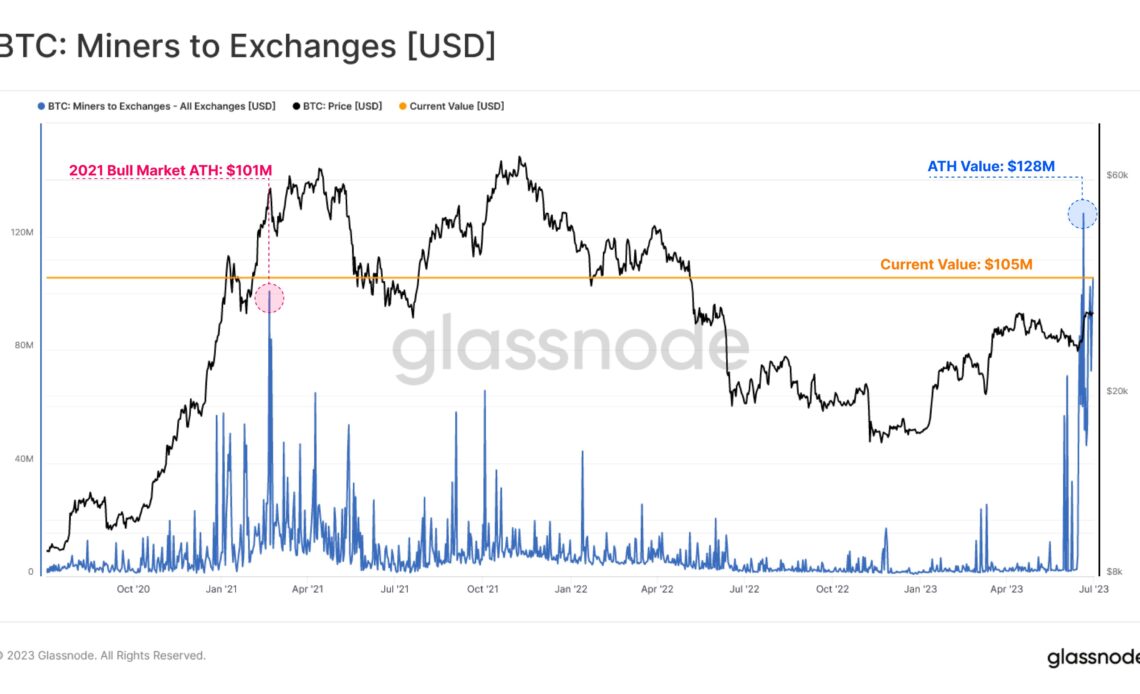

Miners moved $105 million worth of Bitcoin (BTC) onto exchanges as the top crypto reclaimed the $30,000 price point, according to the digital asset analytics firm Glassnode.

Glassnode says it represents the second-largest US dollar-denominated transfer on record.

“Following the ascension in spot price above the psychologically key $30,000 level, Bitcoin miners have continued to send large clips of BTC to exchanges.

Currently, miners are sending $105 million to exchanges, the second largest USD-denominated transfer on record.”

