The emergence of forty-year high inflation readings and the increasingly dire-looking global economy has prompted many financial analysts to recommend investing in gold to protect against volatility and a possible decline in the value of the United States dollar.

For years, crypto traders have referred to Bitcoin (BTC) as “digital gold,” but is it actually a better investment than gold? Let’s take a look at some of the conventional arguments investors cite when praising gold as an investment and why Bitcoin might be an even better long-term option.

Value retention

One of the most common reasons to buy both gold and Bitcoin is that they have a history of holding their value through times of economic uncertainty.

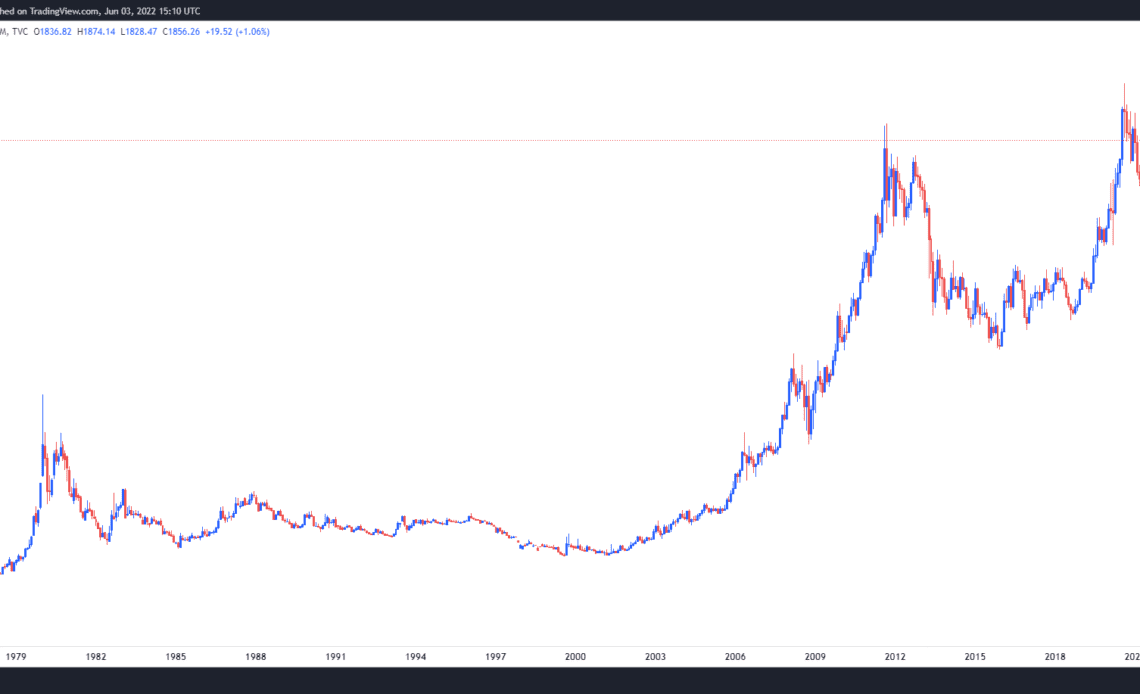

This fact has been well documented, and there’s no denying that gold has offered some of the best wealth protection historically, but it doesn’t always maintain value. The chart below shows that gold traders have also been subject to long bouts of price declines.

For example, a person who bought gold in September of 2011 would have had to wait until July 2020 to get back in the green, and if they continued to hold, they would once again be near even or underwater.

In the history of Bitcoin, it has never taken more than three to four years for its price to regain and surpass its all-time high, suggesting that on a long-term timeline, BTC could be a better store of value.

Could Bitcoin be a better inflation hedge?

Gold has historically been seen as a good hedge against inflation because its price tended to rise alongside increases in the cost of living.

