A leading analytics firm reveals that one of the world’s largest market makers has accumulated hundreds of millions of dollars worth of stablecoin USD Coin (USDC) and Ethereum (ETH) in as little as one month.

Arkham Intelligence shows that quant trading firm Jane Street has over $1.26 billion worth of crypto assets in its portfolio.

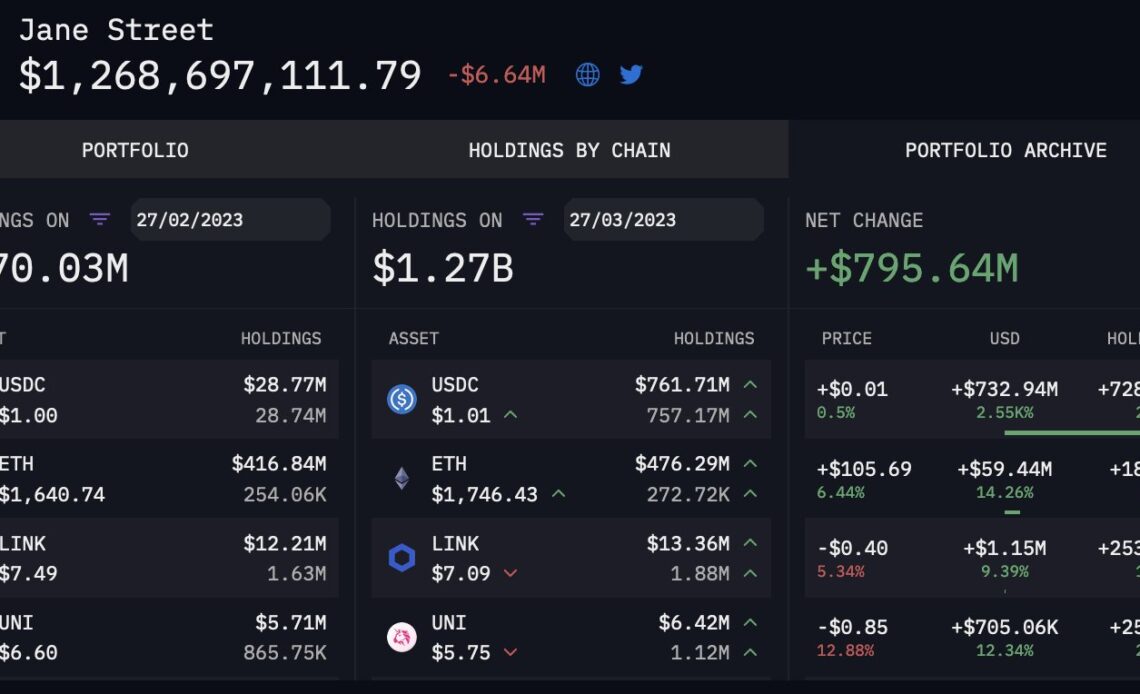

According to the analytics firm, Jane Street had about $470 million worth of crypto assets on February 27th, with Ethereum making most of the market maker’s portfolio. At the time, Jane Street held $416.84 million worth of ETH, $28.77 million in USDC, $12.21 million worth of the decentralized oracle network Chainlink (LINK) and $5.71 million worth of the decentralized exchange Uniswap (UNI).

Arkham says that Jane Street has been rapidly growing its crypto stacks over the past month, with massive amounts of USDC and ETH being added to their holding addresses.

According to the crypto intelligence firm, Jane Street now holds $761.71 million worth of USDC, $476.29 million worth of ETH, $13.36 million worth of LINK and $6.42 million worth of UNI.

Arkham Intelligence says that the quant trading firm’s crypto portfolio exploded by $795.64 million in about 30 days.

The analytics firm also points out they’re quite sure that the wallets containing the crypto assets belong to the market maker.

“Our label attributions are algorithmically greater than 95% confidence and manually reviewed before being uploaded to the platform. As for customer balances – this appears to be coming into their main wallets rather than an OTC [over-the-counter] service.”

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence…

Click Here to Read the Full Original Article at Ethereum News – The Daily Hodl…