Ether (ETH) price has been locked within a tight trading range spanning from $1,800 to $1,900 since July 21. This remarkable lack of volatility has instilled a sense of uncertainty and skepticism among investors, despite recent positive developments which include the launch of PayPal’s Ethereum-based stablecoin, and a surge in requests for Ether-based exchange-traded funds (ETFs).

PayPal’s entrance into the world of cryptocurrencies could signify a major step toward mainstream adoption for Ethereum. However, this move also raises concerns about centralization and the potential loss of control over personal assets.

At the same time, the United States Securities and Exchange Commission (SEC) has recently witnessed a surge in applications for Ether exchange-traded funds (ETFs), which mirrors a trend of major asset management firms seeking to establish spot Bitcoin ETFs.

ETH’s drop in DApp deposits and active users is concerning

The Ethereum network is having problems because of high gas fees, which are the costs for transactions, including those done with smart contracts. For the past two months, the average transaction fee has been more than $4, which limited the demand for its decentralized apps (DApps).

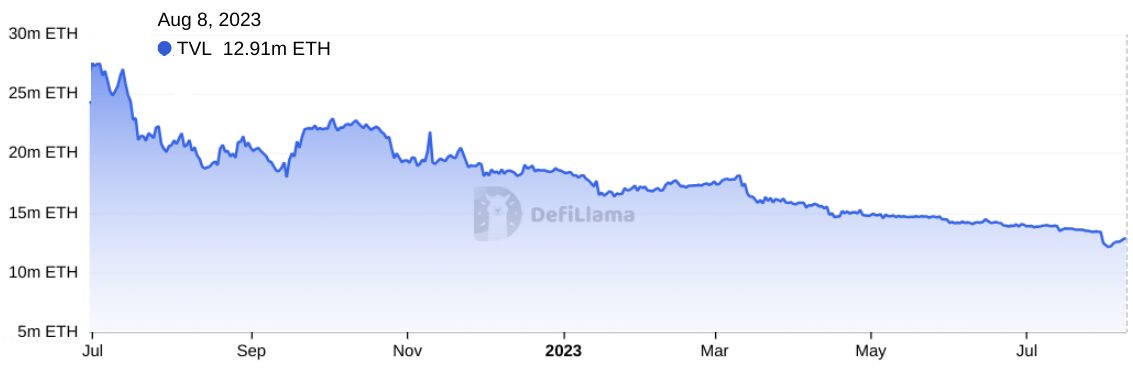

There has been a noticeable decline in the total value of deposits locked (TVL) in the Ethereum network. This decrease marked the lowest TVL level observed over the past three years, as reported by DefiLlama.

While there may have been some shifts in this trend over the past week, the current scenario still reflects a substantial reduction in Ether deposits, specifically around 12.9 million, in contrast to the 14.75 million recorded three months ago.

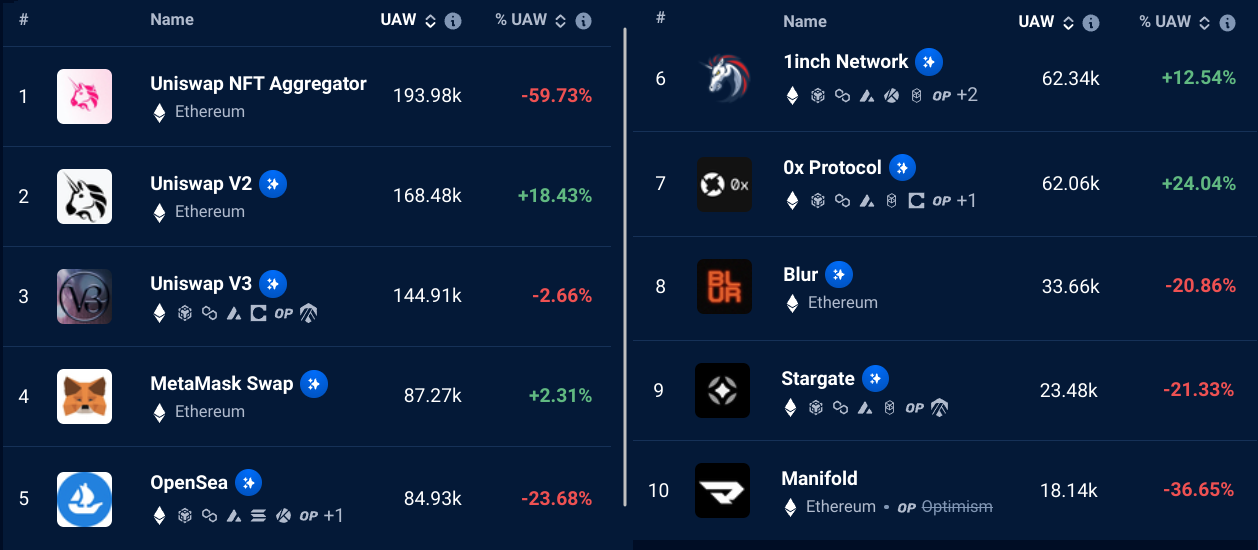

To ascertain whether the decline in Ethereum’s TVL correlates with a decline in its user base, investors should monitor the utilization of decentralized applications (DApps). It’s important to note that certain DApps, such as gaming platforms and marketplaces, do not require substantial deposits.

The number of active addresses using DApps is also down, which is concerning. In the last 30 days, the main DApps on Ethereum had 25% fewer active users. This might reflect that investors aren’t satisfied about how much it costs to transact on the network.

Now, let’s examine Ether derivatives to figure out whether the $1,800 level could actually prove a reliable support based on how ETH investors are…

Click Here to Read the Full Original Article at Cointelegraph.com News…