This week, Bitcoin’s (BTC) price took a tumble as a hotter-than-expected consumer price index (CPI) report showed high inflation remains a persistent challenge despite a wave of interest rate hikes from the United States Federal Reserve. Interestingly, the market’s negative reaction to a high CPI print seemed priced in by investors, and BTC’s and Ether’s (ETH) prices reclaimed all of their intraday losses to close the day in the black.

A quick look at Bitcoin’s market structure shows that even with the post-CPI print drop, the price continues to trade in the same price range it has been in for the past 122 days. Adding to this dynamic, Cointelegraph market analyst Ray Salmond reported on a unique situation where Bitcoin’s futures open interest is at a record high, while its volatility is also near record lows.

These factors, along with other indicators, have historically preceded explosive price movements, but history will also show that predicting the direction of these moves is nearly impossible.

So, aside from multiple metrics hinting that a decisive price move is brewing, Bitcoin is still doing more of the same thing it’s done for the past 4.5 months. With that being the case, it is perhaps time to start looking elsewhere for emerging trends and possible opportunities.

Here are a few data points that I’ve continued to be intrigued by.

New rotations will emerge

ETH’s price has lost its luster in the now post-Merge era, and the asset now reflects the bearish trend that dominates the rest of the market. Since the Merge, ETH’s price is down 30% from its $2,000 high, and it’s likely that a good deal of the speculative capital that backed the bullish Merge narrative is now in stablecoins looking for the next investment opportunity.

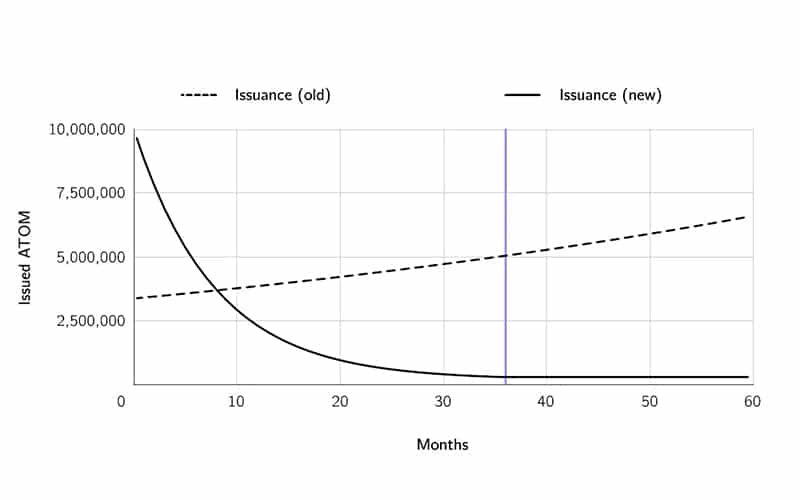

Aside from ETH being an asymmetrical performer in the last four months, Cosmos (ATOM) also defied the market downtrend by posting a monster rally from $5.40 to $16.85. As covered thoroughly by Cointelegraph, oversold conditions, along with the hype of Cosmos 2.0, backed the bullish price action seen in the altcoin, but this chart continues to capture my imagination.

According to the revised Cosmos white paper, the current supply of ATOM will dynamically adjust based on the supply and demand of its staking. As shown in the chart above, when Cosmos 2.0 “kicks in” for the first 10 months, issuance of new ATOM tokens is high, but after the 36th…

Click Here to Read the Full Original Article at Cointelegraph.com News…