Bitcoin (BTC), Ether (ETH) and the crypto market had a rough 2022 from a price perspective, but traders are hopeful that 2023 will include bullish developments that push crypto prices higher.

Despite the market-wide downturn, a handful of altcoins continued to make a positive contribution to the crypto space and thanks to Ethereum, the term altcoin is no longer a derogatory term.

Let’s explore the top altcoins that made a difference in 2022.

Ethereum fundamentals shone in 2022

Ether’s price hit a yearly high at $3,835 on Jan. 2 and has struggled to regain footing amidst the bear market and other macro factors. The Ethereum network is the top project in 2022 not because of Ether’s price action, but for its fundamentals and for completing the long-awaited mainnet upgrade. The Ethereum merge was completed on Sept. 15, 2022 and while many feared the merge to proof-of-stake (PoS) could cause issues, the transition was flawless.

The main advantage of PoS is that it is much more energy-efficient than proof-of-work (PoW) because it does not require expensive and energy-intensive hardware to validate transactions. This reduces usage costs for the end user and makes it a more sustainable and scalable solution for Ethereum’s long-term growth. The Merge also reduced the Ethereum network’s energy consumption by over 99.9%.

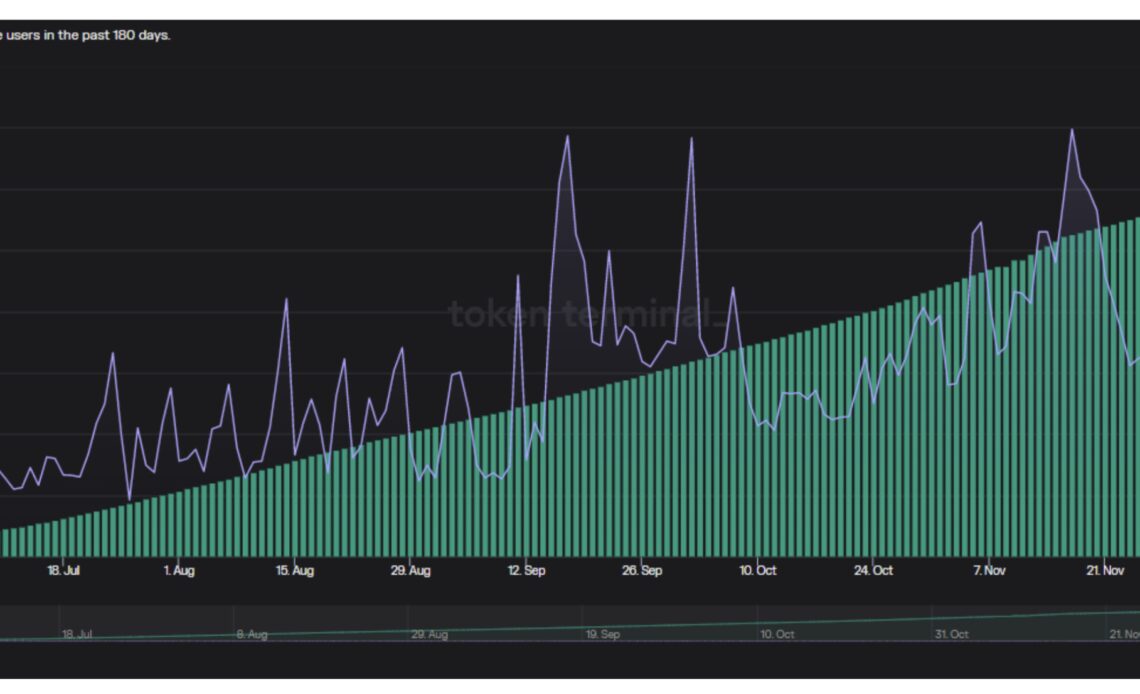

Some analysts are bullish on Ether post-Merge due to its emissions schedule becoming deflationary. Although daily active users have increased for the network, emissions have remained inflationary and Ether price is still down from yearly highs.

In 2023, investors are hopeful that increased transactions on the network creates higher demand for Ether and that this translates to a boost in the altcoin’s price.

Lido (LDO) brought Ethereum network staking to the masses

Lido’s makes it easy for users to participate in Ethereum PoS as validators by providing a simple interface for betting without having to reach the high threshold the network requires to stake.

Since launching, Lido has earned $158.8 million in fees from their staked Ether protocol. At the peak, Lido saw 823 daily active users on Sept. 17.

With the Ethereum network Shanghai hard fork scheduled for March 2023, Lido will have a busy Q1 and all the Ether staked in the platform will have the option of being withdrawn. Aztec Connect, the creator of Lido protocol also recently secured a $100 million fundraising round…

Click Here to Read the Full Original Article at Cointelegraph.com News…