The COVID-19 pandemic, rampant inflation and regional conflicts directly influenced Bitcoin’s (BTC) drop in value over the past two years. However, 2024 promises to be a resurgent period, according to Blockstream CEO Adam Back.

The cryptographer, who pioneered the proof-of-work algorithm applied in Bitcoin’s protocol, tells Cointelegraph that the preeminent cryptocurrency is trailing below the historical price trend line of previous mining reward-halving events.

“Biblical” events hurt Bitcoin

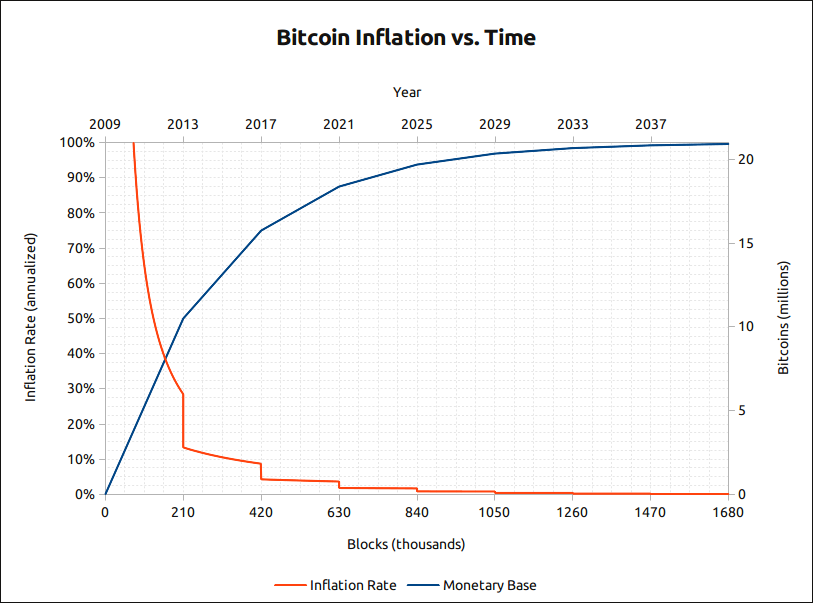

Back weighed in on the potential price action of Bitcoin as the next halving, which will see Bitcoin miners’ block reward reduced by 6.25 BTC to 3.125 BTC, looms in April 2024. Block rewards halvings are programmatically hardwired into Bitcoin’s code, taking place after every 210,000 blocks are mined.

Back says that the overlaid averages of the previous market cycles and halvings indicate that Bitcoin’s relative value is trailing behind widely accepted projections. Multiple events have played a role in driving the price of BTC down, which has also been seen across conventional financial markets:

“The last few years were like biblical pestilence and plague. There was COVID-19, quantitative easing, and wars affecting power prices. Inflation running up people, companies are going bankrupt.”

The impact has keenly affected markets and portfolio management according to Back. Investment managers have had to manage risk and losses over the past few years which has necessitated the sale of more liquid assets.

“They have to come up with cash and sometimes they’ll sell the good stuff because it’s liquid and Bitcoin is super liquid. It used to happen with gold and I think that’s a factor for Bitcoin in the last couple of years,” Back explains.

Bitcoin would have hit $100,000 already

As 2023 comes to a close, many of these macro events that Back cited have wound down while more industry-specific failures have also been resolved. This has been reflected in Bitcoin’s recent price surge from Nov. 2023 onwards.

“The wave of the contagion, the companies that went bankrupt because they were exposed to Three Arrows Capital, Celsius, BlockFi and FTX – that’s mostly done. We don’t think there are many more big surprises in store,” Back said.

Related: Blockstream targets continued Bitcoin miner surplus with Series 2 BASIC Note

Click Here to Read the Full Original Article at Cointelegraph.com News…