A new report from JPMorgan Chase is shedding light on how many Americans can afford to pay for an emergency.

An analysis of 5.9 million households with Chase bank accounts shows 8% are completely unable to cover a $400 “expense shock” – not even with their credit cards.

That adds up to 472,000 customers from within the sample, while the total number of households at JPMorgan Chase stands at over 66 million.

The report shows how relatively small and unexpected expenses like a car breakdown or medical issue can be tough for many families, highlighting the financial vulnerability that exists even among those who use major banking institutions.

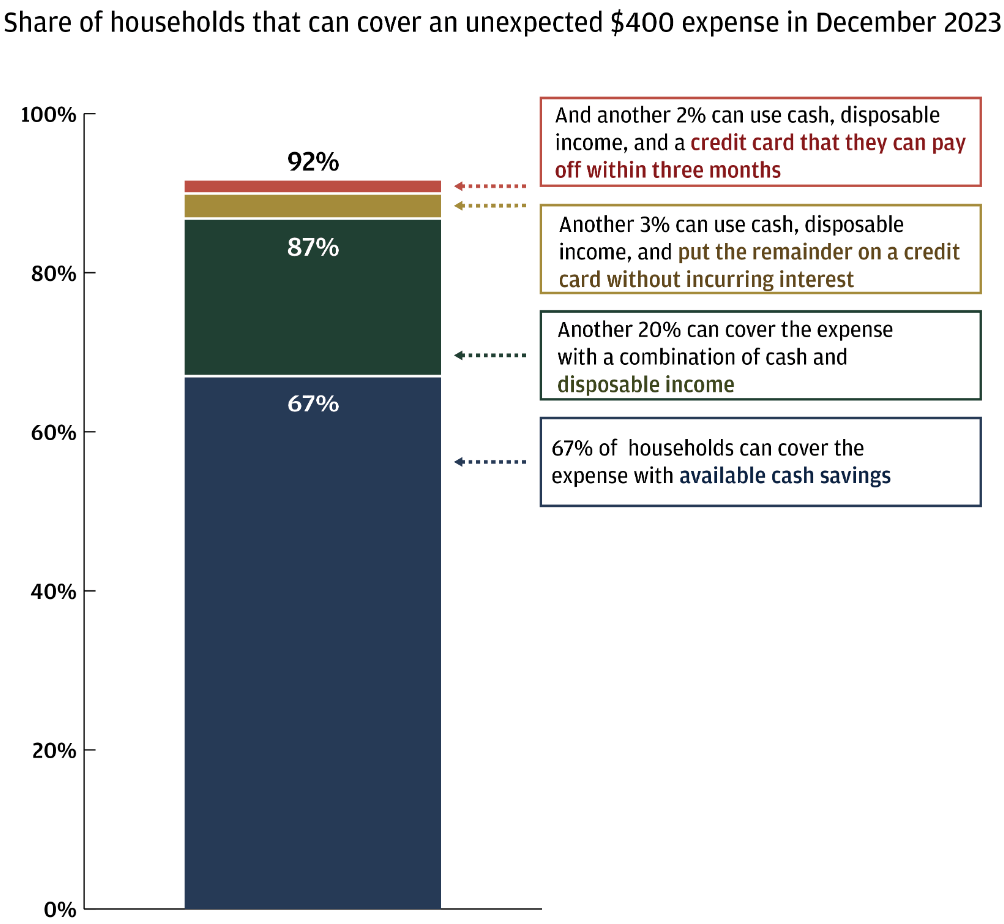

Overall, JPMorgan says 67% of households can cover a $400 emergency with cash savings, and another 20% can cover it with a combination of cash and disposable income.

The banking giant also analyzes a larger emergency scenario, where an abrupt $1,600 expense needs to be paid for.

“Many households are still unable to cover such an expense, including 63% of the lowest-earning households and even 3% of the highest-earning households…

For the lowest-income households, only 25% can cover a $1,600 expense shock using cash or disposable income; short-term use of credit enables an additional 12% to cover the expense.”

JPMorgan’s sample data is from 2021 through 2023. The bank says the proportions have remained consistent since the start of 2022 despite high inflation and interest rates.

“This holds even for larger $1,600 expense shocks: despite fewer households being able to cover these larger expenses, the ability to cover has been consistent during our sample window.

However, this could change as inflation, interest rates, and labor market forces continue to evolve.”

The bank’s sample of 5.9 million households was chosen based on active checking accounts with at least five non-transfer transactions per month and an annual take-home income of at least $12,000.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your…

Click Here to Read the Full Original Article at The Daily Hodl…