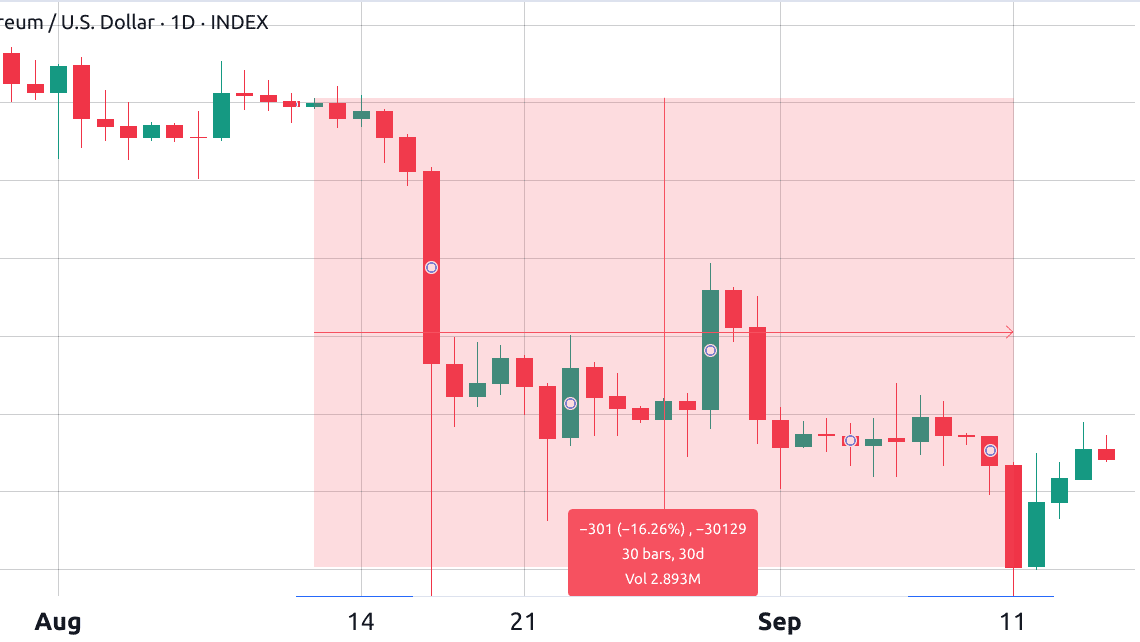

Ether (ETH) price has been dealing with some strong headwinds and on Sept. 11, the price of the altcoin endured a critical test when it plunged to the $1,530 support level. In the days that followed, Ether managed to stage an impressive recovery, by surging by 6%. This resurgence may signal a pivotal moment, following a month that had seen ETH endure losses of 16%.

Even with the somewhat swift recovery, Ether’s price performance raises questions among investors about whether it has the potential to climb back to $1,850, and ETH derivatives and network activity might hold the key to this puzzle.

Macroeconomic factors have played a significant role in mitigating investor pessimism given that inflation in the United States accelerated for the second consecutive month, reaching 3.7% according to the most recent CPI report. Such data reinforces the belief that the U.S. government’s debt will continue to surge, compelling the Treasury to offer higher yields.

Scarce assets are poised to benefit from the inflationary pressure and the expansive monetary policies aimed at bridging the budget deficit. However, the cryptocurrency sector is grappling with its own set of challenges.

Regulatory uncertainty and high network fees limit investors’ appetite

There’s the looming possibility of Binance exchange facing indictment by the U.S. Department of Justice. Furthermore, Binance.US has found itself entangled in legal battles with the U.S. Securities and Exchange Commission (SEC), leading to layoffs and top executives departing from the company.

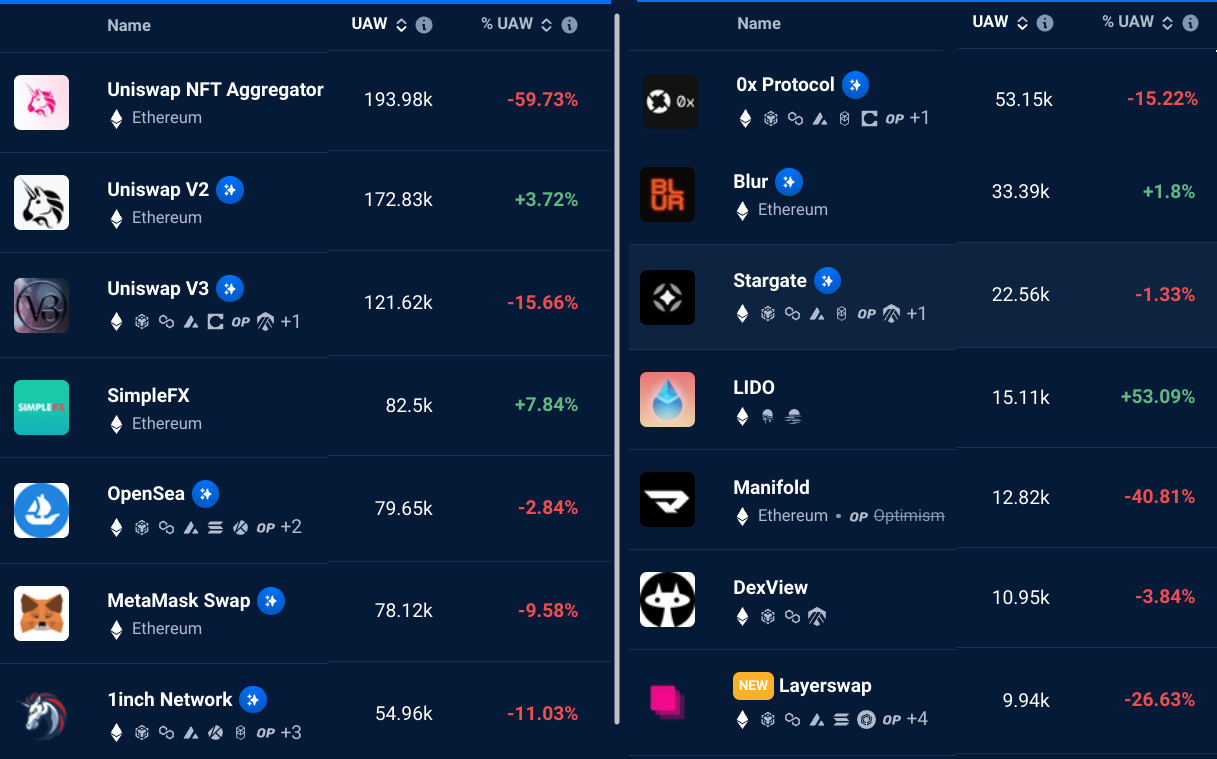

Besides the regulatory hurdles faced by cryptocurrencies, the Ethereum network has witnessed a notable decline in its smart contract activity, which is at the core of its original purpose. The network still grapples with persistently high average fees, hovering above the $3 mark.

Over the past 30 days, the top Ethereum dApps have seen an average 26% decrease in the number of active addresses. An exception to this trend is the Lido (LDO) liquid staking project, which saw a 7% increase in its total value locked (TVL) in ETH terms during the same period. It’s worth mentioning that Lido’s success has been met with criticism due to the project’s dominance, accounting for a substantial 72% of all staked ETH.

Vitalik Buterin, co-founder of Ethereum, has acknowledged the need for Ethereum to become more accessible for…

Click Here to Read the Full Original Article at Cointelegraph.com News…