Bitcoin (BTC), the largest cryptocurrency by market value, experienced its first-ever halving 11 years ago today. As the community celebrates the anniversary of the first Bitcoin halving, it’s timely to revisit some of Bitcoin’s historical milestones ahead of the next halving expected in April 2024.

The first Bitcoin transaction occurred nearly 15 years ago on Jan. 3, 2009, a few months after the pseudonymous creator of Bitcoin, Satoshi Nakamoto, published the Bitcoin white paper in October 2008.

On Nov. 28, 2012, or three years and ten months after Bitcoin’s initial block was mined, the first-ever halving event took place. At the time, BTC traded at just around $12, according to data from StatMuse, or 308,200% below Bitcoin’s current price, according to data from CoinGecko.

Though Bitcoin halving — as well as the digital currency’s 21 million supply cap — is not directly described in Nakamoto’s white paper, the document still hints at certain mechanisms to control the creation of new BTC. The white paper reads:

“To compensate for increasing hardware speed and varying interest in running nodes over time, the proof-of-work difficulty is determined by a moving average targeting an average number of blocks per hour. If they’re generated too fast, the difficulty increases.”

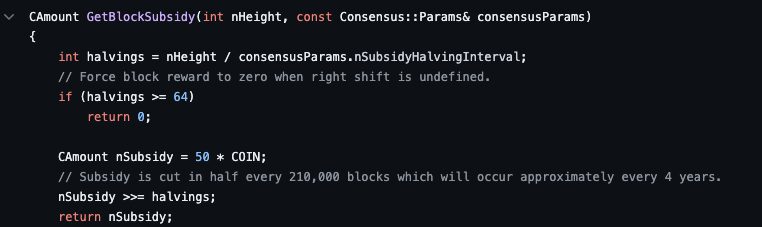

Unlike some of the basic information in the BTC white paper, the halving aspect is mentioned in the Bitcoin source code. The halving is specifically available on the Bitcoin Core GitHub repository on the validation.cpp file, which indicates that the miner’s block subsidy is “cut in half every 210,000 blocks, which will occur every four years.”

The Bitcoin halving mechanism had been programmed into the BTC mining algorithm to counteract inflation by maintaining scarcity.

Before the first halving occurred, miners were compensated with as much as 50 BTC per block. After the first halving event in 2012, the subsidy was slashed to 25 BTC, followed by the second halving in 2016, which reduced the subsidy to 12.5 BTC. The most recent Bitcoin halving occurred in 2020, cutting the block subsidy from 12.5 BTC to 6.25 BTC.

As Bitcoin halvings significantly increase the cryptocurrency’s scarcity, the Bitcoin price cycle has been historically impacted by halvings. Just a year after its first-ever halving, Bitcoin had risen to nearly $1,000, while the second halving triggered a 350% surge during the year…

Click Here to Read the Full Original Article at Cointelegraph.com News…