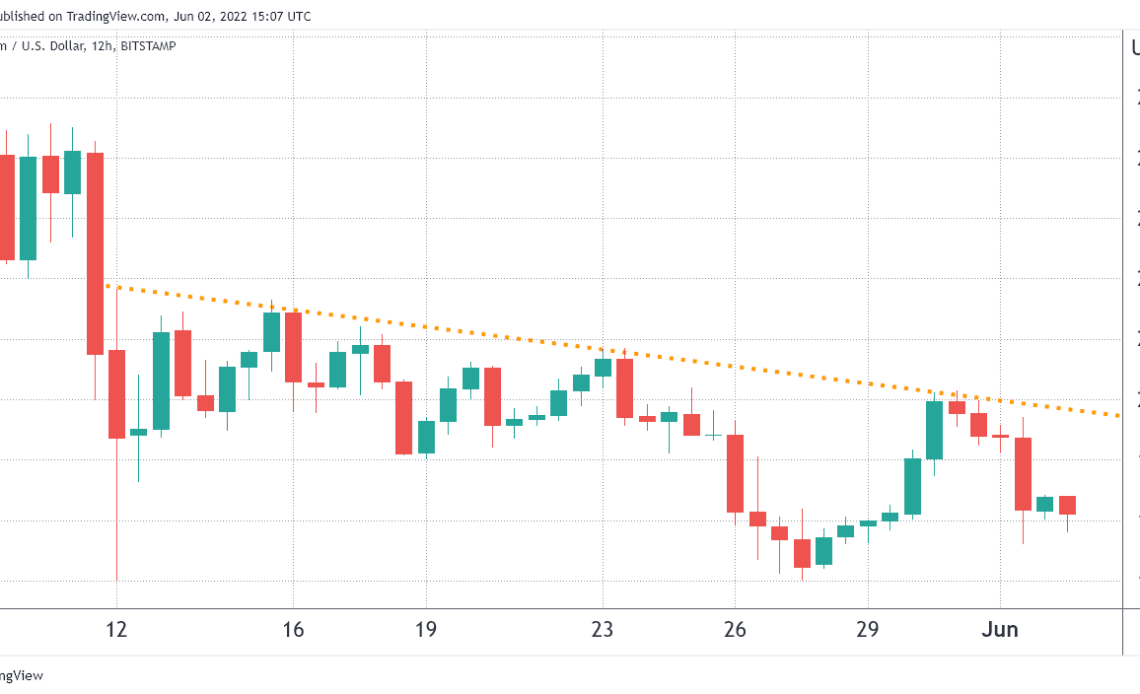

Ether’s (ETH) market structure continues to be bearish despite the failed attempt to break the descending channel resistance at $2,000 on May 31. This three-week-long price formation could mean that an eventual retest of the $1,700 support is underway.

On the non-crypto side, a number of equities-related factors are translating to negative sentiment in the crypto market. This week Microsoft (MSFT) lowered its profit and revenue outlook, citing challenging macroeconomic conditions. The U.S. Federal Reserve signalled in its periodic “Beige Book” that economic activity may have cooled in some parts of the country and the Fed is about to reduce its $9 trillion asset portfolio to combat persistent inflation.

On the bright side, an institutional investor survey published by The Economist magazine showed that 85% of the respondents agreed that open-source cryptocurrencies like Bitcoin (BTC) or Ether (ETH) are useful as diversifiers in a portfolio or treasury account.

From the macroeconomic perspective, investors are still risk-averse, which could translate to a reduced appetite for cryptocurrencies.

Ethereum still has a mountain to climb

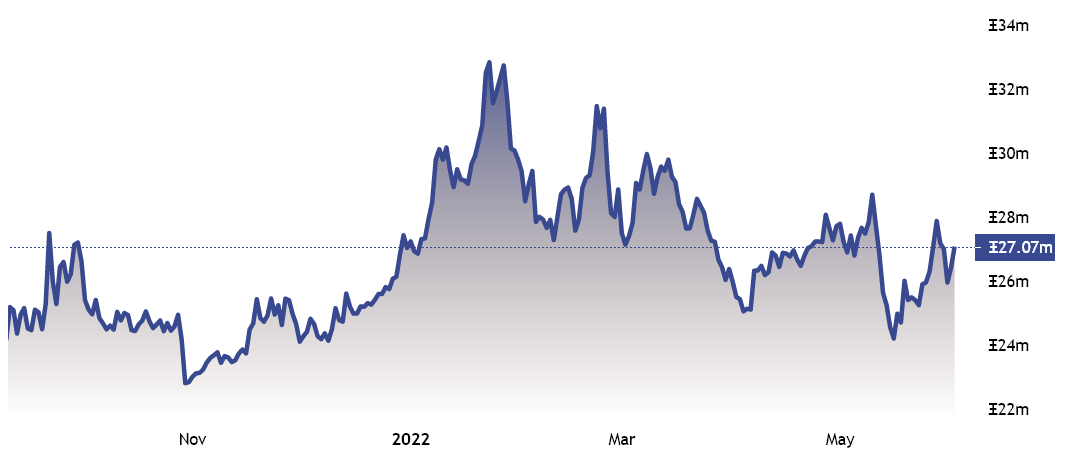

The Ethereum network’s total value locked (TVL), the total amount of assets deposited to the network, has dropped by 5.5% since Ether began its downtrend three weeks ago.

The network’s TVL peaked at 28.7 billion Ether on May 10 and currently stands at 27.1 million. Decentralized finance (DeFi) deposits were deeply impacted by the USD Terra (UST) — now known as TerraUSD Classic (USTC) — stablecoin collapse on May 10. All things considered, the indicator shows a moderate decrease, which is somewhat expected after such an unprecedented event.

To understand how professional traders are positioned, let’s look at Ether’s futures market data. Quarterly futures are whales and arbitrage desks’ preferred instruments due to their…

Click Here to Read the Full Original Article at Cointelegraph.com News…