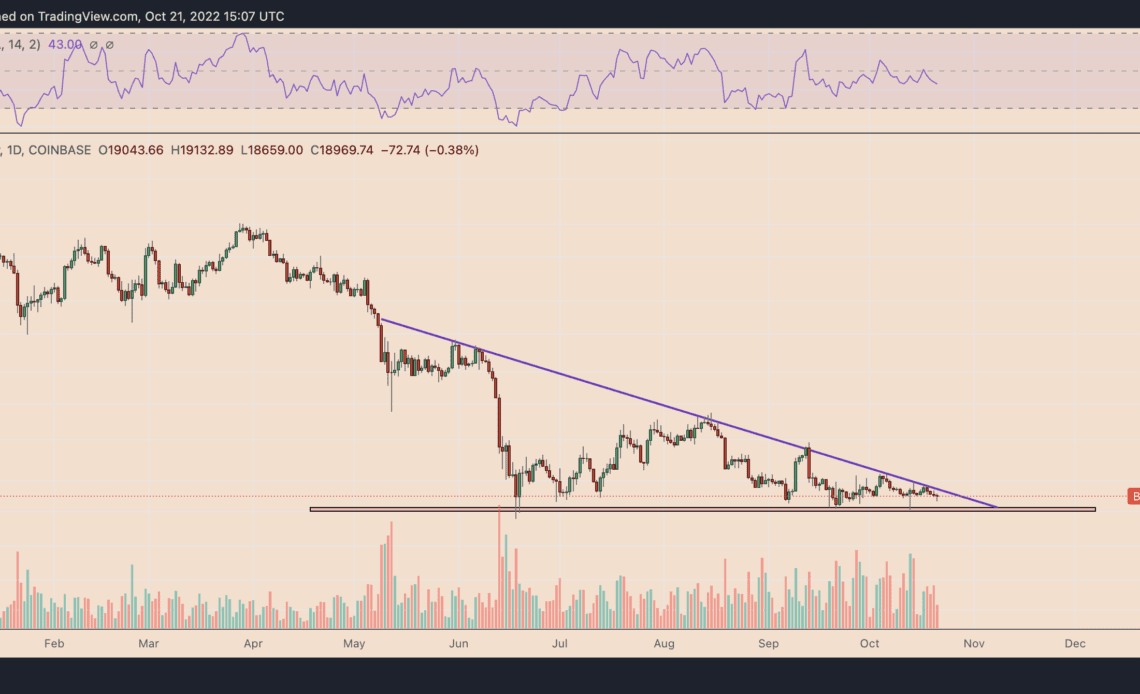

Bitcoin (BTC) and other riskier assets slipped on Oct. 21 as traders scrutinized macro indicators that suggest the Federal Reserve would continue to hike rates. Nonetheless, the BTC/USD pair remains rangebound inside the $18,000–$20,000 price range, showing a strong bias conflict in the market.

BTC price holding above $18K since June

Notably, BTC’s price has been unable to dive deeper below $18,000 since it first tested the support level in June 2022. As a result, some analysts believe that the cryptocurrency is bottoming out, given it has already corrected by over 70% from its record high of $69,000, established almost a year ago.

