Bitcoin (BTC), the leading cryptocurrency, has defied expectations of a steep decline to sub-$20,000 levels and has rebounded to the $26,000 mark, registering a 3.5% gain over the past 24 hours.

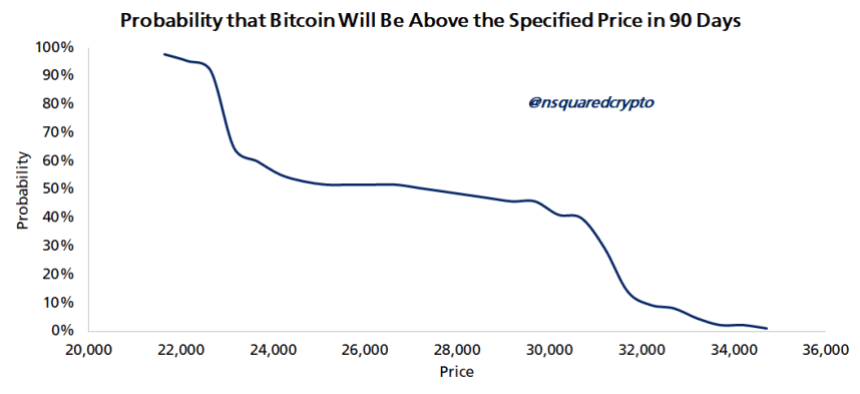

This resurgence in Bitcoin’s price coincides with the predictions made by Chartered Financial Analyst Timothy Peterson, whose recent social media post outlined the probabilities of Bitcoin dropping to $22,600 or rallying to $31,200 within the next 90 days.

Bitcoin Price Analysis, 8% Chance Of Drop To $22,600

Peterson’s analysis indicates an 8% likelihood of Bitcoin experiencing a downward movement to $22,600, while a 71% chance of the cryptocurrency surging to $31,200.

According to the chart above, Bitcoin’s price will likely enter a macro consolidation phase over the next 90 days. During this period, the price may fluctuate within the range of its key Moving Averages (MAs).

However, the crucial factor for bullish investors is the low probability of a drop below $22,000. This allows them to regain control of the 50-day and 200-day MAs in the short term, currently positioned at $27,200 and $27,000, respectively.

The recent recovery of Bitcoin to the $26,000 level has alleviated concerns among market participants who were apprehensive about a potential downward spiral. The cryptocurrency’s ability to bounce back has instilled renewed confidence among investors.

Nevertheless, Bitcoin faces a series of resistance levels that could pose challenges. In the immediate term, resistance at $26,454 has temporarily halted the cryptocurrency’s upward momentum.

As mentioned earlier, Bitcoin lost its key MAs in August, resulting in additional obstacles on its journey back to $30,000. However, if these resistance levels are surpassed, there remains only one more hurdle before the cryptocurrency can surpass its annual high zone.

This final resistance stands at $29,800, which has historically proven to be a formidable barrier whenever Bitcoin has aimed to achieve new highs.

Imminent Final Decline Expected?

As the market approaches the final weeks of Q3 and edges closer to the new year, QCP Capital, an analysis firm, has been closely monitoring the market using two critical blueprints: the supermoon cycle and the Elliot Wave count. According to their analysis, an imminent final decline is expected to close the quarter at its lows.

Click Here to Read the Full Original Article at NewsBTC…