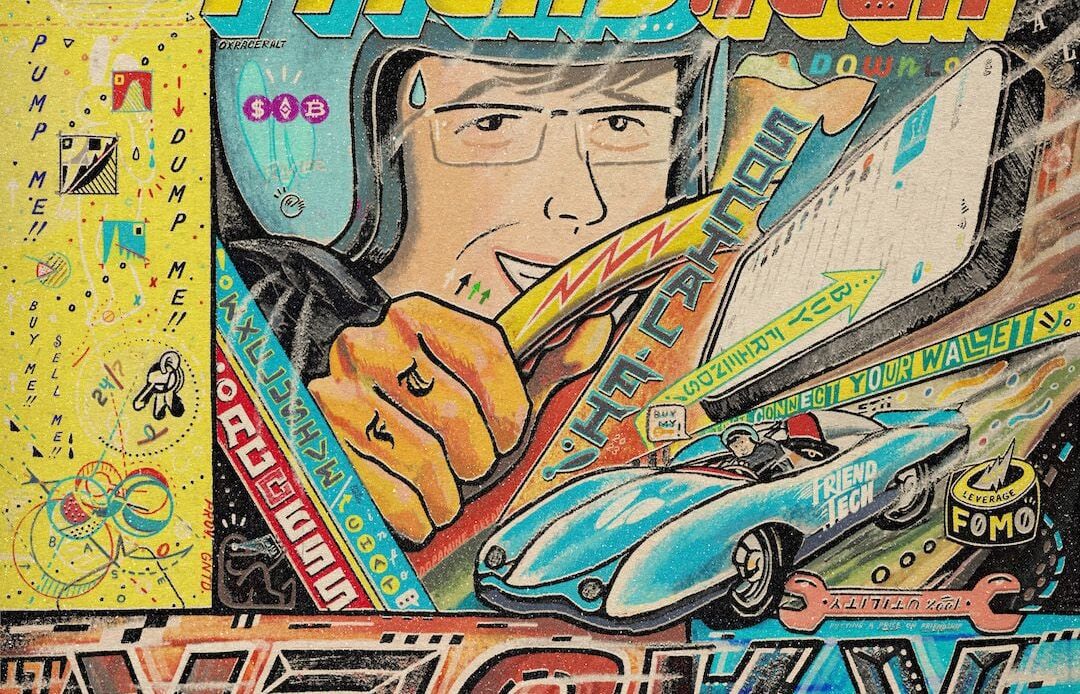

In 2023, we’ve continued to feel some of the aftershocks of the wave of major collapses in 2022, most notably the FTX trial and verdict and the Binance plea deal in November, as well as the momentary depegging of the USDC stablecoin in March amid the banking crisis. At the same time, we’ve continued to see breakthroughs in the space, including the Ethereum’s Shapella upgrade to a full Proof-of-Stake network, also in March, the ruling that XRP was (mostly) not a security in July, the launch of PayPal’s PYUSD stablecoin and Grayscale’s win over the SEC for the Bitcoin spot ETF in August, and the pioneering of novel tokenized social experiences such as the rise of Friend.tech.

We thus enter 2024 with a great optimism on the road ahead. Here are my top predictions for crypto industry in 2024:

1. The resurgence of Bitcoin and “DeFi Summer 2.0”

In 2023, Bitcoin has staged a comeback, with bitcoin dominance (Bitcoin’s proportion of crypto market cap) rising from 38% in January to around 50% in December, making it one of the top ecosystems to look out for in 2024. There are at least three major catalysts driving its renaissance in the next year: (1) the fourth Bitcoin halving due for April 2024, (2) the expected approval of several Bitcoin spot ETFs from institutional investors, and (3) a rise in programmability features, both on the base protocol (such as Ordinals), as well as Layer 2s and other scalability layers such as Stacks and Rootstock.

On the infrastructure level, we believe we will see a proliferation of Bitcoin L2s and other scalability layer to support smart contracts. The Bitcoin ecosystem should coalesce around one or two Turing-complete smart contract languages, with top contenders including Rust, Solidity, or the extension of a Bitcoin-native language such as Clarity. This language will become the “standard” for Bitcoin…

Click Here to Read the Full Original Article at Cryptocurrencies Feed…