Bitcoin (BTC) price gave back some of its recent gains this week, but multiple data points suggest that $30,000 should hold as support going forward.

Bitcoin remained within a narrow 4.3% range for the 15 days leading up to July 7. Despite the proximity of the $29,895 to $31,165 range, investors’ sentiment was significantly impacted by an unsuccessful attempt to break above $31,400 on July 6.

Trader’s tendency to overreact to short-term price movements rather than Bitcoin’s year-to-date gains of 82% could be part of the reason for the short-term correction This same rationale applies to the events related to other cryptocurrencies.

At the front of investors’ minds are questions about whether the recent price gains were solely driven by multiple spot Bitcoin exchange-traded fund (ETF) requests.

Other pressing developments include Binance’s chief strategy officer, Patrick Hillmann, and other top compliance officers reportedly leaving the exchange on July 6 over CEO Changpeng Zhao’s response to the U.S. Justice Department’s investigation. On June 29 he crypto exchange also informed users that its euro banking payment gateway would cease services by September, potentially halting deposits and withdrawals via SEPA bank transfer.

In the same week, the U.S. Treasury curve reached its deepest inversion since 1981 on July 3, reflecting the 2-year note’s 4.94% yield compared to the 10-year trading at 3.86%, the opposite of what is expected from longer-term bonds. The phenomenon is closely watched by investors as it has preceded past recessions.

All of these events are likely having some impact on Bitcoin price and investor sentiment, both topics which we will explore in greater depth below.

Traders show strength in margin, options and futures markets

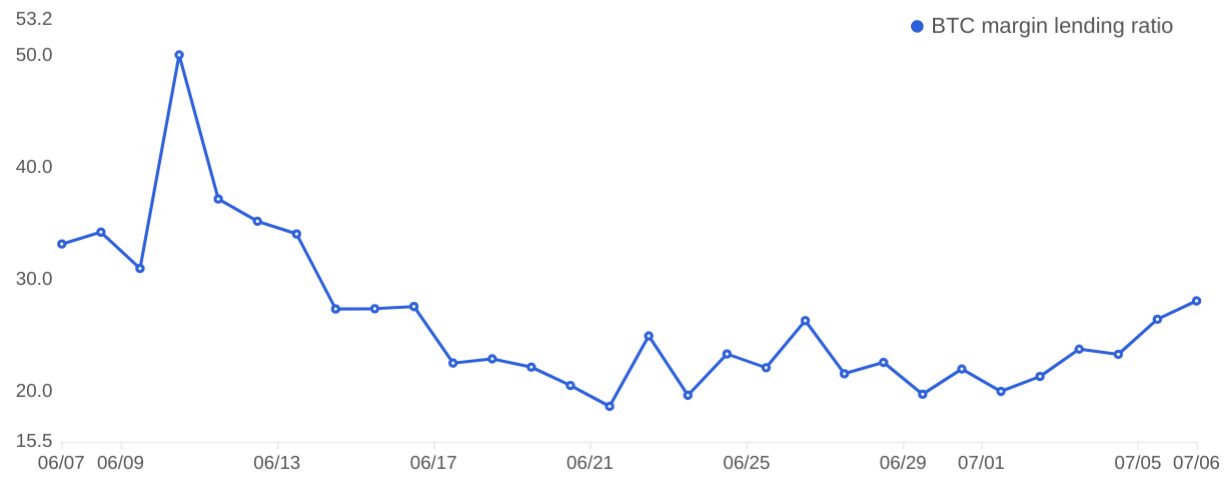

The OKX margin lending indicator based on the stablecoin/BTC ratio has steadily increased from 20x favoring longs on July 1 to the current 29x ratio on July 7, indicating growing confidence among traders using margin lending. However, it remains within a neutral-to-bullish range below the historical 30x threshold associated with excessive optimism.

Besides leaving room for further long leverage, the indicator shows no signs of potential stress on margin markets in case of a sudden Bitcoin price correction.

Traders aren’t buying protective puts or increasing their shorts

Traders can also gauge the market’s sentiment by measuring whether more activity is going…

Click Here to Read the Full Original Article at Cointelegraph.com News…