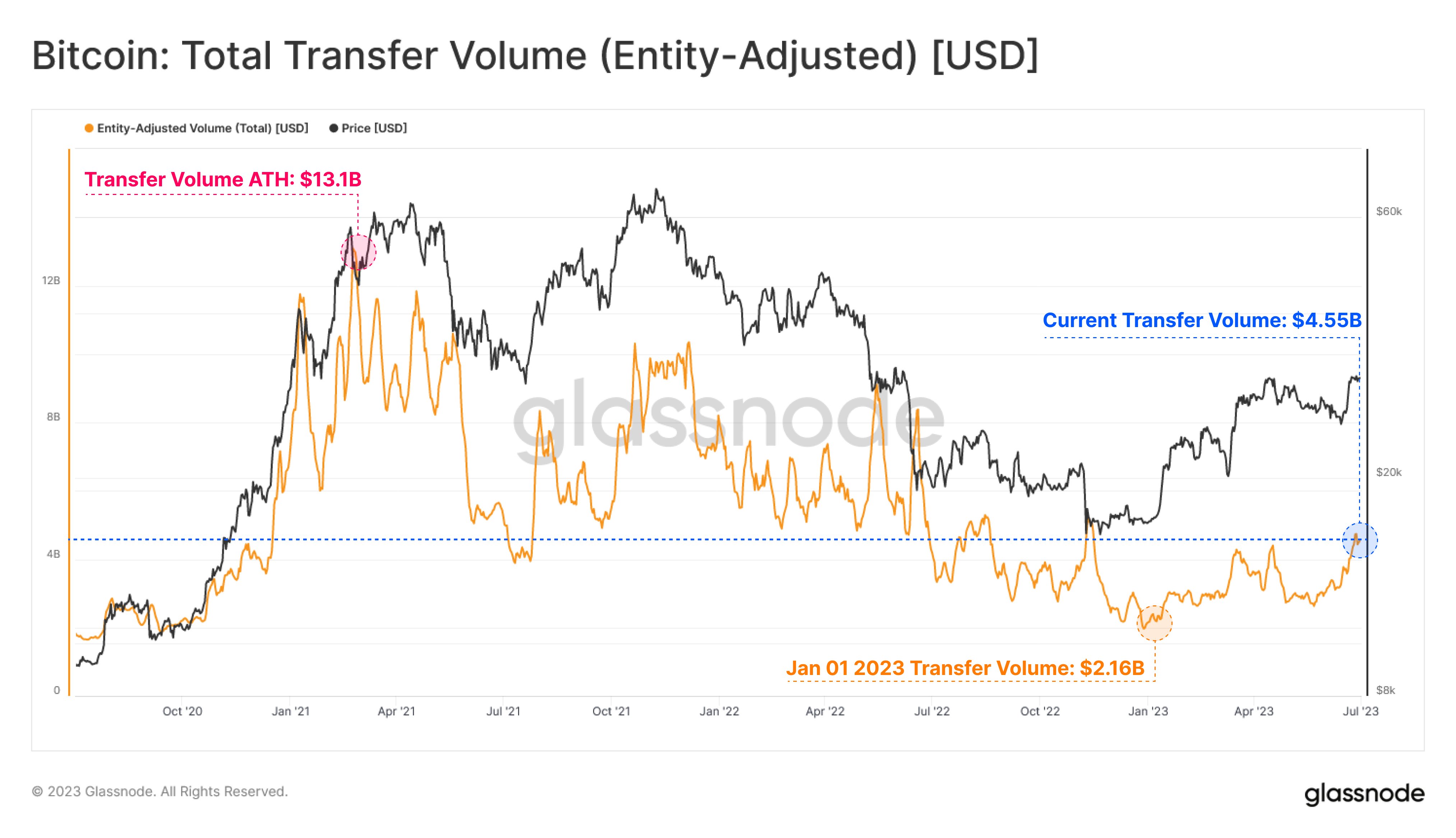

Glassnode also notes that the volume settled on the Bitcoin network has recorded a 211% increase year-to-date, climbing from $2.16 billion to $4.56 billion. The firm says the surge suggests “network utilization continues to improve.”

“However, when compared to the conditions experienced across the 2021 bull market, the current settlement value remains a significant -$8.54 billion (-65%) lower than the ATH (all-time high) of $13.1 billion.”

