Shanghai is the next major Ethereum upgrade, scheduled to go live on April 12.

Once implemented, ETH staked on the staking contract will be unlocked and withdrawable – thus finalizing the process that began with the Beacon Chain launch in December 2020.

The implication of the Shanghai upgrade is subject to much speculation. Some expect the spot price to tank as holders liquidate. Others believe moving into and out of the staking contract easily will attract more stakers, leading to price stability.

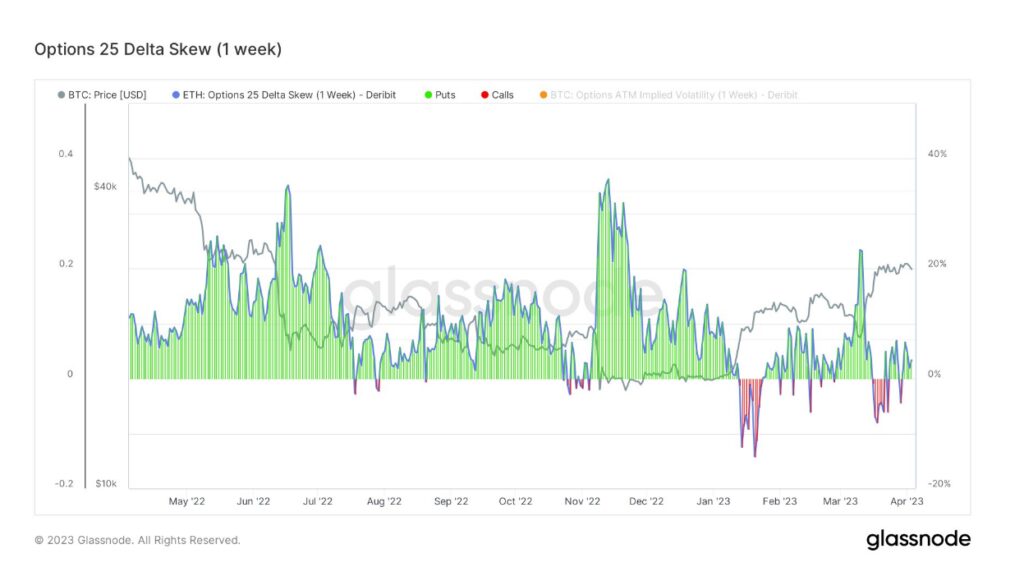

Glassnode data analyzed by CryptoSlate suggested Ethereum derivatives traders are cautious going into the Shanghai upgrade. However, post-Shanghai, sentiment relaxes.

Ethereum – Options 25 Delta Skew

The Options 25 Delta Skew metric looks at the ratio of put-to-call options expressed in terms of Implied Volatility (IV).

A call option gives the holder the right to buy an asset, and a put option gives the holder the right to sell an asset.

For options with a specific expiration date, this metric looks at puts with a delta of -25% and calls with a delta of +25%, netted off to arrive at a data point – giving a measure of the option’s price sensitivity taking into account the change in Ethereum spot price.

Typically, this metric can be organized by periods at which the option contract expires, such as one week, one month, three months, and six months.

The chart below relates to options expiring in a week (near term); it shows puts are now at a premium, suggesting the market is cautious as the Shanghai rollout nears.

The 1-month 25 Delta Skew is somewhat evenly poised between puts and calls, pointing to a settling of sentiment post-Shanghai.

Open Interest

Open Interest by Strike Price refers to the total number of outstanding derivatives contracts yet to settle, organized by the exercised put or call price.

This metric is used to gauge the general market sentiment, particularly the strength behind put or call price trends.

The…

Click Here to Read the Full Original Article at Ethereum (ETH) News | CryptoSlate…