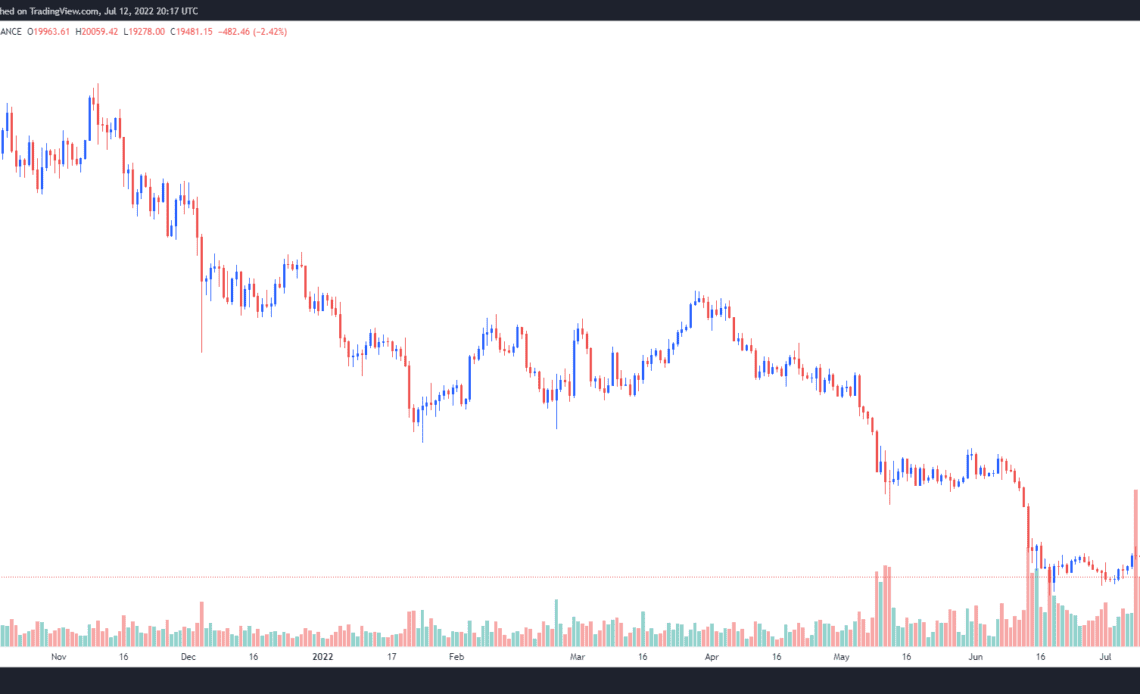

The positive gains recorded in the first ten days of July have all but disappeared on July 13 as Bitcoin (BTC) and the wider market slid back toward new yearly lows.

Subdued action in the market can be traced back to a variety of factors ranging today’s record-high Consumer Price Index print and a raging US dollar that recently hit its highest level since October 2002.

Data from Cointelegraph Markets Pro and TradingView shows that July 13 marked the fifth consecutive day of a declining BTC price, which hit an intra-day low at $18,910, following the declines across the major stock market indices.

As the world awaits a catalyst that can bring positive momentum back into global financial markets, here is what several analysts have to say about what’s next for Bitcoin.

Was Bitcoin’s latest surge the result of wash trading?

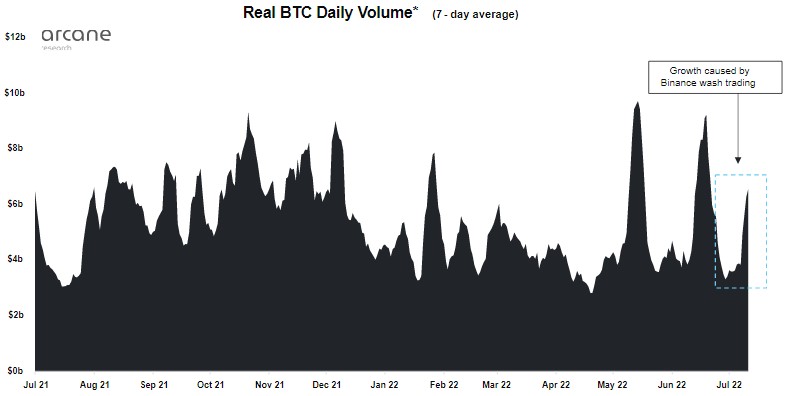

Bitcoin’s gains over the past week had sparked a new wave of optimism for some traders, but that optimism is likely to fade in the near term. Data from Arcane Research shows that a majority of the momentum came from the removal of trading fees for certain Bitcoin pairs on Binance cryptocurrency exchange.

According to Arcane Research, after the fee was removed, trading volumes on the exchange surged and it can be most likely attributed to “wash trading from traders seeking to exploit the fee removal to reach higher fee tiers.”

When looking at the crypto exchange ecosystem as a whole, however, activity remains subdued which is indicative of diminished interest in buying cryptos at the present moment.

Arcane Research said,

“All other exchanges saw muted trading volume last week, with the seven-day average trading volume sitting near 1-year lows, illustrating that the organic trading activity in the market is very muted at the moment.”

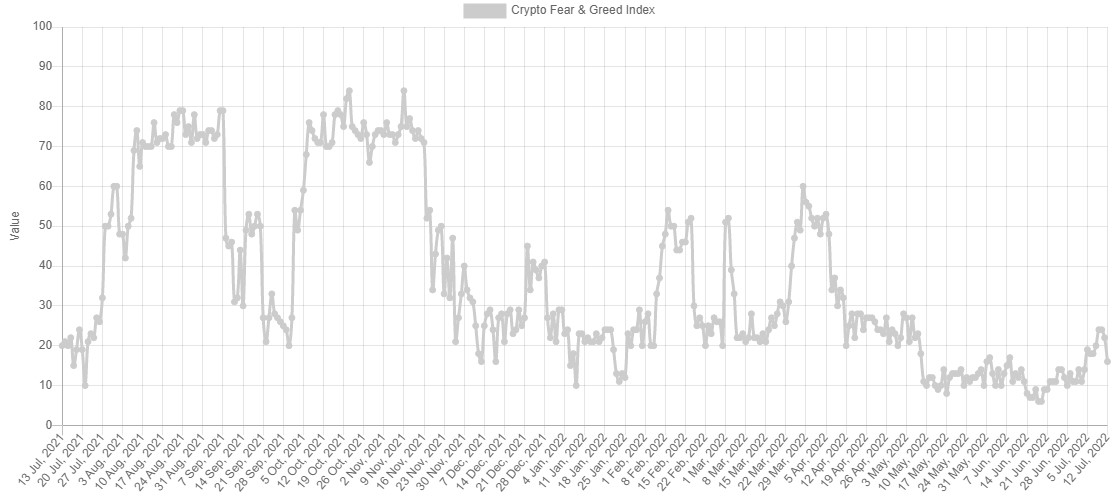

Extreme fear persists

Further evidence highlighting the lack of interest in buying Bitcoin can be found from the Crypto Fear and Greed Index, which is currently experiencing a “record-long 68-day streak” in the extremely fearfully territory.

As noted by Arcane Research, the spike to a score of 24 on July 10 was largely influenced by Binance’s decision to remove trading fees, which “led the metric to overstate the current market sentiment fearfulness.”

After the novelty of fee-less Bitcoin trading on the top exchange subsided and volumes returned…

Click Here to Read the Full Original Article at Cointelegraph.com News…