The Bitcoin network and its underlying assets have evolved since its launch in 2009, and keeping up with the changes and updates can be challenging. In a post, financial strategist Lyn Alden broke down five key metrics to help BTC investors assess the network’s current state.

Beyond Price: A Look At The Bitcoin Network Vitality

As Lyn Alden suggests, a deeper dive into the Bitcoin network is essential for any investor. This approach offers a more nuanced understanding of Bitcoin’s status, moving past the “superficialities of price fluctuations” to gauge its true potential and challenges.

Alden claims that price may not capture the complete story but remains a critical signal of adoption and market positioning. Bitcoin competes not just with other cryptocurrencies but also with traditional assets like gold and fiat currencies.

Its fluctuating price reflects its relative youth and volatility compared to more established currencies. However, its fixed supply of 21 million Bitcoin provides an alternative to the constantly inflated supply of fiat currencies, such as the US dollar. The analyst stated:

The Bitcoin network itself might be serving as a heartbeat of clockwork order in a world of chaos, but price is nonetheless a measure of its adoption.

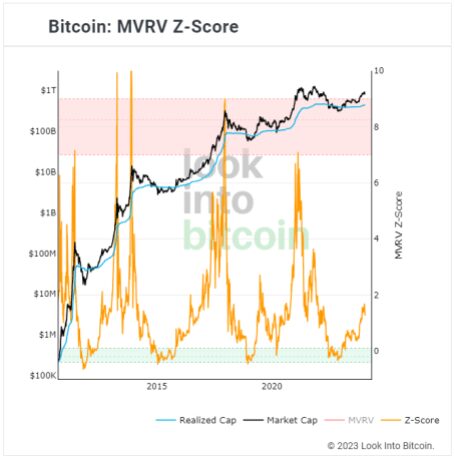

Bitcoin has consistently shown an upward trend, historically making it one of the best-performing assets, as seen in the chart below. The uptrend in the BTC price shows that the project has successfully operated as an alternative to traditional forms of money.

A key aspect to consider is liquidity – how much daily trading volume occurs and how much transaction value is circulated on-chain. High liquidity indicates a robust, widely used network. On the latter, Alden pointed out:

(…) now that bitcoin has billions of dollars of trading volume, there are trillion-dollar pools of capital that can’t put meaningful percentages into it; it’s still too small and illiquid for them. If they start putting a few hundred million dollars or a couple billions of dollars per day into it, that’s enough to tilt the supply/demand toward the buy side and seriously inflect the price upward. Since inception, the Bitcoin ecosystem has had to achieve certain levels of liquidity before it even gets on the radar of bigger pools of capital. It’s like leveling up.

The narrative surrounding Bitcoin…

Click Here to Read the Full Original Article at NewsBTC…