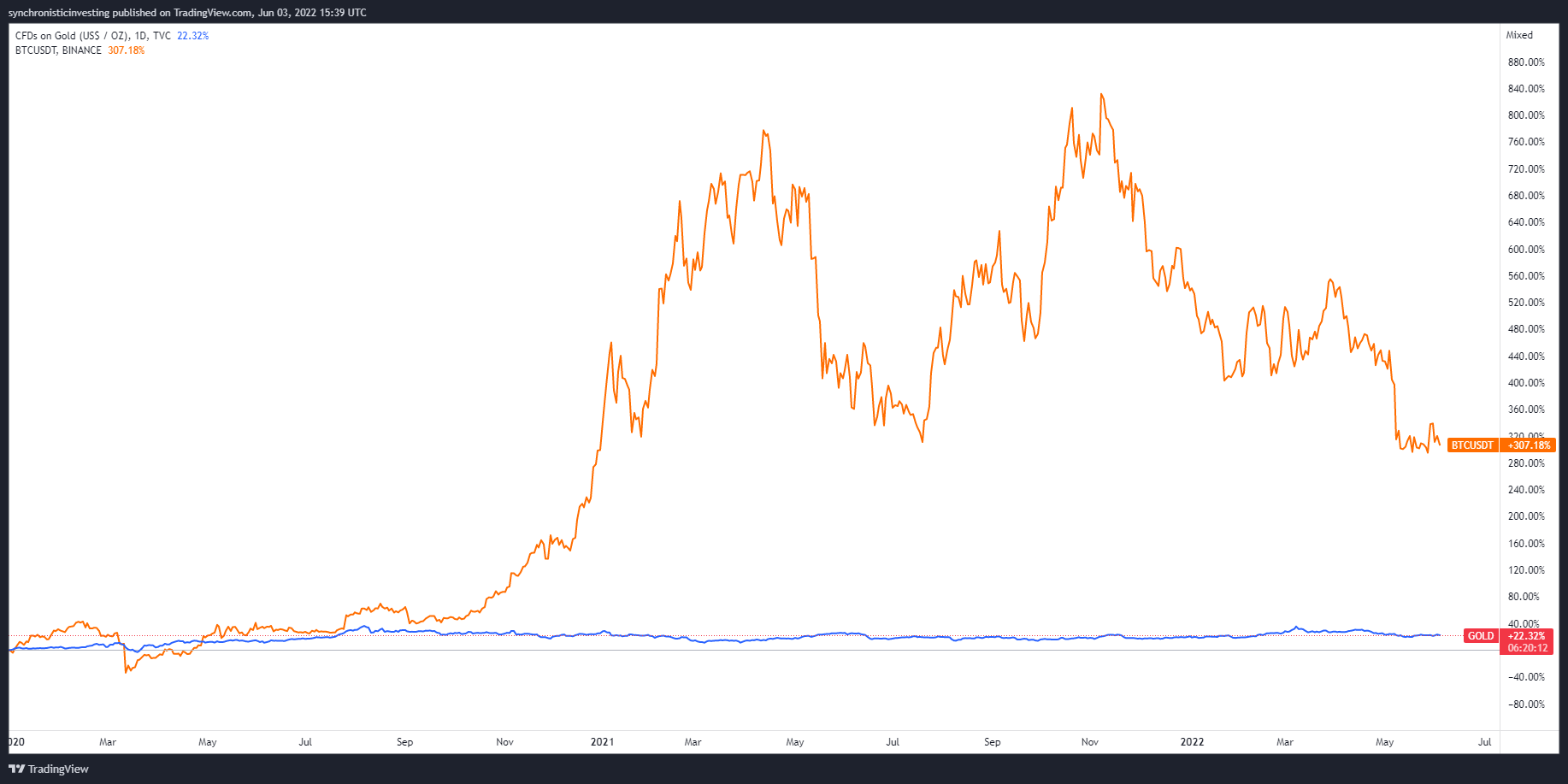

But, a closer look at the chart for gold compared with Bitcoin shows that while gold has seen a modest gain of 21.84% over the past two years, the price of Bitcoin has increased 311%.

In a world where the overall cost of living is rising faster than most people can handle, holding an asset that can outpace the rising…

Click Here to Read the Full Original Article at Cointelegraph.com News…