Bitcoin investors’ sentiment improved after signals pointing to lower inflationary pressure suggested that the U.S. Federal Reserve could soon move away from its interest rate increase and quantitative tightening. Commonly known as a pivot, the trend change would benefit risk assets such as cryptocurrencies.

On Jan. 22, the China-based peer-to-peer trades of USD Coin (USDC) reached a 3.5% premium versus the United States dollar, indicating moderate FOMO by retail traders. This level is the highest in more than 6 months, suggesting excessive cryptocurrency buying demand has pressured the indicator above fair value.

The all-time high on the 7-day Bitcoin hash rate — an estimate of processing power dedicated to mining — also supported the bullish momentum. The indicator peaked at 276.9 exo-hash per second (EH/s) on Jan. 19, signaling a reversion of the recent weakness caused by miners facing financial difficulties.

Despite the bears’ best efforts, Bitcoin has been trading above $20,000 since Jan. 14 — a movement that explains why the $1.48 billion Bitcoin monthly options expiry will vastly benefit bulls despite the recent failure to break the $23,200 resistance.

Bulls were too optimistic, but remain well positioned

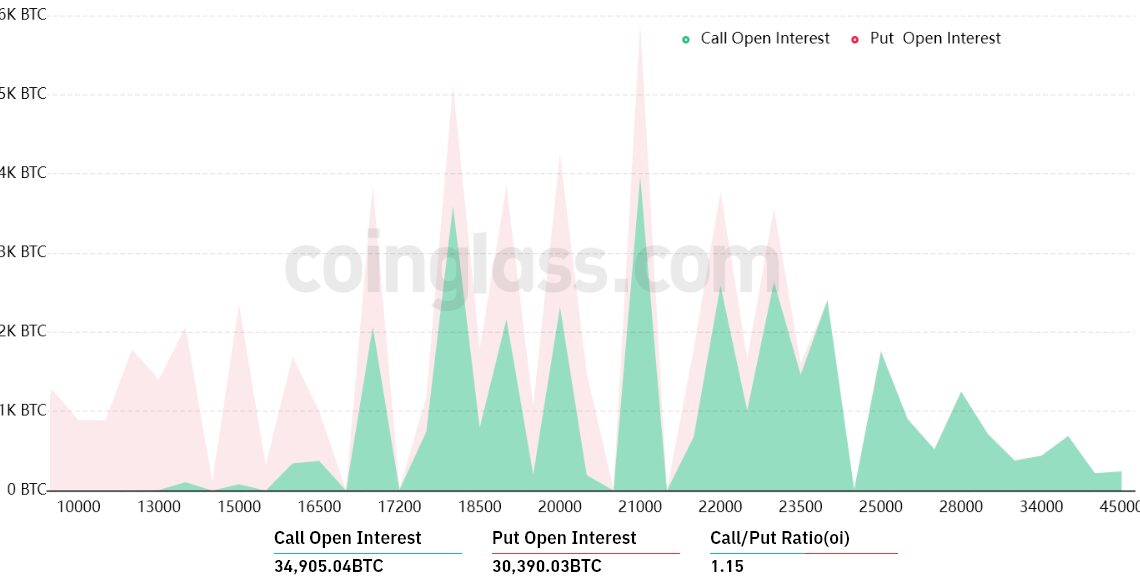

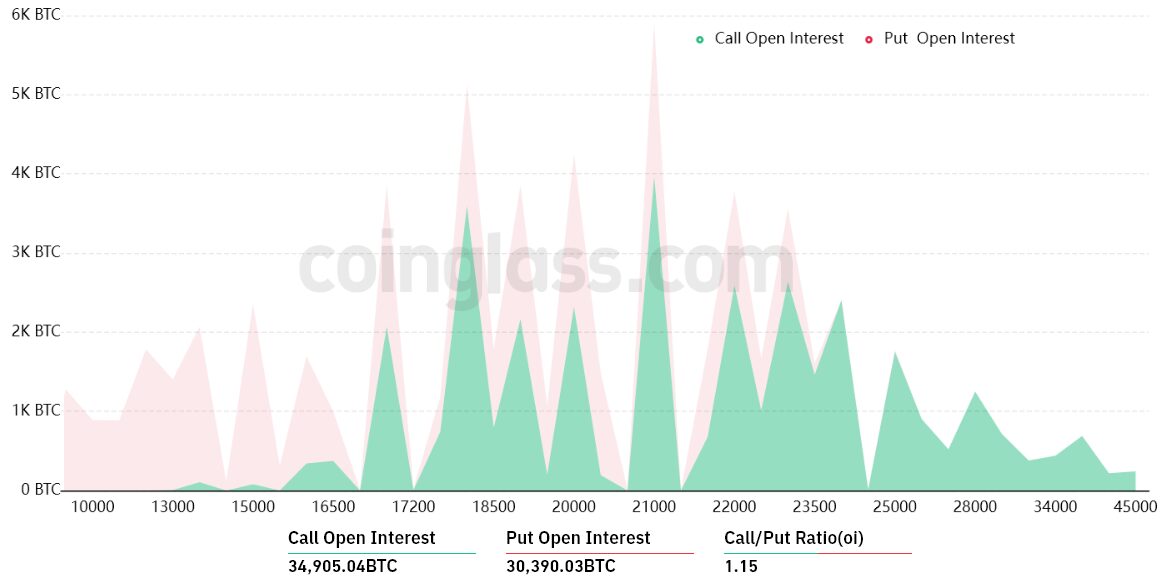

Bitcoin’s latest rally on Jan. 20 caught bears by surprise, as a mere 6% of the put (sell) options for the monthly expiry have been placed above $22,000. Thus, bulls are better positioned even though they set nearly 40% of their call (buy) options at $23,000 or higher.

A broader view using the 1.15 call-to-put ratio shows more bullish bets because the call (buy) open interest stands at $790 million against the $680 million put (sell) options. Nevertheless, most bearish bets will likely become worthless as Bitcoin is up 36% in January.

If Bitcoin’s price remains above $22,000 at 8:00 am UTC on Jan. 27, only $38 million worth of these put (sell) options will be available. This difference happens because there is no use in the right to sell Bitcoin at $21,000 or $22,000 if it trades higher on expiry.

Bears could secure a $595 million profit

Below are the four most likely scenarios based on the current price action. The number of options contracts available on Jan. 27 for call (bull) and put (bear) instruments varies, depending on the expiry price. The imbalance favoring each side constitutes the theoretical profit:

- Between $20,000 and $21,000: 12,800 calls vs. 7,100 puts. The net…

Click Here to Read the Full Original Article at Cointelegraph.com News…