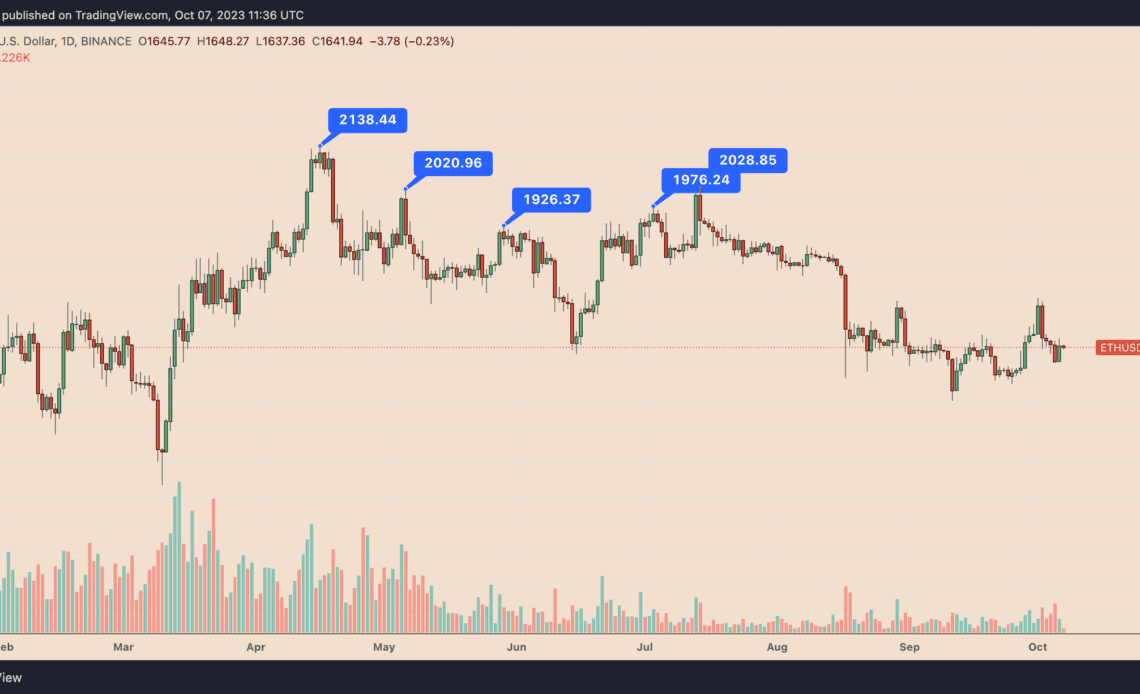

The price of Ethereum’s native token, Ether (ETH), has gained around 35% so far in 2023. But its attempts to break above $2,000, a psychological resistance level, have witnessed strong bearish rejections multiple times.

Let’s take a closer looks at the three likely reasons why Ethereum price has failed to decisively retake $2,000 since May 2022.

Ethereum price paints bear cycle fractal

Ethereum’s inability to cross above $2,000 in 2023 resembles the bearish rejection near $425 in 2018-2019.

In both cases, Ether appears to be in a recovery phase while eying close above its 0.236 Fib line of the Fibonacci retracement graph.

In 2018-2019, the 0.236 Fib line was near $425 and was instrumental in limiting Ether’s recovery attempts. In 2023, the same line is near $2,000, enforcing itself again as a selling area and, thus, pressuring ETH’s price lower.

Stronger U.S. dollar, Bitcoin

A strengthening U.S. dollar has dampened demand for Ethereum in recent months, thus reducing its ability to close decisively above $2,000.

The prevailing negative correlation between top cryptocurrencies and the dollar has been the main culprit. In 2023, in particular, the weekly correlation coefficient between Ether and the U.S. dollar index (DXY) has been consistently negative, as shown below.

Meanwhile, Ethereum has largely underperformed Bitcoin in 2023 due to the ongoing spot Bitcoin ETF hype. For instance, the widely-tracked ETH/BTC pair is down 20% year-to-date (YTD).

Additionally, the net capital held by Ethereum-tied investment funds has dropped by $114 million so far in 2023, according to CoinShares’ weekly report. In comparison, Bitcoin-based funds have attracted $168 million in the same period.

Related: Time to ‘pull the brakes’ on Ethereum and rotate back to Bitcoin: K33…

Click Here to Read the Full Original Article at Cointelegraph.com News…