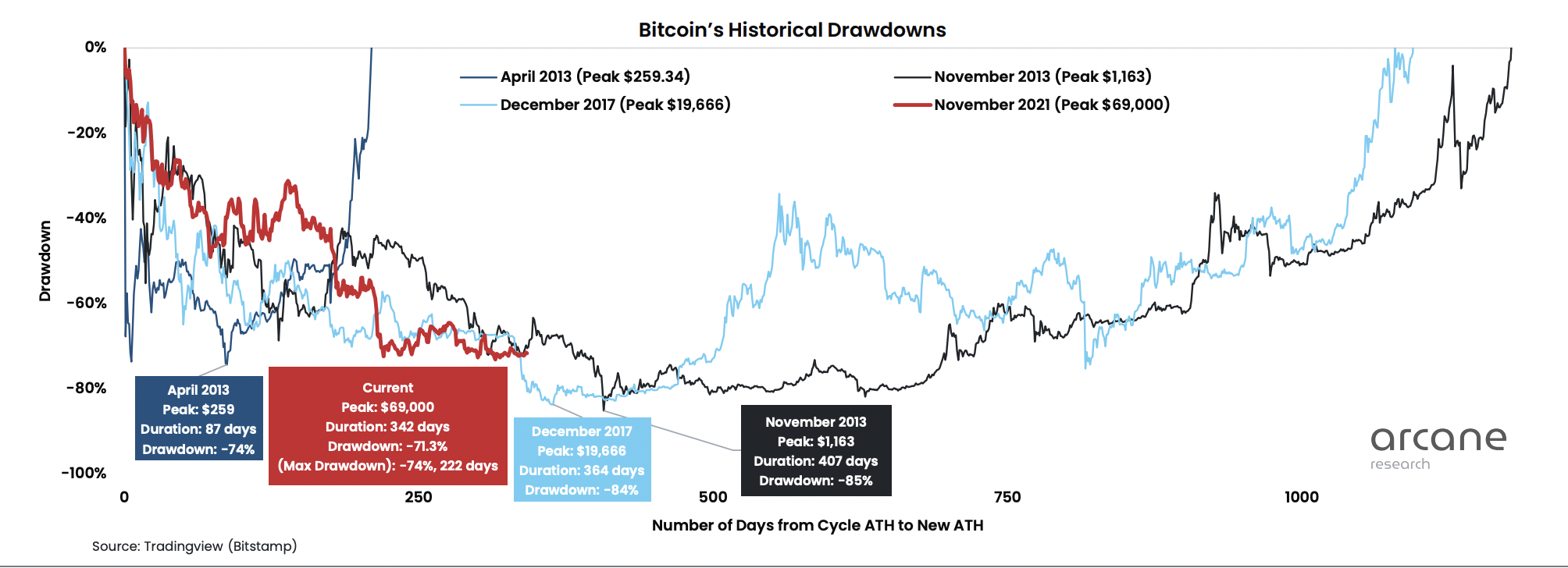

“During the 2018 bear market, BTC saw a max drawdown from peak to trough of 84%, lasting 364 days, while the 2014 cycle lasted longer, bottoming after 407 days,” noted Arcane Research in its weekly crypto market report, adding:

“Both bottoms were followed by unusually low volatility.”

In addition, a flurry of widely-watched on-chain Bitcoin indicators also hints at a potential bullish reversal ahead. Let’s look at some of the most historically significant metrics.

Bitcoin MVRV-Z Score

The MVRV-Z Score assesses Bitcoin’s overbought and oversold statuses based on its market and fair value.

Historically, when Bitcoin’s market value crosses the fair value, it indicates a market top (the red zone). Conversely, it indicates a market bottom (the green zone) when the market value crosses below the fair value.

The MVRV-Z Score has been in the green zone since late June, suggesting Bitcoin is bottoming out.

Reserve Risk

Bitcoin’s Reserve Risk assesses the confidence of the token’s long-term holders relative to its price at the point in time. Historically, a higher Reserve Risk (the red zone) has coincided with market tops, reflecting lower investment confidence at record-high Bitcoin prices.

Conversely, higher confidence and lower Bitcoin price mean lower Reserve Risk (the green zone), or better risk/reward for investing.

Bitcoin’s Reserve Risk plunged into the green zone in late June, suggesting that BTC may undergo a strong bullish reversal sooner or later.

Bitcoin Puell Multiple

The Puell Multiple reflects the ratio of the daily Bitcoin issuance (in U.S. dollars) and the 365-day moving average of daily issuance value.

Related: Bitcoin bear market will…

Click Here to Read the Full Original Article at Cointelegraph.com News…