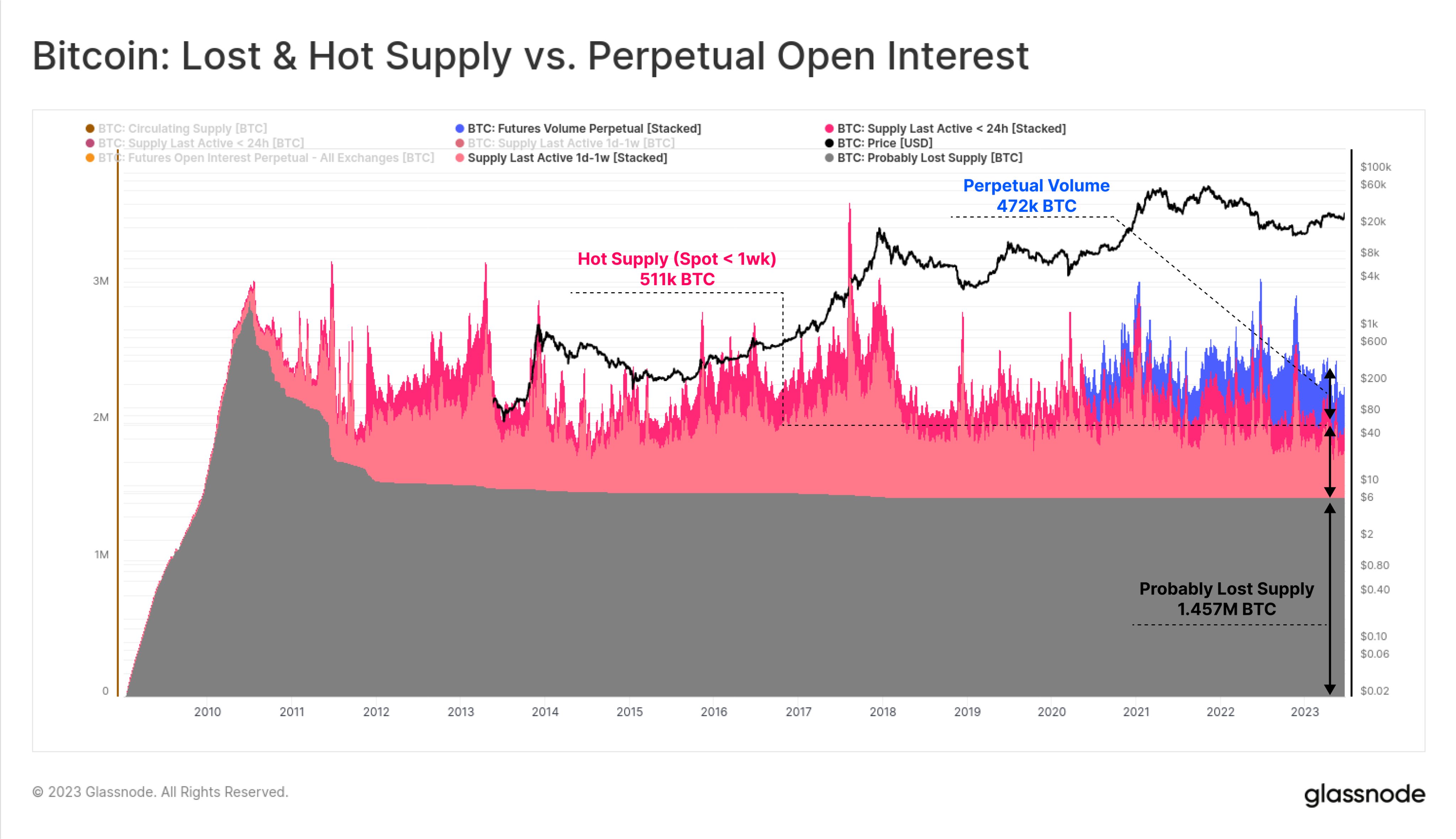

Glassnode also examines Bitcoin’s “hot supply,” a term it uses to approximate the BTC that is actively participating in price discovery. According to the analytics firm, less than $30 billion worth of BTC is available for trading.

“With a median size of 0.67 million BTC and a maximum of 2.2 million BTC, hot supply represents between 3.5% to 11.3% of the total supply.

Perpetual Futures Open Interest (472,000 BTC) and hot supply (511,000 BTC) are similar in size as shown below, suggesting that a volume of around 983,000 BTC (~$29.5 billion) is currently ‘available’ for sale, with just under half of this being spot Bitcoin.”

Bitcoin is trading at $30,907 at time of writing.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl…

Click Here to Read the Full Original Article at Bitcoin News – The Daily Hodl…